Deep learning forecasting leverages neural networks to model complex patterns in large datasets, offering adaptability and accuracy in predicting financial trends. Time series analysis employs statistical methods like ARIMA and exponential smoothing to directly analyze temporal dependencies in accounting data. Explore the nuances of each approach to enhance your financial forecasting strategies.

Why it is important

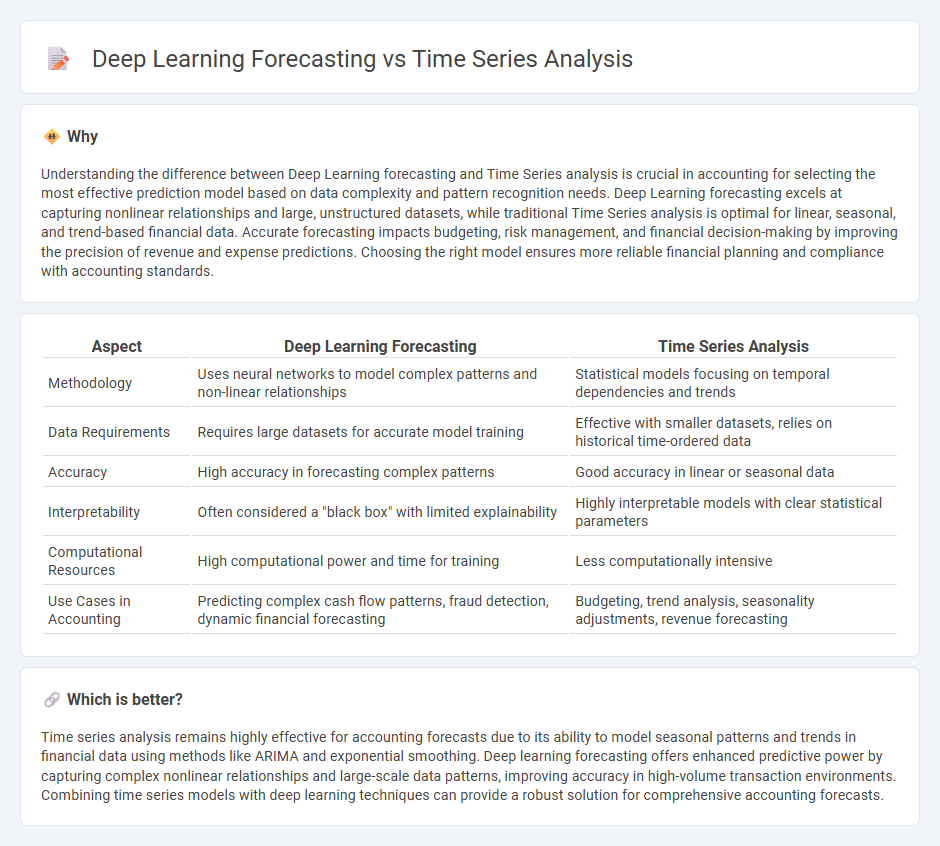

Understanding the difference between Deep Learning forecasting and Time Series analysis is crucial in accounting for selecting the most effective prediction model based on data complexity and pattern recognition needs. Deep Learning forecasting excels at capturing nonlinear relationships and large, unstructured datasets, while traditional Time Series analysis is optimal for linear, seasonal, and trend-based financial data. Accurate forecasting impacts budgeting, risk management, and financial decision-making by improving the precision of revenue and expense predictions. Choosing the right model ensures more reliable financial planning and compliance with accounting standards.

Comparison Table

| Aspect | Deep Learning Forecasting | Time Series Analysis |

|---|---|---|

| Methodology | Uses neural networks to model complex patterns and non-linear relationships | Statistical models focusing on temporal dependencies and trends |

| Data Requirements | Requires large datasets for accurate model training | Effective with smaller datasets, relies on historical time-ordered data |

| Accuracy | High accuracy in forecasting complex patterns | Good accuracy in linear or seasonal data |

| Interpretability | Often considered a "black box" with limited explainability | Highly interpretable models with clear statistical parameters |

| Computational Resources | High computational power and time for training | Less computationally intensive |

| Use Cases in Accounting | Predicting complex cash flow patterns, fraud detection, dynamic financial forecasting | Budgeting, trend analysis, seasonality adjustments, revenue forecasting |

Which is better?

Time series analysis remains highly effective for accounting forecasts due to its ability to model seasonal patterns and trends in financial data using methods like ARIMA and exponential smoothing. Deep learning forecasting offers enhanced predictive power by capturing complex nonlinear relationships and large-scale data patterns, improving accuracy in high-volume transaction environments. Combining time series models with deep learning techniques can provide a robust solution for comprehensive accounting forecasts.

Connection

Deep learning forecasting leverages neural networks to model complex patterns in time series data, enhancing the accuracy of financial predictions in accounting. Time series analysis provides the structured temporal data essential for training deep learning algorithms to detect trends, seasonality, and anomalies. Integrating these methods enables accountants to optimize budgeting, risk assessment, and revenue forecasting through improved predictive analytics.

Key Terms

Autocorrelation

Time series analysis relies heavily on autocorrelation to capture temporal dependencies and predict future values based on past observations, using models like ARIMA and Holt-Winters. Deep learning forecasting, especially with architectures like LSTM and GRU, automatically learns complex, non-linear patterns in autocorrelation without explicit manual feature engineering. Explore further to understand which method best harnesses autocorrelation for your forecasting needs.

Feature extraction

Time series analysis relies heavily on manual feature extraction techniques such as autocorrelation, seasonality identification, and trend decomposition to capture temporal patterns. Deep learning forecasting methods utilize automated feature extraction through architectures like recurrent neural networks (RNNs) and convolutional neural networks (CNNs), enabling the model to learn complex, non-linear relationships directly from raw data. Explore the advantages and limitations of both approaches to optimize your forecasting strategy.

Model overfitting

Time series analysis techniques such as ARIMA and exponential smoothing often rely on simpler models with fewer parameters, reducing the risk of overfitting compared to deep learning models like LSTM and Transformer networks, which can capture complex patterns but may memorize noise if not properly regularized. Overfitting in deep learning forecasting is mitigated through methods like dropout, early stopping, and cross-validation, yet requires careful tuning of hyperparameters and extensive computational resources. Explore detailed strategies and best practices to balance model complexity and generalization in both approaches.

Source and External Links

Time Series Analysis: Steps, Types, and Examples - Time series analysis is a statistical technique used to analyze data points recorded at regular intervals to identify patterns, trends, and seasonal variations, which helps in forecasting future values.

Time Series Analysis and Forecasting - This approach systematically studies sequential data collected over time, focusing on decomposing the series into trend, seasonality, and residual components to understand and predict underlying patterns.

Time Series Analysis: Definition, Types & Techniques - Time series analysis examines how variables change over time, requiring consistent, large datasets to reveal reliable trends and enable accurate forecasting based on historical data.

dowidth.com

dowidth.com