A sustainability ledger systematically records environmental, social, and governance (ESG) metrics to track organizational impact and progress toward sustainability goals. Climate risk disclosure involves reporting potential financial risks and strategic responses related to climate change, addressing regulatory compliance and investor demands. Explore detailed insights into how these accounting practices intersect to enhance corporate transparency and long-term resilience.

Why it is important

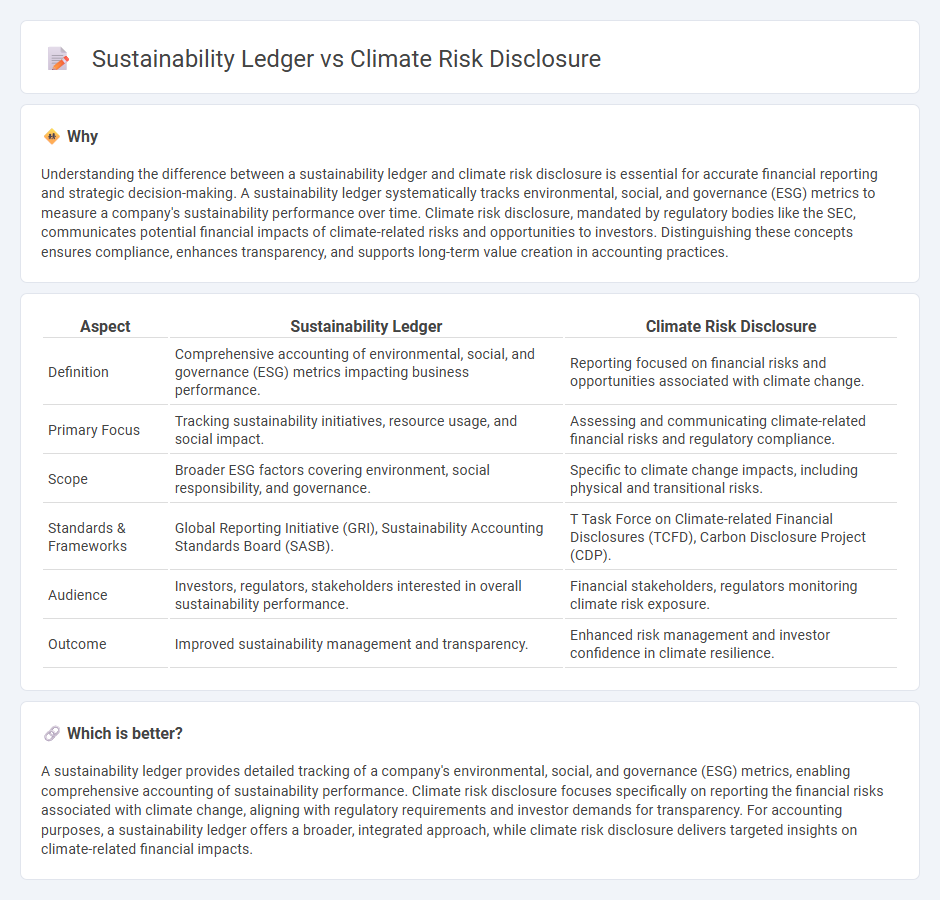

Understanding the difference between a sustainability ledger and climate risk disclosure is essential for accurate financial reporting and strategic decision-making. A sustainability ledger systematically tracks environmental, social, and governance (ESG) metrics to measure a company's sustainability performance over time. Climate risk disclosure, mandated by regulatory bodies like the SEC, communicates potential financial impacts of climate-related risks and opportunities to investors. Distinguishing these concepts ensures compliance, enhances transparency, and supports long-term value creation in accounting practices.

Comparison Table

| Aspect | Sustainability Ledger | Climate Risk Disclosure |

|---|---|---|

| Definition | Comprehensive accounting of environmental, social, and governance (ESG) metrics impacting business performance. | Reporting focused on financial risks and opportunities associated with climate change. |

| Primary Focus | Tracking sustainability initiatives, resource usage, and social impact. | Assessing and communicating climate-related financial risks and regulatory compliance. |

| Scope | Broader ESG factors covering environment, social responsibility, and governance. | Specific to climate change impacts, including physical and transitional risks. |

| Standards & Frameworks | Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB). | T Task Force on Climate-related Financial Disclosures (TCFD), Carbon Disclosure Project (CDP). |

| Audience | Investors, regulators, stakeholders interested in overall sustainability performance. | Financial stakeholders, regulators monitoring climate risk exposure. |

| Outcome | Improved sustainability management and transparency. | Enhanced risk management and investor confidence in climate resilience. |

Which is better?

A sustainability ledger provides detailed tracking of a company's environmental, social, and governance (ESG) metrics, enabling comprehensive accounting of sustainability performance. Climate risk disclosure focuses specifically on reporting the financial risks associated with climate change, aligning with regulatory requirements and investor demands for transparency. For accounting purposes, a sustainability ledger offers a broader, integrated approach, while climate risk disclosure delivers targeted insights on climate-related financial impacts.

Connection

Sustainability ledgers integrate environmental, social, and governance (ESG) data into traditional accounting systems, providing a comprehensive view of a company's ecological impact and resource usage. Climate risk disclosure requires organizations to report on financial risks linked to climate change, including emissions data, carbon footprints, and compliance with regulatory frameworks like TCFD or SASB. By embedding climate-related financial information into sustainability ledgers, businesses enhance transparency and enable more accurate risk assessment and strategic decision-making aligned with sustainability goals.

Key Terms

Materiality

Climate risk disclosure emphasizes the identification and reporting of material environmental, social, and governance (ESG) risks that could significantly impact a company's financial performance. Sustainability ledgers track a broader range of non-financial data, integrating material and non-material ESG factors to provide a comprehensive overview of a company's sustainable practices. Explore how materiality considerations shape these reporting frameworks to enhance transparency and stakeholder trust.

Greenhouse Gas (GHG) Emissions

Climate risk disclosure provides detailed reporting on Greenhouse Gas (GHG) emissions to inform investors about the environmental impact and regulatory risks faced by companies. Sustainability ledgers systematically track GHG emissions across supply chains, enabling real-time monitoring and accountability for reduction targets. Explore how integrating climate risk disclosures with sustainability ledgers can enhance transparency and drive effective emissions management.

Double Materiality

Climate risk disclosure emphasizes the impact of environmental factors on financial performance, aligning with traditional materiality focused on investor interests. Sustainability ledger expands this view by integrating double materiality, capturing both the financial risks and the environmental, social impacts the company exerts on the planet and society. Explore how double materiality reshapes corporate accountability and reporting frameworks for a comprehensive understanding.

Source and External Links

SEC Climate Risk Disclosure: What You Need to Know | EcoVadis - The SEC climate disclosure rule requires publicly traded companies to include detailed climate-risk information in their filings, covering governance, risk management, emissions reporting, and financial impacts to improve investor confidence and reduce greenwashing.

Corporate Climate Disclosure Has Passed a Tipping Point - Climate-related disclosures have shifted from voluntary to mandatory globally, with new rules affecting nearly 40% of the global economy, requiring companies to report financially material climate risks consistently across jurisdictions.

SEC Adopts Rules to Enhance and Standardize Climate-Related Disclosures - The SEC's final rule mandates public companies to disclose material climate risks in SEC filings, providing investors with consistent, comparable climate information directly in annual reports and registration statements rather than on websites.

dowidth.com

dowidth.com