Tax technology leverages automation and artificial intelligence to streamline compliance, optimize tax calculations, and enhance reporting accuracy, reducing manual errors and improving efficiency. Audit technology integrates data analytics, machine learning, and continuous monitoring tools to detect anomalies, assess risks, and ensure regulatory compliance in real time. Explore the latest advancements in tax and audit technology to transform your accounting processes and achieve greater financial accuracy.

Why it is important

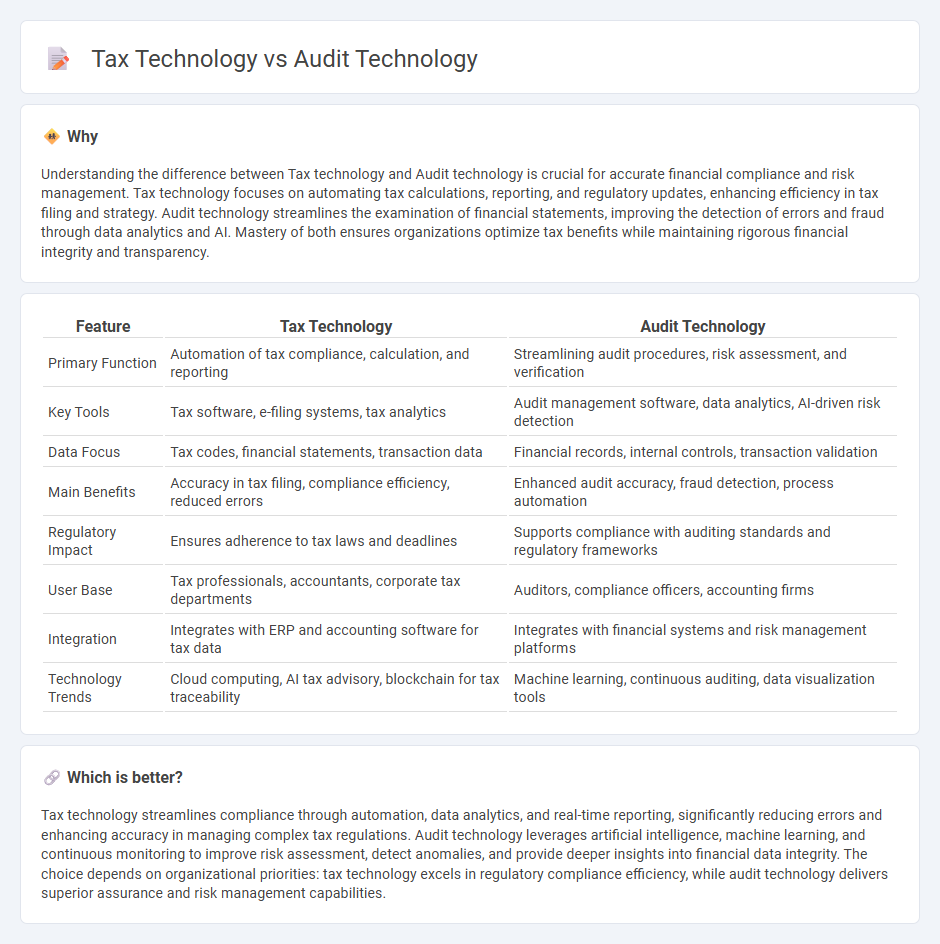

Understanding the difference between Tax technology and Audit technology is crucial for accurate financial compliance and risk management. Tax technology focuses on automating tax calculations, reporting, and regulatory updates, enhancing efficiency in tax filing and strategy. Audit technology streamlines the examination of financial statements, improving the detection of errors and fraud through data analytics and AI. Mastery of both ensures organizations optimize tax benefits while maintaining rigorous financial integrity and transparency.

Comparison Table

| Feature | Tax Technology | Audit Technology |

|---|---|---|

| Primary Function | Automation of tax compliance, calculation, and reporting | Streamlining audit procedures, risk assessment, and verification |

| Key Tools | Tax software, e-filing systems, tax analytics | Audit management software, data analytics, AI-driven risk detection |

| Data Focus | Tax codes, financial statements, transaction data | Financial records, internal controls, transaction validation |

| Main Benefits | Accuracy in tax filing, compliance efficiency, reduced errors | Enhanced audit accuracy, fraud detection, process automation |

| Regulatory Impact | Ensures adherence to tax laws and deadlines | Supports compliance with auditing standards and regulatory frameworks |

| User Base | Tax professionals, accountants, corporate tax departments | Auditors, compliance officers, accounting firms |

| Integration | Integrates with ERP and accounting software for tax data | Integrates with financial systems and risk management platforms |

| Technology Trends | Cloud computing, AI tax advisory, blockchain for tax traceability | Machine learning, continuous auditing, data visualization tools |

Which is better?

Tax technology streamlines compliance through automation, data analytics, and real-time reporting, significantly reducing errors and enhancing accuracy in managing complex tax regulations. Audit technology leverages artificial intelligence, machine learning, and continuous monitoring to improve risk assessment, detect anomalies, and provide deeper insights into financial data integrity. The choice depends on organizational priorities: tax technology excels in regulatory compliance efficiency, while audit technology delivers superior assurance and risk management capabilities.

Connection

Tax technology and audit technology are interconnected through their reliance on advanced data analytics and automation to enhance accuracy and efficiency in financial processes. Both technologies utilize artificial intelligence and machine learning algorithms to detect anomalies, ensure compliance with tax regulations, and streamline audits. Integration of these technologies enables real-time data sharing, improving transparency and reducing risks of errors or fraud in accounting practices.

Key Terms

**Audit technology:**

Audit technology leverages artificial intelligence, machine learning, and data analytics to automate risk assessment, improve accuracy in financial audits, and enhance compliance monitoring. Key tools include continuous auditing software, blockchain verification, and robotic process automation (RPA) that streamline audit procedures and reduce human error. Discover how integrating audit technology transforms auditing efficiency and accuracy within your organization.

Data Analytics

Audit technology leverages data analytics to enhance the accuracy and efficiency of financial audits by identifying anomalies and trends within vast datasets. Tax technology utilizes data analytics to optimize tax compliance, forecasting, and strategic planning by analyzing tax-related data and regulatory changes. Explore how these innovations transform financial processes and improve decision-making.

Continuous Auditing

Continuous auditing leverages advanced audit technology such as AI, blockchain, and data analytics to provide real-time assurance and automatic anomaly detection, significantly reducing risks and operational inefficiencies. Tax technology, while also incorporating automation and data analytics, primarily focuses on compliance, reporting accuracy, and regulatory changes to optimize tax processes and minimize liabilities. Explore the latest innovations in audit and tax technology to fully understand how continuous auditing transforms financial oversight.

Source and External Links

Audit technology - EY - EY integrates leading-edge digital technology such as AI, data analytics, blockchain, drones, and automation into its audit process using platforms like EY Canvas, EY Helix, and EY Atlas to enhance audit quality and insights while reducing client burden.

Audit technology - Wikipedia - Audit technology uses computerization, AI, robotics, and drones to improve audit efficiency, accuracy, and timeliness, with firms like PwC employing AI audit systems such as Aura to standardize and monitor audit quality in real time.

Next-generation audit technology: Advancements, ... - AI, machine learning, and blockchain automate routine audit tasks, deliver deeper data insights, enhance fraud detection, and improve transparency, while continuous training is essential for auditors to keep pace with evolving technologies and methodologies.

dowidth.com

dowidth.com