Transfer pricing analytics focuses on evaluating intercompany transaction prices to ensure compliance with tax regulations and optimize global profit allocation. Activity-based costing allocates overhead costs based on actual activities, providing precise insights into product and service profitability. Explore these methodologies further to enhance financial accuracy and strategic decision-making in complex business environments.

Why it is important

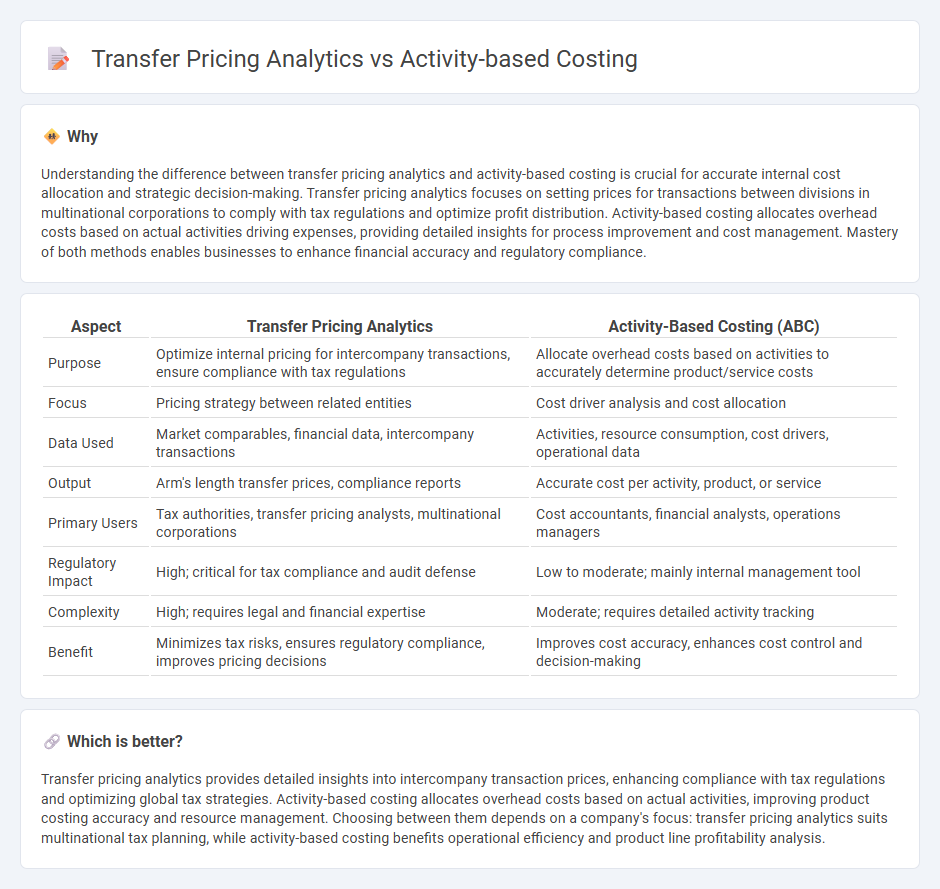

Understanding the difference between transfer pricing analytics and activity-based costing is crucial for accurate internal cost allocation and strategic decision-making. Transfer pricing analytics focuses on setting prices for transactions between divisions in multinational corporations to comply with tax regulations and optimize profit distribution. Activity-based costing allocates overhead costs based on actual activities driving expenses, providing detailed insights for process improvement and cost management. Mastery of both methods enables businesses to enhance financial accuracy and regulatory compliance.

Comparison Table

| Aspect | Transfer Pricing Analytics | Activity-Based Costing (ABC) |

|---|---|---|

| Purpose | Optimize internal pricing for intercompany transactions, ensure compliance with tax regulations | Allocate overhead costs based on activities to accurately determine product/service costs |

| Focus | Pricing strategy between related entities | Cost driver analysis and cost allocation |

| Data Used | Market comparables, financial data, intercompany transactions | Activities, resource consumption, cost drivers, operational data |

| Output | Arm's length transfer prices, compliance reports | Accurate cost per activity, product, or service |

| Primary Users | Tax authorities, transfer pricing analysts, multinational corporations | Cost accountants, financial analysts, operations managers |

| Regulatory Impact | High; critical for tax compliance and audit defense | Low to moderate; mainly internal management tool |

| Complexity | High; requires legal and financial expertise | Moderate; requires detailed activity tracking |

| Benefit | Minimizes tax risks, ensures regulatory compliance, improves pricing decisions | Improves cost accuracy, enhances cost control and decision-making |

Which is better?

Transfer pricing analytics provides detailed insights into intercompany transaction prices, enhancing compliance with tax regulations and optimizing global tax strategies. Activity-based costing allocates overhead costs based on actual activities, improving product costing accuracy and resource management. Choosing between them depends on a company's focus: transfer pricing analytics suits multinational tax planning, while activity-based costing benefits operational efficiency and product line profitability analysis.

Connection

Transfer pricing analytics and activity-based costing (ABC) are connected through their focus on accurately assigning costs to products and services for internal and external financial reporting. Transfer pricing analytics uses ABC data to determine the true cost of intercompany transactions, ensuring compliance with tax regulations and preventing profit shifting. This integration enhances decision-making by providing detailed cost insights and supporting fair allocation of resources across multinational enterprises.

Key Terms

Cost Driver

Activity-based costing allocates overhead costs based on specific cost drivers that directly influence resource consumption, enabling precise product and service cost analysis. Transfer pricing analytics focus on setting prices for goods, services, or intangibles exchanged between divisions within a company, where cost drivers impact internal transaction pricing strategies and compliance with tax regulations. Explore how integrating cost driver analysis enhances accuracy and fairness in both activity-based costing and transfer pricing decisions.

Internal Transactions

Activity-based costing allocates internal costs based on specific activities, providing precise insights into resource consumption within internal transactions. Transfer pricing analytics focuses on setting prices for intercompany transactions that comply with tax regulations and optimize profit allocation across divisions. Explore in-depth methodologies to enhance financial transparency and decision-making in internal transaction management.

Allocation Basis

Activity-based costing allocates overhead costs based on specific activities driving expenses, enhancing accuracy by tracing costs to products or services. Transfer pricing analytics deals with setting prices for transactions between related entities, often emphasizing fair market value and tax compliance over cost allocation detail. Explore these concepts further to optimize your internal financial strategies.

Source and External Links

Activity-Based Costing - Overview, Approach, Benefits - This webpage provides an overview of activity-based costing, its approach, and its benefits in allocating overhead costs more accurately.

Activity Based Costing (ABC) : A Detailed Definition and Explanation - This site offers a detailed explanation of activity-based costing, focusing on its core principles and how it uses activity measures to allocate costs.

Time-Driven Activity-Based Costing - This webpage discusses time-driven activity-based costing, a method that enables managers to report costs in a way that reveals both the efficiency and the capacity of resources.

dowidth.com

dowidth.com