Continuous close accounting involves real-time financial data updates that enhance accuracy and timeliness, reducing the risk of errors and enabling faster decision-making. Hard close accounting requires a fixed period-end process to finalize financial statements, which can delay insights but ensures thorough review and compliance. Explore the differences in depth to optimize your accounting strategy effectively.

Why it is important

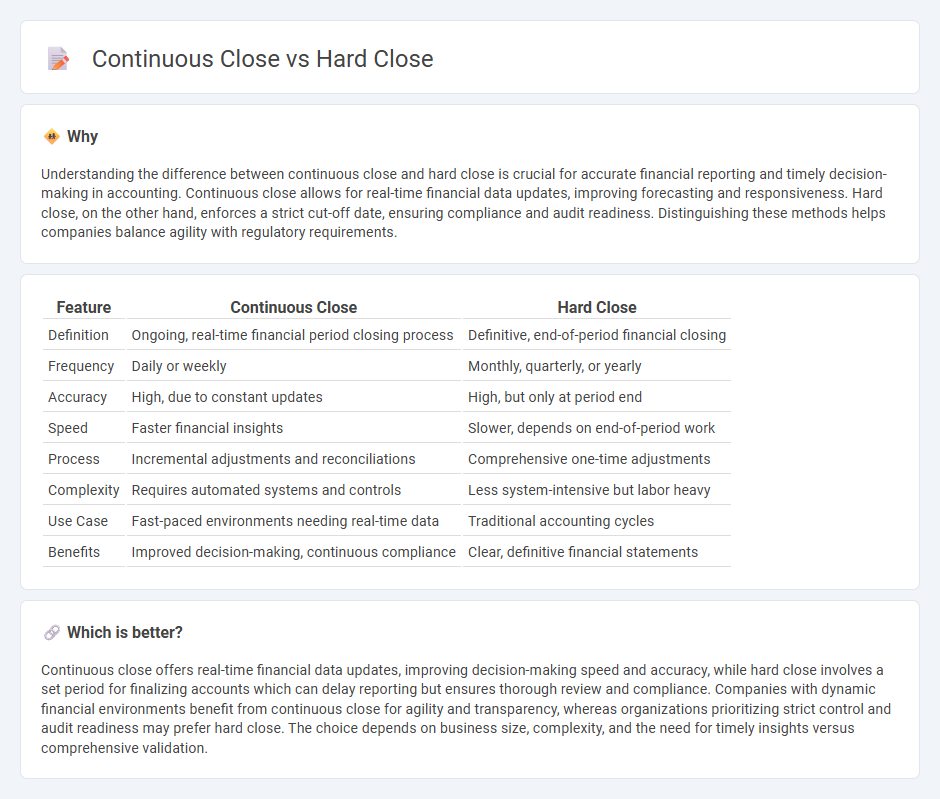

Understanding the difference between continuous close and hard close is crucial for accurate financial reporting and timely decision-making in accounting. Continuous close allows for real-time financial data updates, improving forecasting and responsiveness. Hard close, on the other hand, enforces a strict cut-off date, ensuring compliance and audit readiness. Distinguishing these methods helps companies balance agility with regulatory requirements.

Comparison Table

| Feature | Continuous Close | Hard Close |

|---|---|---|

| Definition | Ongoing, real-time financial period closing process | Definitive, end-of-period financial closing |

| Frequency | Daily or weekly | Monthly, quarterly, or yearly |

| Accuracy | High, due to constant updates | High, but only at period end |

| Speed | Faster financial insights | Slower, depends on end-of-period work |

| Process | Incremental adjustments and reconciliations | Comprehensive one-time adjustments |

| Complexity | Requires automated systems and controls | Less system-intensive but labor heavy |

| Use Case | Fast-paced environments needing real-time data | Traditional accounting cycles |

| Benefits | Improved decision-making, continuous compliance | Clear, definitive financial statements |

Which is better?

Continuous close offers real-time financial data updates, improving decision-making speed and accuracy, while hard close involves a set period for finalizing accounts which can delay reporting but ensures thorough review and compliance. Companies with dynamic financial environments benefit from continuous close for agility and transparency, whereas organizations prioritizing strict control and audit readiness may prefer hard close. The choice depends on business size, complexity, and the need for timely insights versus comprehensive validation.

Connection

Continuous close in accounting streamlines financial reporting by regularly updating financial data, ensuring real-time accuracy and reducing errors. Hard close marks the formal cutoff point for the accounting period, finalizing all transactions and locking the books to prevent further changes. Together, continuous close facilitates a smoother and faster hard close, enhancing overall financial control and reporting efficiency.

Key Terms

Period-End Processing

Hard close during Period-End Processing involves finalizing all financial transactions, ensuring no further adjustments can be made, which guarantees accurate and auditable financial statements. Continuous close, by contrast, spreads the closing activities throughout the reporting period, enabling real-time data validation and faster period-end completion. Explore the benefits and implementation strategies of both methods to optimize your financial close process.

Real-Time Reporting

Hard close requires finalizing all financial data by a specific deadline, ensuring accuracy but potentially delaying insights. Continuous close leverages real-time reporting tools, enabling ongoing updates and faster decision-making by integrating data as transactions occur. Explore how adopting continuous close can enhance your financial agility and reporting precision.

Financial Statement Timeliness

Hard close requires finalizing all financial statements by a strict deadline, ensuring accuracy but limiting post-close adjustments, which improves regulatory compliance and reporting reliability. Continuous close leverages real-time data integration and automation to update financial statements throughout the period, enhancing timeliness and reducing the end-of-period pressure. Explore how adopting these closing methods can optimize your financial reporting efficiency and decision-making process.

Source and External Links

The Art of the Hard Close: What You Should Know - This article discusses the hard close technique, which involves directly asking for a sale to instill a sense of urgency in prospects.

Soft Close vs Hard Close: Which is Best - This webpage compares soft and hard close techniques, highlighting the hard close as a direct and assertive method to finalize deals quickly.

Sales 101: The hard and soft close - This article explains the hard close as a direct method requiring an immediate response, useful for maintaining control and guiding the conversation with authority.

dowidth.com

dowidth.com