Forensic data analytics involves the systematic examination of large data sets to detect anomalies, patterns, and trends indicative of financial misconduct. Fraud examination focuses on identifying, investigating, and preventing fraudulent activities through evidence collection and legal procedures. Explore more on how these approaches complement each other in strengthening financial integrity.

Why it is important

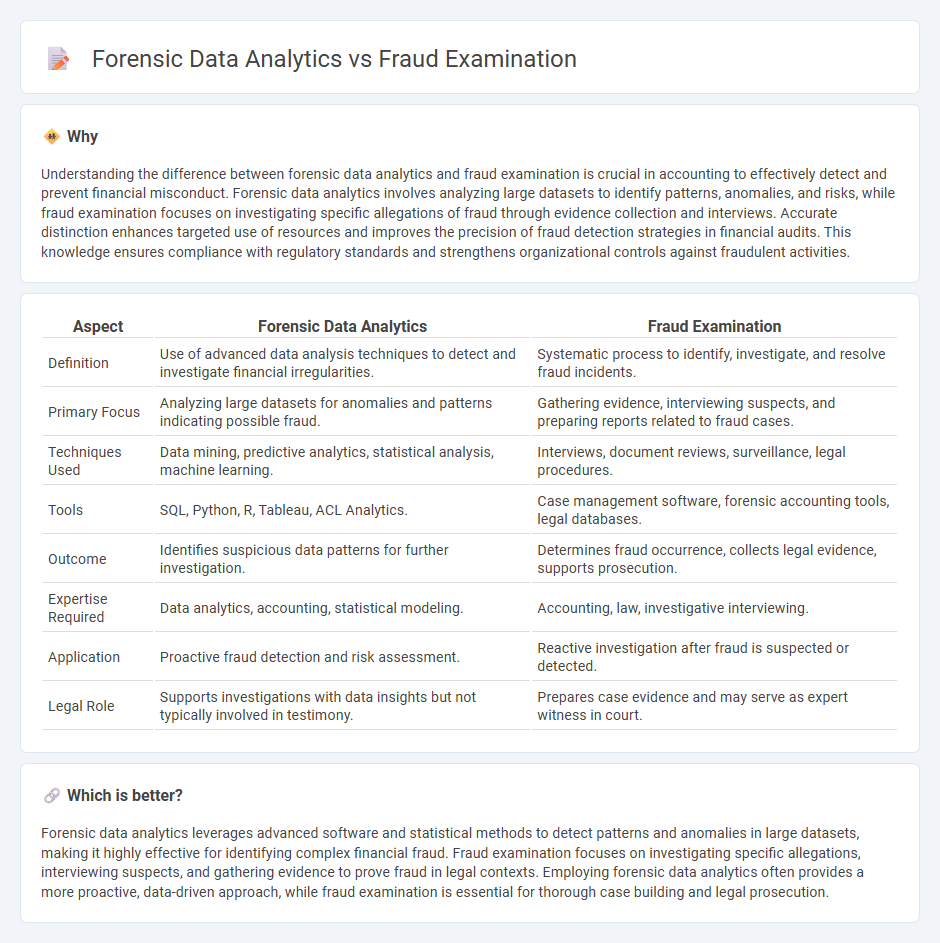

Understanding the difference between forensic data analytics and fraud examination is crucial in accounting to effectively detect and prevent financial misconduct. Forensic data analytics involves analyzing large datasets to identify patterns, anomalies, and risks, while fraud examination focuses on investigating specific allegations of fraud through evidence collection and interviews. Accurate distinction enhances targeted use of resources and improves the precision of fraud detection strategies in financial audits. This knowledge ensures compliance with regulatory standards and strengthens organizational controls against fraudulent activities.

Comparison Table

| Aspect | Forensic Data Analytics | Fraud Examination |

|---|---|---|

| Definition | Use of advanced data analysis techniques to detect and investigate financial irregularities. | Systematic process to identify, investigate, and resolve fraud incidents. |

| Primary Focus | Analyzing large datasets for anomalies and patterns indicating possible fraud. | Gathering evidence, interviewing suspects, and preparing reports related to fraud cases. |

| Techniques Used | Data mining, predictive analytics, statistical analysis, machine learning. | Interviews, document reviews, surveillance, legal procedures. |

| Tools | SQL, Python, R, Tableau, ACL Analytics. | Case management software, forensic accounting tools, legal databases. |

| Outcome | Identifies suspicious data patterns for further investigation. | Determines fraud occurrence, collects legal evidence, supports prosecution. |

| Expertise Required | Data analytics, accounting, statistical modeling. | Accounting, law, investigative interviewing. |

| Application | Proactive fraud detection and risk assessment. | Reactive investigation after fraud is suspected or detected. |

| Legal Role | Supports investigations with data insights but not typically involved in testimony. | Prepares case evidence and may serve as expert witness in court. |

Which is better?

Forensic data analytics leverages advanced software and statistical methods to detect patterns and anomalies in large datasets, making it highly effective for identifying complex financial fraud. Fraud examination focuses on investigating specific allegations, interviewing suspects, and gathering evidence to prove fraud in legal contexts. Employing forensic data analytics often provides a more proactive, data-driven approach, while fraud examination is essential for thorough case building and legal prosecution.

Connection

Forensic data analytics plays a crucial role in fraud examination by systematically analyzing financial data to identify irregular patterns and anomalies indicative of fraudulent activities. Advanced algorithms and statistical techniques help forensic accountants detect concealed transactions, asset misappropriations, and financial statement manipulations. The integration of forensic data analytics enhances the accuracy and efficiency of fraud detection, supporting comprehensive investigations and litigation support.

Key Terms

**Fraud Examination:**

Fraud examination involves the systematic process of investigating allegations or suspicions of fraud by collecting, analyzing, and evaluating evidence to determine the occurrence of fraudulent activities. It emphasizes identifying fraudulent schemes, interviewing suspects and witnesses, and preparing detailed reports for legal or disciplinary actions. Explore more about how fraud examination techniques protect organizations and strengthen compliance frameworks.

Red Flags

Fraud examination emphasizes identifying red flags such as unusual financial transactions, discrepancies in accounting records, and sudden lifestyle changes as indicators of potential fraud. Forensic data analytics utilizes advanced data mining techniques and statistical analysis to detect anomalies and patterns that signal fraudulent activities within large datasets. Explore more to understand how combining these approaches enhances fraud detection and investigation.

Interview Techniques

Fraud examination emphasizes in-depth interview techniques to uncover inconsistencies and gather direct evidence from suspects and witnesses, using behavioral analysis and tailored questioning strategies. Forensic data analytics leverages data-driven insights to identify anomalies and patterns that guide interview focus and validate information collected during interrogations. Explore more about how these interview approaches enhance fraud detection and investigation.

Source and External Links

How to Become a Certified Fraud Examiner - Fraud examiners investigate, detect, and prevent financial crimes by analyzing records, gathering evidence, and collaborating with law enforcement to protect organizations.

What is Forensic Accounting and Fraud Examination - Fraud examination systematically investigates financial and non-financial information to uncover fraud schemes, asset misappropriation, and other deceptive practices, often providing evidence for legal proceedings.

Forensic and Fraud Examination, M.S. - This graduate program trains professionals to detect, investigate, and prevent financial fraud using an interdisciplinary curriculum covering business, law, accounting, and data technology for careers in both public and private sectors.

dowidth.com

dowidth.com