Sustainability ledger tracks an organization's environmental and social impacts through detailed, quantitative data integrated into financial accounting systems. ESG reporting compiles qualitative and quantitative information aligned with environmental, social, and governance criteria to inform stakeholders and comply with regulations. Discover how these frameworks enhance transparency and accountability in corporate sustainability.

Why it is important

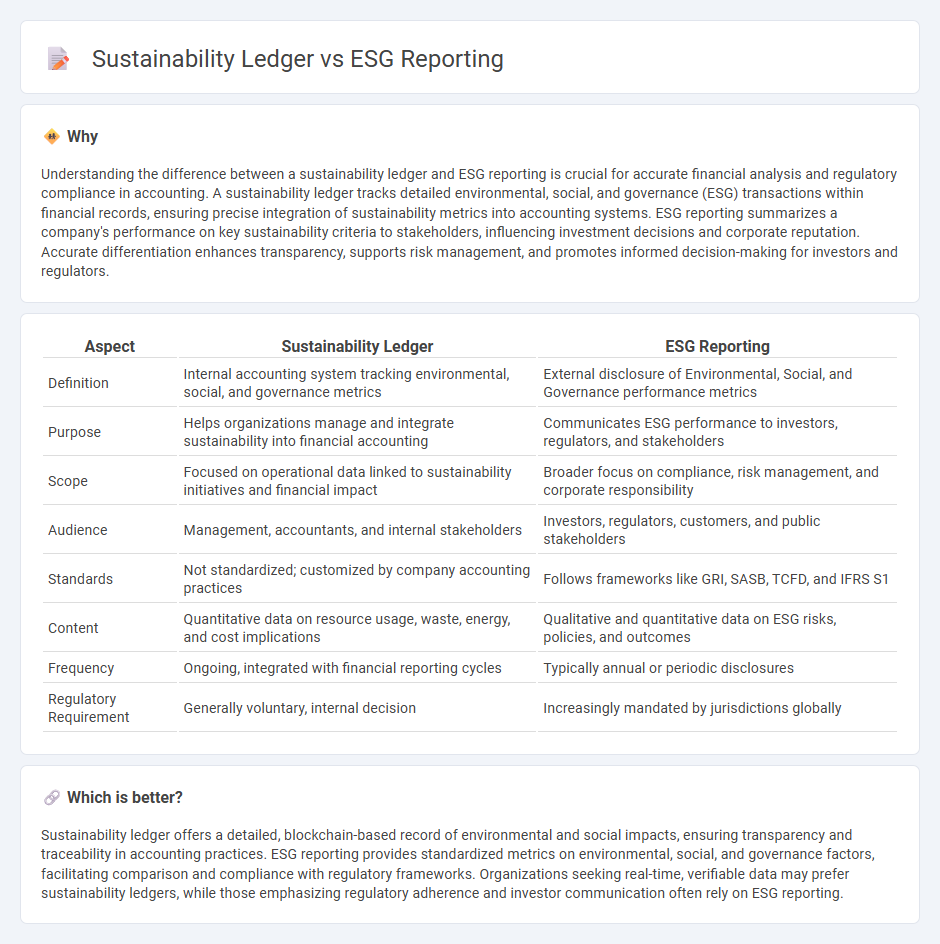

Understanding the difference between a sustainability ledger and ESG reporting is crucial for accurate financial analysis and regulatory compliance in accounting. A sustainability ledger tracks detailed environmental, social, and governance (ESG) transactions within financial records, ensuring precise integration of sustainability metrics into accounting systems. ESG reporting summarizes a company's performance on key sustainability criteria to stakeholders, influencing investment decisions and corporate reputation. Accurate differentiation enhances transparency, supports risk management, and promotes informed decision-making for investors and regulators.

Comparison Table

| Aspect | Sustainability Ledger | ESG Reporting |

|---|---|---|

| Definition | Internal accounting system tracking environmental, social, and governance metrics | External disclosure of Environmental, Social, and Governance performance metrics |

| Purpose | Helps organizations manage and integrate sustainability into financial accounting | Communicates ESG performance to investors, regulators, and stakeholders |

| Scope | Focused on operational data linked to sustainability initiatives and financial impact | Broader focus on compliance, risk management, and corporate responsibility |

| Audience | Management, accountants, and internal stakeholders | Investors, regulators, customers, and public stakeholders |

| Standards | Not standardized; customized by company accounting practices | Follows frameworks like GRI, SASB, TCFD, and IFRS S1 |

| Content | Quantitative data on resource usage, waste, energy, and cost implications | Qualitative and quantitative data on ESG risks, policies, and outcomes |

| Frequency | Ongoing, integrated with financial reporting cycles | Typically annual or periodic disclosures |

| Regulatory Requirement | Generally voluntary, internal decision | Increasingly mandated by jurisdictions globally |

Which is better?

Sustainability ledger offers a detailed, blockchain-based record of environmental and social impacts, ensuring transparency and traceability in accounting practices. ESG reporting provides standardized metrics on environmental, social, and governance factors, facilitating comparison and compliance with regulatory frameworks. Organizations seeking real-time, verifiable data may prefer sustainability ledgers, while those emphasizing regulatory adherence and investor communication often rely on ESG reporting.

Connection

Sustainability ledgers integrate environmental, social, and governance (ESG) data to provide transparent and verifiable accounting records that enhance corporate responsibility. ESG reporting relies on accurate sustainability ledgers to track metrics like carbon emissions, labor practices, and governance policies, ensuring compliance with frameworks such as GRI and SASB. Together, these tools enable organizations to quantify sustainability performance, drive strategic decision-making, and meet stakeholder demands for ethical business practices.

Key Terms

Materiality

ESG reporting emphasizes materiality by identifying and disclosing environmental, social, and governance factors that significantly impact a company's financial performance and stakeholder decisions. In contrast, sustainability ledger tracks a broader range of non-financial data, including all sustainability metrics regardless of immediate material financial impact. Explore the differences and benefits of both approaches to enhance your organization's sustainability strategy.

Non-financial disclosures

ESG reporting emphasizes comprehensive non-financial disclosures, including environmental impact, social responsibility, and governance practices, to inform stakeholders and comply with regulatory frameworks. Sustainability ledgers provide a structured, transparent record of sustainability metrics and initiatives, facilitating real-time tracking and integration with financial data for enhanced accountability. Discover how combining ESG reporting with sustainability ledgers can transform your organization's transparency and performance metrics.

Double-entry environmental accounting

Double-entry environmental accounting integrates ESG reporting and sustainability ledger principles by recording both environmental impacts and financial transactions, enhancing accuracy and accountability in corporate sustainability. This method captures quantitative data such as carbon emissions and resource consumption, linking them directly to financial outcomes for comprehensive risk management and regulatory compliance. Explore how double-entry accounting transforms ESG data into strategic decision-making tools for sustainable business growth.

Source and External Links

ESG Reporting: Your Comprehensive Guide for 2025 - PlanA.Earth - This guide provides steps for companies to effectively report their ESG performance, emphasizing goal setting, materiality assessment, and transparency.

What Is ESG Reporting? - IBM - IBM explains ESG reporting as a disclosure of business operations focusing on environmental, social, and governance areas, providing stakeholders with actionable insights.

Building a Sustainable Path to ESG Reporting - ISO - This resource highlights the growing importance of ESG reporting, especially in managing risk and sustainability, with increasing regulatory requirements worldwide.

dowidth.com

dowidth.com