Data lake reconciliation involves matching and verifying large volumes of transactional data stored in centralized repositories to ensure accuracy and consistency across diverse sources. Intercompany reconciliation focuses on resolving discrepancies between financial records of different entities within the same corporate group, ensuring consolidated financial reporting integrity. Explore our detailed guide to understand how each reconciliation type enhances accounting accuracy and efficiency.

Why it is important

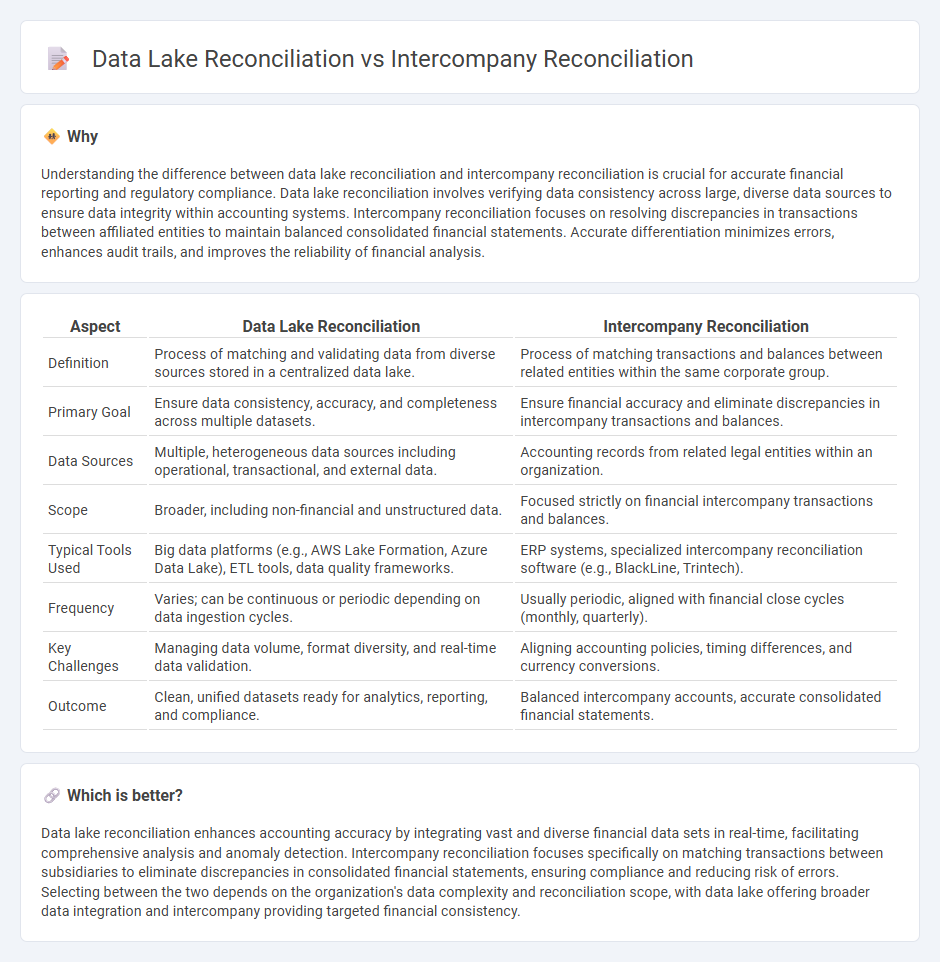

Understanding the difference between data lake reconciliation and intercompany reconciliation is crucial for accurate financial reporting and regulatory compliance. Data lake reconciliation involves verifying data consistency across large, diverse data sources to ensure data integrity within accounting systems. Intercompany reconciliation focuses on resolving discrepancies in transactions between affiliated entities to maintain balanced consolidated financial statements. Accurate differentiation minimizes errors, enhances audit trails, and improves the reliability of financial analysis.

