Revenue recognition automation streamlines the accurate recording of income by integrating real-time data from sales and contracts, reducing errors and compliance risks under ASC 606 and IFRS 15 standards. Expense management automation optimizes cost tracking and approval processes, enhancing visibility into spending and ensuring adherence to budgetary controls and corporate policies. Explore how these automation solutions transform financial workflows and maximize operational efficiency.

Why it is important

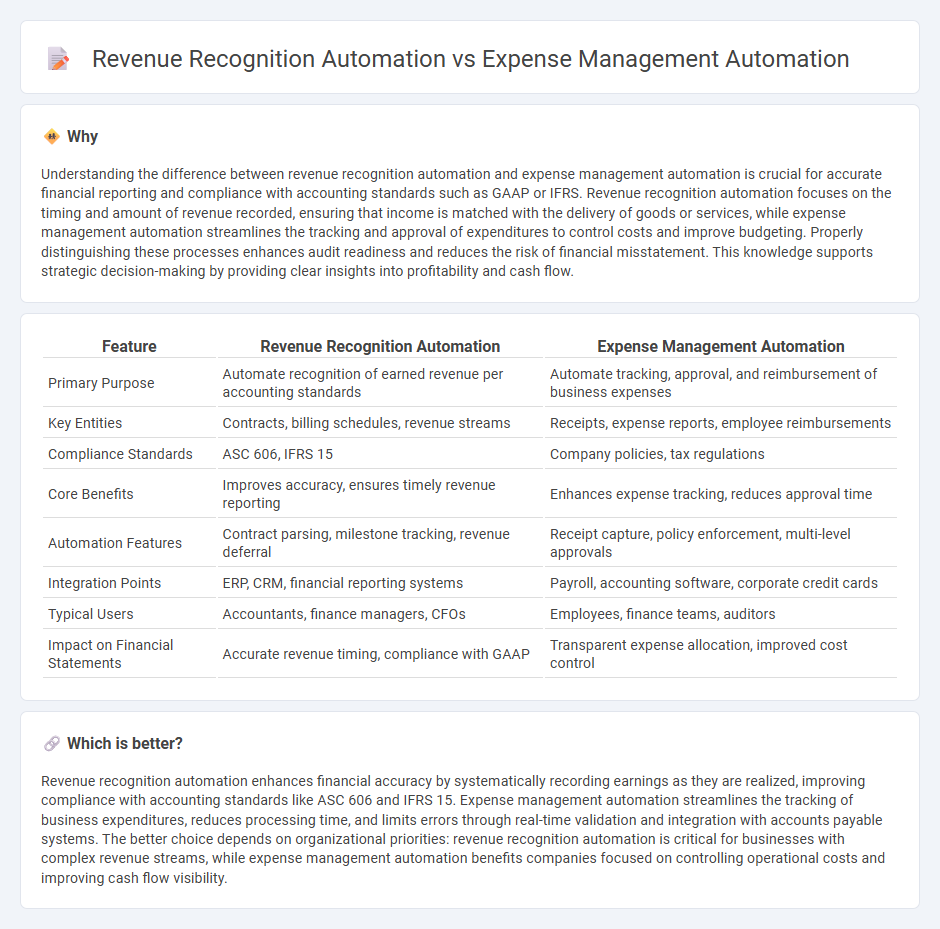

Understanding the difference between revenue recognition automation and expense management automation is crucial for accurate financial reporting and compliance with accounting standards such as GAAP or IFRS. Revenue recognition automation focuses on the timing and amount of revenue recorded, ensuring that income is matched with the delivery of goods or services, while expense management automation streamlines the tracking and approval of expenditures to control costs and improve budgeting. Properly distinguishing these processes enhances audit readiness and reduces the risk of financial misstatement. This knowledge supports strategic decision-making by providing clear insights into profitability and cash flow.

Comparison Table

| Feature | Revenue Recognition Automation | Expense Management Automation |

|---|---|---|

| Primary Purpose | Automate recognition of earned revenue per accounting standards | Automate tracking, approval, and reimbursement of business expenses |

| Key Entities | Contracts, billing schedules, revenue streams | Receipts, expense reports, employee reimbursements |

| Compliance Standards | ASC 606, IFRS 15 | Company policies, tax regulations |

| Core Benefits | Improves accuracy, ensures timely revenue reporting | Enhances expense tracking, reduces approval time |

| Automation Features | Contract parsing, milestone tracking, revenue deferral | Receipt capture, policy enforcement, multi-level approvals |

| Integration Points | ERP, CRM, financial reporting systems | Payroll, accounting software, corporate credit cards |

| Typical Users | Accountants, finance managers, CFOs | Employees, finance teams, auditors |

| Impact on Financial Statements | Accurate revenue timing, compliance with GAAP | Transparent expense allocation, improved cost control |

Which is better?

Revenue recognition automation enhances financial accuracy by systematically recording earnings as they are realized, improving compliance with accounting standards like ASC 606 and IFRS 15. Expense management automation streamlines the tracking of business expenditures, reduces processing time, and limits errors through real-time validation and integration with accounts payable systems. The better choice depends on organizational priorities: revenue recognition automation is critical for businesses with complex revenue streams, while expense management automation benefits companies focused on controlling operational costs and improving cash flow visibility.

Connection

Revenue recognition automation streamlines the accurate recording of income by integrating real-time sales data with accounting systems, ensuring compliance with standards like ASC 606. Expense management automation complements this process by capturing and categorizing expenditures efficiently, providing a clear view of costs against recognized revenue. Together, these automated systems enhance financial accuracy, improve reporting timeliness, and support better decision-making through synchronized financial data flows.

Key Terms

**Expense Management Automation:**

Expense management automation streamlines the tracking, approval, and reimbursement of business expenses by leveraging AI-powered tools to reduce manual errors and enhance compliance with company policies. Advanced platforms integrate with accounting software to provide real-time visibility into spending patterns, optimize budget control, and accelerate financial close processes. Discover how implementing expense management automation can transform your organization's financial efficiency and operational accuracy.

Spend Analysis

Expense management automation streamlines spend analysis by categorizing and tracking expenditures in real-time, enhancing financial visibility and control. Revenue recognition automation ensures accurate and timely recording of income based on contract terms and accounting standards. Explore how integrating both automations can optimize overall financial management and reporting.

Approval Workflow

Expense management automation streamlines the approval workflow by automatically routing expense reports to designated approvers based on predefined policies, ensuring faster validation and compliance control. Revenue recognition automation integrates approval processes within financial software to verify revenue events meet accounting standards before booking, enhancing accuracy and reducing manual errors. Explore the differences in approval workflow efficiency and control between expense management and revenue recognition automation to optimize your financial operations.

Source and External Links

Why Expense Management Automation is Crucial for Businesses - This resource explains the importance of expense management automation for streamlining and optimizing business expense processes.

Expense Management Automation 101 for Employers - This guide provides an overview of how automated expense management streamlines the expense reporting process, reduces errors, and enhances compliance.

What is Expense Management Automation - This resource describes expense management automation as software that automates the process of handling business expenses, from recording transactions to tracking receipts.

dowidth.com

dowidth.com