Transfer pricing analytics focuses on evaluating and optimizing intercompany pricing strategies to comply with tax regulations and maximize profitability across global operations. Global supply chain finance integrates financial processes and data management to improve cash flow, reduce risk, and enhance collaboration between buyers and suppliers worldwide. Explore how these critical accounting practices drive financial efficiency and regulatory compliance in multinational corporations.

Why it is important

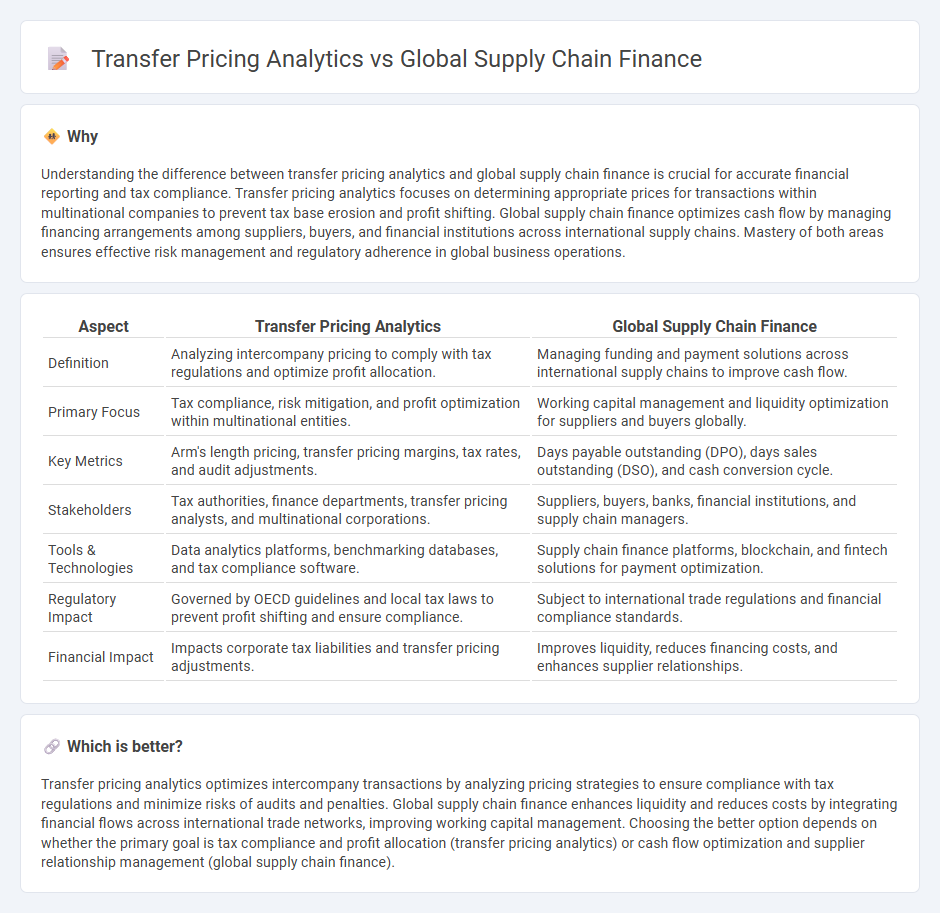

Understanding the difference between transfer pricing analytics and global supply chain finance is crucial for accurate financial reporting and tax compliance. Transfer pricing analytics focuses on determining appropriate prices for transactions within multinational companies to prevent tax base erosion and profit shifting. Global supply chain finance optimizes cash flow by managing financing arrangements among suppliers, buyers, and financial institutions across international supply chains. Mastery of both areas ensures effective risk management and regulatory adherence in global business operations.

