Intercompany automation streamlines financial transactions between affiliated entities by using advanced software to automate data exchange and eliminate manual errors. In contrast, intercompany reconciliation focuses on identifying and resolving discrepancies in intercompany balances to ensure accurate consolidated financial reporting. Explore how integrating automation with reconciliation processes can enhance efficiency and accuracy in accounting.

Why it is important

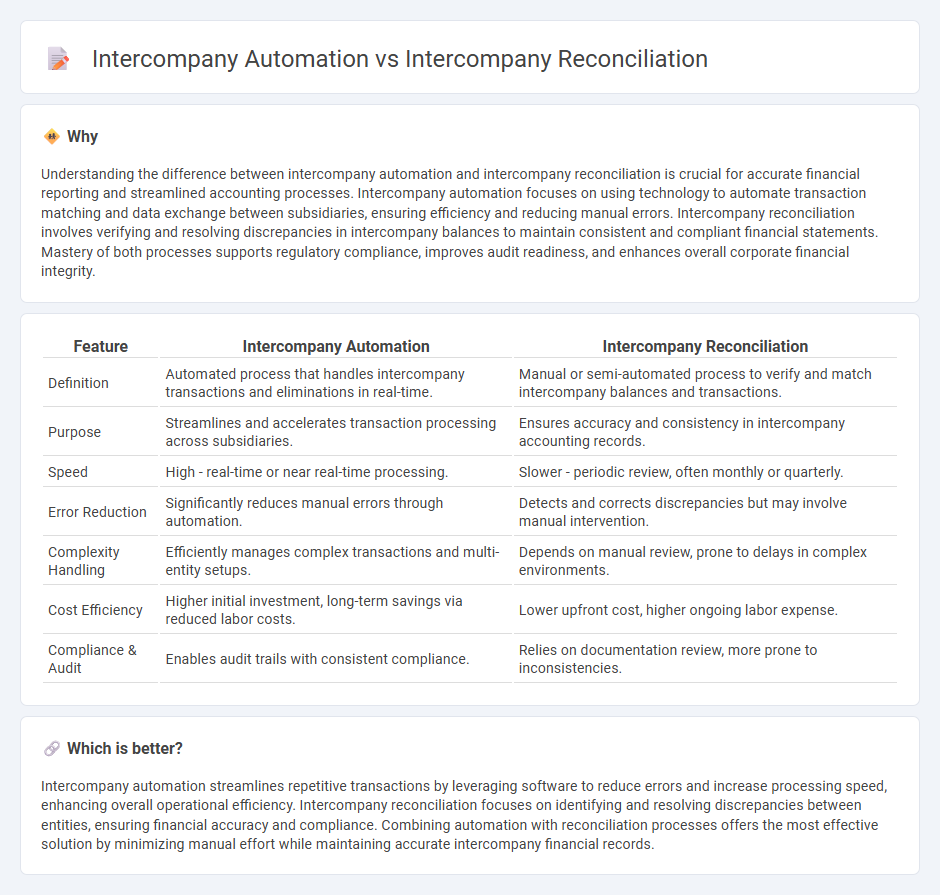

Understanding the difference between intercompany automation and intercompany reconciliation is crucial for accurate financial reporting and streamlined accounting processes. Intercompany automation focuses on using technology to automate transaction matching and data exchange between subsidiaries, ensuring efficiency and reducing manual errors. Intercompany reconciliation involves verifying and resolving discrepancies in intercompany balances to maintain consistent and compliant financial statements. Mastery of both processes supports regulatory compliance, improves audit readiness, and enhances overall corporate financial integrity.

Comparison Table

| Feature | Intercompany Automation | Intercompany Reconciliation |

|---|---|---|

| Definition | Automated process that handles intercompany transactions and eliminations in real-time. | Manual or semi-automated process to verify and match intercompany balances and transactions. |

| Purpose | Streamlines and accelerates transaction processing across subsidiaries. | Ensures accuracy and consistency in intercompany accounting records. |

| Speed | High - real-time or near real-time processing. | Slower - periodic review, often monthly or quarterly. |

| Error Reduction | Significantly reduces manual errors through automation. | Detects and corrects discrepancies but may involve manual intervention. |

| Complexity Handling | Efficiently manages complex transactions and multi-entity setups. | Depends on manual review, prone to delays in complex environments. |

| Cost Efficiency | Higher initial investment, long-term savings via reduced labor costs. | Lower upfront cost, higher ongoing labor expense. |

| Compliance & Audit | Enables audit trails with consistent compliance. | Relies on documentation review, more prone to inconsistencies. |

Which is better?

Intercompany automation streamlines repetitive transactions by leveraging software to reduce errors and increase processing speed, enhancing overall operational efficiency. Intercompany reconciliation focuses on identifying and resolving discrepancies between entities, ensuring financial accuracy and compliance. Combining automation with reconciliation processes offers the most effective solution by minimizing manual effort while maintaining accurate intercompany financial records.

Connection

Intercompany automation streamlines the data exchange and transaction processing between affiliated entities, significantly reducing manual errors and processing time in intercompany reconciliation. Enhanced automation tools enable real-time matching, validation, and consolidation of intercompany balances, ensuring accuracy and compliance with accounting standards. This seamless integration supports faster financial close cycles and improved transparency in consolidated financial statements.

Key Terms

**Intercompany Reconciliation:**

Intercompany reconciliation involves matching and verifying transactions between subsidiaries to ensure accuracy and consistency in consolidated financial statements. It reduces discrepancies by identifying intercompany balances, eliminating double counting, and maintaining compliance with accounting standards. Explore how streamlined intercompany reconciliation enhances financial transparency and operational efficiency.

Balance confirmation

Intercompany reconciliation involves manually verifying and matching balance confirmations between subsidiaries to ensure accurate financial reporting, often leading to time-consuming processes and potential errors. Intercompany automation streamlines balance confirmation by using software solutions to automatically reconcile transactions and discrepancies in real-time, improving accuracy and efficiency. Explore detailed comparisons on how automation enhances intercompany balance confirmation accuracy and reduces reconciliation cycles.

Transaction matching

Intercompany reconciliation involves manually verifying and matching transactions between different entities within a corporation, often leading to time-consuming errors and delays. Intercompany automation leverages advanced software tools to perform transaction matching swiftly and accurately, reducing discrepancies and accelerating closing cycles. Discover how transitioning to automated transaction matching can enhance accuracy and efficiency in your intercompany processes.

dowidth.com

dowidth.com