Digital asset taxation involves the identification, recording, and reporting of cryptocurrencies and other blockchain-based assets for tax compliance, requiring specialized knowledge of tax codes and valuation methods. Inventory accounting focuses on tracking physical goods' acquisition costs, storage, and sales to accurately report asset values and cost of goods sold in financial statements. Explore the nuances of digital asset taxation versus inventory accounting to optimize your financial strategies.

Why it is important

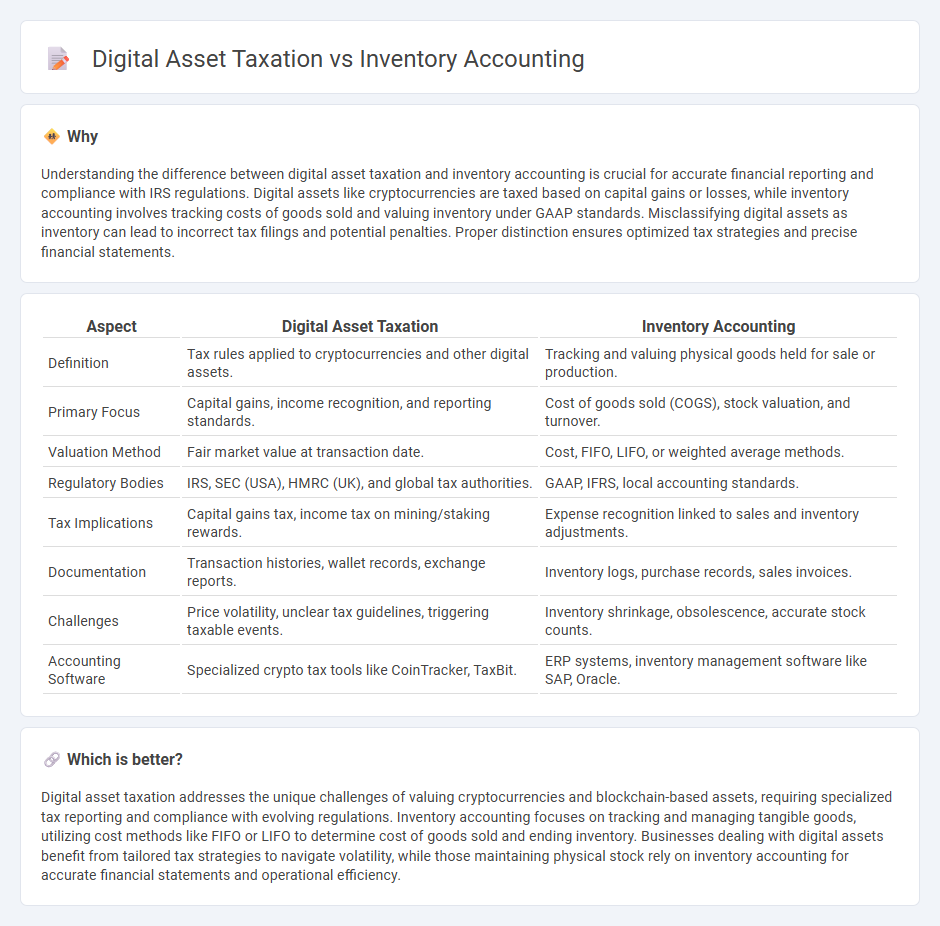

Understanding the difference between digital asset taxation and inventory accounting is crucial for accurate financial reporting and compliance with IRS regulations. Digital assets like cryptocurrencies are taxed based on capital gains or losses, while inventory accounting involves tracking costs of goods sold and valuing inventory under GAAP standards. Misclassifying digital assets as inventory can lead to incorrect tax filings and potential penalties. Proper distinction ensures optimized tax strategies and precise financial statements.

Comparison Table

| Aspect | Digital Asset Taxation | Inventory Accounting |

|---|---|---|

| Definition | Tax rules applied to cryptocurrencies and other digital assets. | Tracking and valuing physical goods held for sale or production. |

| Primary Focus | Capital gains, income recognition, and reporting standards. | Cost of goods sold (COGS), stock valuation, and turnover. |

| Valuation Method | Fair market value at transaction date. | Cost, FIFO, LIFO, or weighted average methods. |

| Regulatory Bodies | IRS, SEC (USA), HMRC (UK), and global tax authorities. | GAAP, IFRS, local accounting standards. |

| Tax Implications | Capital gains tax, income tax on mining/staking rewards. | Expense recognition linked to sales and inventory adjustments. |

| Documentation | Transaction histories, wallet records, exchange reports. | Inventory logs, purchase records, sales invoices. |

| Challenges | Price volatility, unclear tax guidelines, triggering taxable events. | Inventory shrinkage, obsolescence, accurate stock counts. |

| Accounting Software | Specialized crypto tax tools like CoinTracker, TaxBit. | ERP systems, inventory management software like SAP, Oracle. |

Which is better?

Digital asset taxation addresses the unique challenges of valuing cryptocurrencies and blockchain-based assets, requiring specialized tax reporting and compliance with evolving regulations. Inventory accounting focuses on tracking and managing tangible goods, utilizing cost methods like FIFO or LIFO to determine cost of goods sold and ending inventory. Businesses dealing with digital assets benefit from tailored tax strategies to navigate volatility, while those maintaining physical stock rely on inventory accounting for accurate financial statements and operational efficiency.

Connection

Digital asset taxation requires meticulous inventory accounting to track purchases, sales, and transfers of cryptocurrencies and other digital assets. Accurate inventory accounting methods, such as FIFO or LIFO, impact the calculation of gains and losses reported for tax purposes. Proper integration of digital asset inventories ensures compliance with tax regulations and precise financial reporting.

Key Terms

**Inventory Accounting:**

Inventory accounting involves tracking and valuing physical goods held for sale, using methods like FIFO, LIFO, or weighted average to determine cost of goods sold and ending inventory value. It impacts financial statements and tax reporting by accurately reflecting stock levels and associated costs, ensuring compliance with accounting standards such as GAAP or IFRS. Explore detailed insights on inventory accounting principles and their role in business financial health.

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) in inventory accounting calculates the direct costs of producing goods sold, including materials, labor, and overhead, which affects financial reporting and tax deductions. In digital asset taxation, COGS is applied to cryptocurrencies or digital goods by determining the acquisition cost of assets sold or disposed of, impacting capital gains calculations. Explore how these methodologies diverge to optimize tax strategies and compliance.

FIFO/LIFO Methods

Inventory accounting methods such as FIFO (First In, First Out) and LIFO (Last In, First Out) significantly impact the valuation of stock and cost of goods sold, affecting taxable income for businesses. In digital asset taxation, applying FIFO or LIFO determines the cost basis and capital gains calculations, influencing tax liabilities on cryptocurrency transactions. Explore further to understand how these methods optimize tax strategies across traditional inventory and modern digital assets.

Source and External Links

How to Use 3 Inventory Accounting Methods - Shopify - Inventory accounting assigns costs to items as they move through production and are sold, using either cost or market value methods, and directly impacts COGS and inventory valuation on financial statements.

Inventory Accounting Guide: Methods, Formulas, & How it Works - Effective inventory accounting requires selecting appropriate cost flow assumptions (like FIFO or LIFO), maintaining perpetual inventory records, and accurately calculating landed costs to ensure compliance and accurate financial reporting.

Inventory Accounting Guidelines - Division of Financial Services - Inventory is recorded as an asset on the balance sheet, must be physically counted annually, and transactions are managed through dedicated sales operating and inventory object code accounts to ensure accurate financial records.

dowidth.com

dowidth.com