Comparison Table

| Aspect | Data Lake Reconciliation | Intercompany Reconciliation |

|---|---|---|

| Definition | Process of matching and validating data from diverse sources stored in a centralized data lake. | Process of matching transactions and balances between related entities within the same corporate group. |

| Primary Goal | Ensure data consistency, accuracy, and completeness across multiple datasets. | Ensure financial accuracy and eliminate discrepancies in intercompany transactions and balances. |

| Data Sources | Multiple, heterogeneous data sources including operational, transactional, and external data. | Accounting records from related legal entities within an organization. |

| Scope | Broader, including non-financial and unstructured data. | Focused strictly on financial intercompany transactions and balances. |

| Typical Tools Used | Big data platforms (e.g., AWS Lake Formation, Azure Data Lake), ETL tools, data quality frameworks. | ERP systems, specialized intercompany reconciliation software (e.g., BlackLine, Trintech). |

| Frequency | Varies; can be continuous or periodic depending on data ingestion cycles. | Usually periodic, aligned with financial close cycles (monthly, quarterly). |

| Key Challenges | Managing data volume, format diversity, and real-time data validation. | Aligning accounting policies, timing differences, and currency conversions. |

| Outcome | Clean, unified datasets ready for analytics, reporting, and compliance. | Balanced intercompany accounts, accurate consolidated financial statements. |

Which is better?

Data lake reconciliation enhances accounting accuracy by integrating vast and diverse financial data sets in real-time, facilitating comprehensive analysis and anomaly detection. Intercompany reconciliation focuses specifically on matching transactions between subsidiaries to eliminate discrepancies in consolidated financial statements, ensuring compliance and reducing risk of errors. Selecting between the two depends on the organization's data complexity and reconciliation scope, with data lake offering broader data integration and intercompany providing targeted financial consistency.

Connection

Data lake reconciliation centralizes vast transactional datasets, enabling efficient cross-verification of accounting records across multiple systems. Intercompany reconciliation leverages this centralized data to identify mismatches between affiliated entities, ensuring accurate elimination of intercompany balances in consolidated financial statements. The integration of data lakes enhances the speed and accuracy of intercompany reconciliation by providing a unified source of truth for all intercompany transactions.

Key Terms

**Intercompany reconciliation:**

Intercompany reconciliation ensures accurate matching of transactions between subsidiaries, reducing discrepancies and streamlining financial consolidation. It involves automated tools that facilitate real-time matching of invoices, payments, and balances to maintain consistency across corporate entities. Explore how advanced intercompany reconciliation solutions enhance audit readiness and financial transparency.

Eliminations

Intercompany reconciliation involves matching and eliminating intercompany transactions within financial statements to prevent double counting, ensuring accurate consolidated reporting. Data lake reconciliation leverages large-scale data storage and processing to identify and resolve discrepancies in transactional data from multiple sources, improving the accuracy of elimination entries. Explore our detailed guide to understand how advanced reconciliation techniques optimize financial eliminations.

Intercompany balances

Intercompany reconciliation involves matching and settling transactions between subsidiaries to ensure accurate intercompany balances, reducing discrepancies and streamlining financial reporting. Data lake reconciliation leverages large-scale data storage and analytics to verify intercompany transactions at scale, enhancing data accuracy across multiple systems and business units. Explore detailed methodologies and tools to optimize intercompany balance management.

Source and External Links

Intercompany Reconciliation: How to Reconcile Multi-Entity - Intercompany reconciliation involves matching and verifying transactions between entities within the same corporation, ensuring intercompany balances net to zero and producing reliable consolidated financial statements by identifying all intercompany transactions like loans, service fees, and product transfers with standardized coding.

Intercompany Reconciliation Guide With Examples - SoftLedger - The reconciliation process begins with identifying all intercompany transactions in each entity's accounts and can be conducted manually or with software, using methods like G/L open items or account reconciliations, with automation recommended to reduce errors and speed month-end close.

What is Intercompany Reconciliation: Process and Examples - Intercompany reconciliation ensures transactions between subsidiaries and parent companies are accurately recorded and balanced across entities, verifying amounts match on both sides of transactions such as sales or fund transfers to maintain financial accuracy, compliance, and transparency.

dowidth.com

dowidth.com