Fair value measurement reflects the current market value of assets and liabilities, providing a dynamic and relevant financial snapshot, while historical cost records transactions based on the original purchase price, ensuring reliability and verifiability. This distinction impacts financial reporting, influencing investor decisions and regulatory compliance under frameworks like IFRS and GAAP. Explore more to understand how these valuation methods affect financial transparency and economic decision-making.

Why it is important

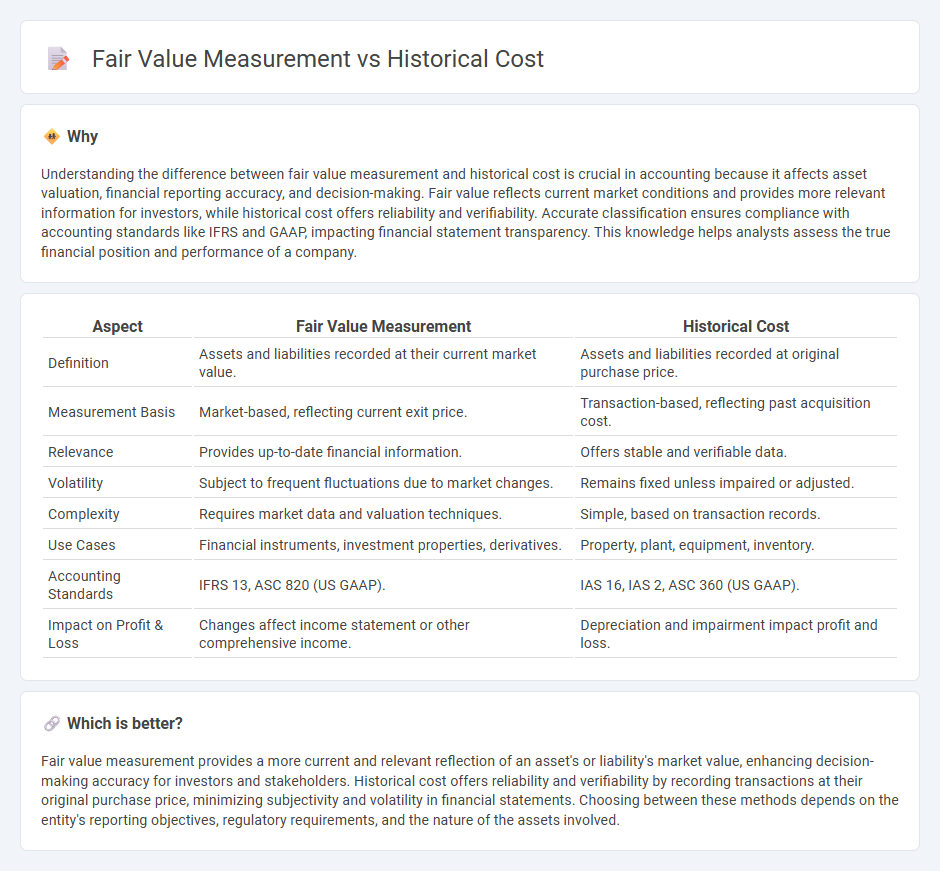

Understanding the difference between fair value measurement and historical cost is crucial in accounting because it affects asset valuation, financial reporting accuracy, and decision-making. Fair value reflects current market conditions and provides more relevant information for investors, while historical cost offers reliability and verifiability. Accurate classification ensures compliance with accounting standards like IFRS and GAAP, impacting financial statement transparency. This knowledge helps analysts assess the true financial position and performance of a company.

Comparison Table

| Aspect | Fair Value Measurement | Historical Cost |

|---|---|---|

| Definition | Assets and liabilities recorded at their current market value. | Assets and liabilities recorded at original purchase price. |

| Measurement Basis | Market-based, reflecting current exit price. | Transaction-based, reflecting past acquisition cost. |

| Relevance | Provides up-to-date financial information. | Offers stable and verifiable data. |

| Volatility | Subject to frequent fluctuations due to market changes. | Remains fixed unless impaired or adjusted. |

| Complexity | Requires market data and valuation techniques. | Simple, based on transaction records. |

| Use Cases | Financial instruments, investment properties, derivatives. | Property, plant, equipment, inventory. |

| Accounting Standards | IFRS 13, ASC 820 (US GAAP). | IAS 16, IAS 2, ASC 360 (US GAAP). |

| Impact on Profit & Loss | Changes affect income statement or other comprehensive income. | Depreciation and impairment impact profit and loss. |

Which is better?

Fair value measurement provides a more current and relevant reflection of an asset's or liability's market value, enhancing decision-making accuracy for investors and stakeholders. Historical cost offers reliability and verifiability by recording transactions at their original purchase price, minimizing subjectivity and volatility in financial statements. Choosing between these methods depends on the entity's reporting objectives, regulatory requirements, and the nature of the assets involved.

Connection

Fair value measurement and historical cost are key accounting valuation methods that provide different perspectives on asset and liability reporting. Historical cost records assets based on the original purchase price, ensuring reliability and consistency, while fair value reflects current market conditions, offering relevance and timely information for decision-making. The integration of both measures in financial statements balances objectivity with market-based insights, enhancing transparency and comparability in accounting practices.

Key Terms

Asset Valuation

Historical cost measurement records assets at their original purchase price, providing a reliable and verifiable basis for financial reporting but may not reflect current market conditions. Fair value measurement estimates the price at which an asset could be exchanged between knowledgeable, willing parties, offering timely and relevant information that better captures economic realities. Explore the implications of each valuation method to understand their impact on asset reporting and financial decision-making.

Reliability

Historical cost measurement ensures high reliability by recording assets and liabilities based on actual transaction prices, providing verifiable and objective data. Fair value measurement offers less reliability due to its reliance on estimates, market assumptions, and subjective judgments, which can introduce volatility and reduce comparability. Explore these valuation methods further to understand their impact on financial reporting reliability.

Relevance

Historical cost measurement records assets and liabilities based on their original purchase price, ensuring reliability and verifiability but often lacking relevance in reflecting current market conditions. Fair value measurement enhances relevance by providing updated valuations that reflect current market prices, improving decision-making for investors and stakeholders. Explore further to understand how these measurement bases impact financial statements and investment decisions.

Source and External Links

What is Historical Cost? - SuperfastCPA CPA Review - Historical cost is an accounting principle referring to the original monetary value paid to acquire an asset, including additional costs to prepare it for use, and remains unchanged on financial statements except for depreciation or impairment adjustments.

Historical Cost - Overview, Example, Accounting Adjustment - It is the original purchase price of an asset used in accounting records, reflecting the cost principle that assets and liabilities are recorded at acquisition cost without adjustments for market value changes over time.

Historical cost definition - AccountingTools - Historical cost includes the purchase price plus all additional expenses incurred to bring the asset to its usable state, recorded initially and not subject to upward market value revaluation under GAAP rules.

dowidth.com

dowidth.com