Comparison Table

| Aspect | Transfer Pricing Analytics | Global Supply Chain Finance |

|---|---|---|

| Definition | Analyzing intercompany pricing to comply with tax regulations and optimize profit allocation. | Managing funding and payment solutions across international supply chains to improve cash flow. |

| Primary Focus | Tax compliance, risk mitigation, and profit optimization within multinational entities. | Working capital management and liquidity optimization for suppliers and buyers globally. |

| Key Metrics | Arm's length pricing, transfer pricing margins, tax rates, and audit adjustments. | Days payable outstanding (DPO), days sales outstanding (DSO), and cash conversion cycle. |

| Stakeholders | Tax authorities, finance departments, transfer pricing analysts, and multinational corporations. | Suppliers, buyers, banks, financial institutions, and supply chain managers. |

| Tools & Technologies | Data analytics platforms, benchmarking databases, and tax compliance software. | Supply chain finance platforms, blockchain, and fintech solutions for payment optimization. |

| Regulatory Impact | Governed by OECD guidelines and local tax laws to prevent profit shifting and ensure compliance. | Subject to international trade regulations and financial compliance standards. |

| Financial Impact | Impacts corporate tax liabilities and transfer pricing adjustments. | Improves liquidity, reduces financing costs, and enhances supplier relationships. |

Which is better?

Transfer pricing analytics optimizes intercompany transactions by analyzing pricing strategies to ensure compliance with tax regulations and minimize risks of audits and penalties. Global supply chain finance enhances liquidity and reduces costs by integrating financial flows across international trade networks, improving working capital management. Choosing the better option depends on whether the primary goal is tax compliance and profit allocation (transfer pricing analytics) or cash flow optimization and supplier relationship management (global supply chain finance).

Connection

Transfer pricing analytics plays a critical role in global supply chain finance by ensuring that intercompany transactions are priced accurately according to regulatory standards, which helps multinational corporations optimize tax liabilities and maintain compliance. Accurate transfer pricing data enhances financial transparency and risk management across the supply chain, enabling efficient capital allocation and cost control. These analytics provide actionable insights for strategic decision-making, improving cash flow management and supporting sustainable financing structures within complex international operations.

Key Terms

**Global Supply Chain Finance:**

Global Supply Chain Finance enhances liquidity by optimizing payment terms and financing options across international trade networks, reducing working capital constraints for suppliers and buyers. This strategic financial tool leverages data analytics to improve cash flow visibility and mitigate risks associated with currency fluctuations and geopolitical instability. Explore how integrating advanced supply chain finance solutions can transform your global trade operations.

Working Capital Optimization

Global supply chain finance leverages financial solutions to enhance liquidity and reduce financing costs across supply chain networks, directly impacting working capital by improving cash flow and payment terms. Transfer pricing analytics involves evaluating intercompany pricing strategies to optimize tax efficiency and regulatory compliance while indirectly influencing working capital through better cost allocation and profit distribution. Explore how integrating these approaches can drive superior working capital optimization and operational efficiency.

Reverse Factoring

Reverse Factoring in global supply chain finance enhances liquidity by enabling suppliers to receive early payments through third-party financing, optimizing working capital and reducing payment risks. Transfer pricing analytics evaluates intercompany transactions to ensure compliance with tax regulations, preventing profit shifting while reflecting market conditions accurately. Explore how integrating Reverse Factoring with transfer pricing analytics can drive financial efficiency and regulatory adherence.

Source and External Links

IFC's Global Supply Chain Finance Program - The IFC's Global Supply Chain Finance (GSCF) program, established in 2022, provides short-term financing to emerging market suppliers through financial institutions, focusing on reverse factoring to help underserved SMEs improve working capital without collateral requirements.

World's Best Supply Chain Finance Providers 2024 - The global supply chain finance market, valued at $6 billion in 2021, is projected to grow to $13.4 billion by 2031, driven by technology investment, digitalization, and regulatory changes that make SCF more accessible and efficient for buyers and suppliers worldwide.

What is driving the growth of SCF? - flow - Deutsche Bank - Supply Chain Finance volumes have grown by 21% year-on-year to over $2 trillion, fueled by globalization, regulatory updates, fintech-bank collaborations, and increased investor interest, especially across Africa and Asia, enhancing transparency and digital adoption in the SCF industry.

dowidth.com

dowidth.com