Dynamic discounting leverages real-time payment capabilities to optimize early payment discounts, enhancing cash flow management for both buyers and suppliers. Cash discounts, traditionally offered as a fixed percentage reduction for prompt invoice payment within a set period, help accelerate receivables and reduce outstanding payables. Explore the advantages and strategic applications of dynamic and cash discounts in modern accounting practices.

Why it is important

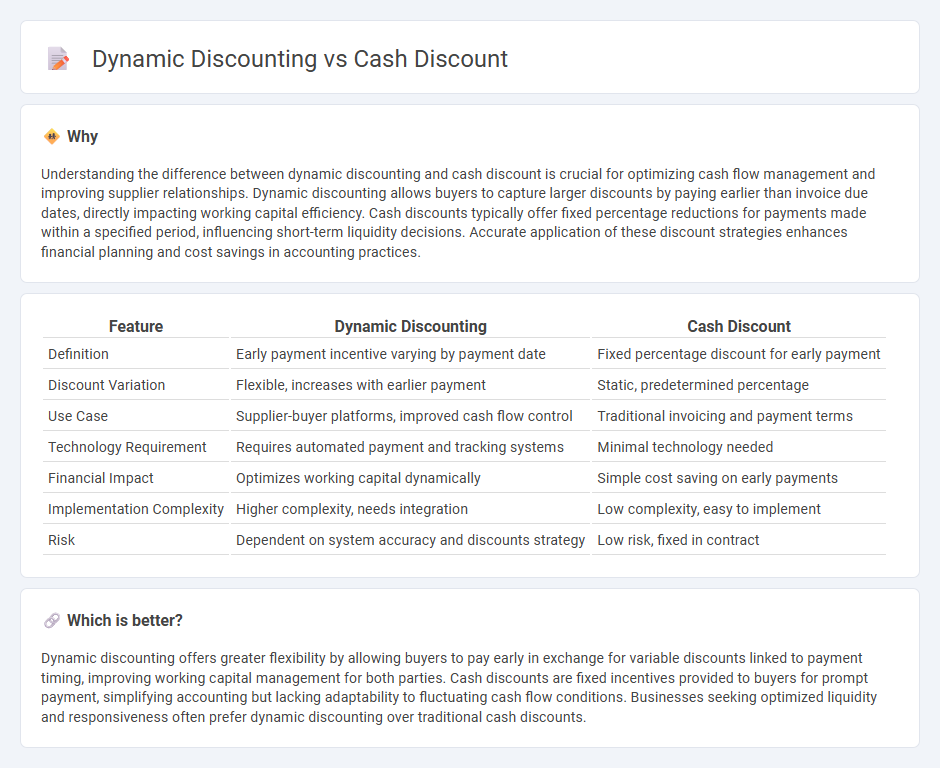

Understanding the difference between dynamic discounting and cash discount is crucial for optimizing cash flow management and improving supplier relationships. Dynamic discounting allows buyers to capture larger discounts by paying earlier than invoice due dates, directly impacting working capital efficiency. Cash discounts typically offer fixed percentage reductions for payments made within a specified period, influencing short-term liquidity decisions. Accurate application of these discount strategies enhances financial planning and cost savings in accounting practices.

Comparison Table

| Feature | Dynamic Discounting | Cash Discount |

|---|---|---|

| Definition | Early payment incentive varying by payment date | Fixed percentage discount for early payment |

| Discount Variation | Flexible, increases with earlier payment | Static, predetermined percentage |

| Use Case | Supplier-buyer platforms, improved cash flow control | Traditional invoicing and payment terms |

| Technology Requirement | Requires automated payment and tracking systems | Minimal technology needed |

| Financial Impact | Optimizes working capital dynamically | Simple cost saving on early payments |

| Implementation Complexity | Higher complexity, needs integration | Low complexity, easy to implement |

| Risk | Dependent on system accuracy and discounts strategy | Low risk, fixed in contract |

Which is better?

Dynamic discounting offers greater flexibility by allowing buyers to pay early in exchange for variable discounts linked to payment timing, improving working capital management for both parties. Cash discounts are fixed incentives provided to buyers for prompt payment, simplifying accounting but lacking adaptability to fluctuating cash flow conditions. Businesses seeking optimized liquidity and responsiveness often prefer dynamic discounting over traditional cash discounts.

Connection

Dynamic discounting leverages real-time payment capabilities to offer variable cash discounts based on how early an invoice is settled, enhancing cash flow management. Cash discounts provide a fixed percentage reduction on invoice amounts for prompt payments, incentivizing quicker settlements and reducing accounts receivable days. Both mechanisms aim to optimize working capital by encouraging early payments, thereby improving liquidity and reducing financing costs for businesses.

Key Terms

Early Payment

Cash discount offers a fixed percentage reduction on invoices to encourage early payment, improving supplier cash flow predictably. Dynamic discounting adjusts the discount rate based on the actual payment date, creating flexible savings opportunities tied directly to payment timing. Explore the advantages of each approach to optimize your early payment strategy.

Discount Rate

Cash discount offers a fixed discount rate, typically ranging from 1% to 3%, incentivizing early invoice payment within a set period, such as 10 days. Dynamic discounting features a variable discount rate that adjusts based on the actual payment date, often increasing as the payment is made earlier than the due date, optimizing savings for buyers and improving cash flow for suppliers. Explore the benefits and applications of each to determine the best approach for your business.

Payment Terms

Cash discount offers a fixed percentage reduction on invoices paid within a specified early payment period, encouraging quicker settlements under predefined payment terms. Dynamic discounting allows buyers to negotiate variable discounts based on actual payment dates, providing flexible incentives that adjust according to when payments are made ahead of due dates. Explore detailed comparisons of cash discount versus dynamic discounting to optimize your payment terms strategies effectively.

Source and External Links

What is a cash discount? - A cash discount is a deduction allowed by sellers or service providers to encourage customers to pay within a specified earlier period, often resulting in a reduced invoice amount if paid promptly.

Cash discount definition - A cash discount is a reduction in the invoice amount offered by the seller to the buyer in exchange for early payment, typically expressed as a percentage (e.g., 2% 10/net 30).

7.2 Cash Discounts - Mathematics of Finance - Cash discounts are reductions in the invoice's net amount available only if payment is made within a shorter, specified time frame, incentivizing faster payment and benefiting both buyer and seller.

dowidth.com

dowidth.com