Embedded finance reconciliation streamlines the process of matching transactions within integrated financial services, ensuring seamless alignment of payment data across platforms. Bank reconciliation focuses on verifying and comparing company ledgers against bank statements to detect discrepancies and maintain accurate financial records. Explore further to understand the key differences and benefits of each reconciliation method.

Why it is important

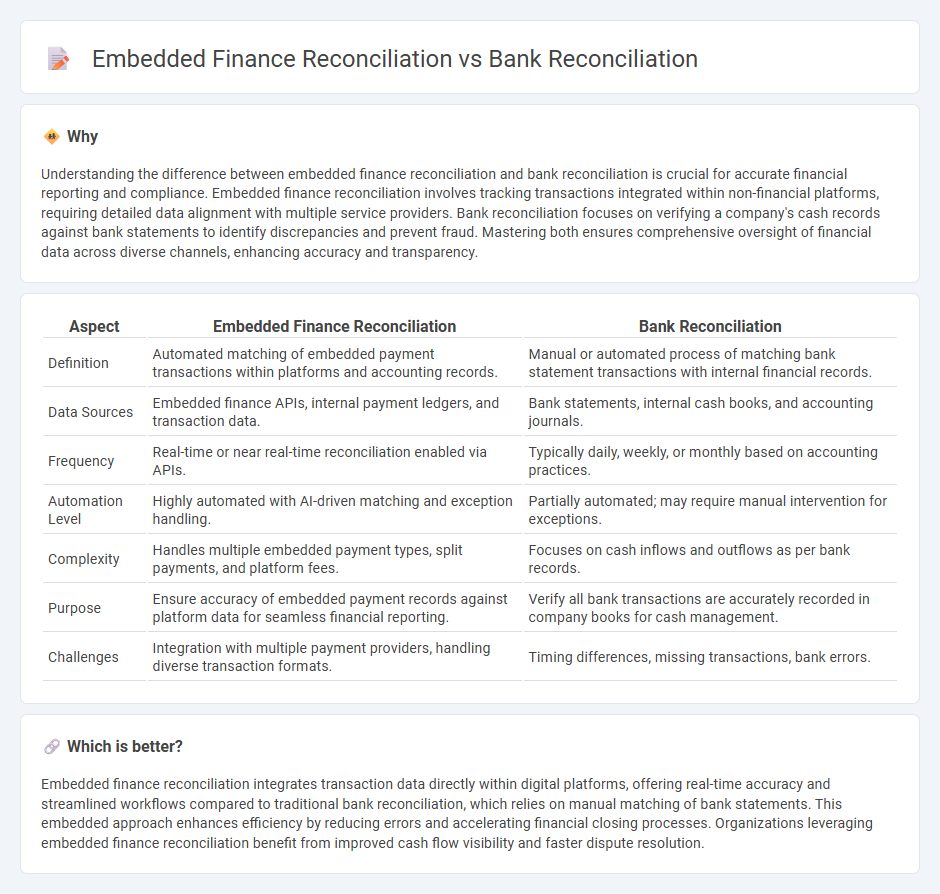

Understanding the difference between embedded finance reconciliation and bank reconciliation is crucial for accurate financial reporting and compliance. Embedded finance reconciliation involves tracking transactions integrated within non-financial platforms, requiring detailed data alignment with multiple service providers. Bank reconciliation focuses on verifying a company's cash records against bank statements to identify discrepancies and prevent fraud. Mastering both ensures comprehensive oversight of financial data across diverse channels, enhancing accuracy and transparency.

Comparison Table

| Aspect | Embedded Finance Reconciliation | Bank Reconciliation |

|---|---|---|

| Definition | Automated matching of embedded payment transactions within platforms and accounting records. | Manual or automated process of matching bank statement transactions with internal financial records. |

| Data Sources | Embedded finance APIs, internal payment ledgers, and transaction data. | Bank statements, internal cash books, and accounting journals. |

| Frequency | Real-time or near real-time reconciliation enabled via APIs. | Typically daily, weekly, or monthly based on accounting practices. |

| Automation Level | Highly automated with AI-driven matching and exception handling. | Partially automated; may require manual intervention for exceptions. |

| Complexity | Handles multiple embedded payment types, split payments, and platform fees. | Focuses on cash inflows and outflows as per bank records. |

| Purpose | Ensure accuracy of embedded payment records against platform data for seamless financial reporting. | Verify all bank transactions are accurately recorded in company books for cash management. |

| Challenges | Integration with multiple payment providers, handling diverse transaction formats. | Timing differences, missing transactions, bank errors. |

Which is better?

Embedded finance reconciliation integrates transaction data directly within digital platforms, offering real-time accuracy and streamlined workflows compared to traditional bank reconciliation, which relies on manual matching of bank statements. This embedded approach enhances efficiency by reducing errors and accelerating financial closing processes. Organizations leveraging embedded finance reconciliation benefit from improved cash flow visibility and faster dispute resolution.

Connection

Embedded finance reconciliation and bank reconciliation intersect through their shared goal of aligning financial data for accuracy and compliance. Embedded finance reconciliation integrates transactional data from digital platforms directly into accounting systems, streamlining the verification of embedded payments. Bank reconciliation corroborates these records against bank statements, ensuring all entries match and discrepancies are identified promptly for accurate financial reporting.

Key Terms

**Bank Reconciliation:**

Bank reconciliation involves comparing a company's internal financial records with bank statements to identify discrepancies, ensuring accuracy in cash flow management. This process detects errors such as duplicate payments, unauthorized transactions, or timing differences, providing a precise cash balance. Explore more to understand how bank reconciliation integrates with embedded finance reconciliation for seamless financial operations.

Outstanding Checks

Outstanding checks in bank reconciliation represent checks issued by the company but not yet cleared by the bank, causing discrepancies between the bank statement and company records. In embedded finance reconciliation, outstanding checks may be tracked within integrated financial platforms, streamlining real-time payment status updates and reducing manual reconciliation errors. Explore how these approaches impact cash flow management and operational efficiency in your financial processes.

Deposits in Transit

Bank reconciliation primarily addresses discrepancies in deposits in transit by matching bank statements with a company's ledger to ensure accuracy in recorded deposits. Embedded finance reconciliation involves integrating financial services within non-financial platforms, requiring real-time tracking and validation of deposits in transit across multiple systems for seamless transaction processing. Explore the distinct mechanisms and tools that enhance deposit accuracy in both reconciliation methods for deeper insights.

Source and External Links

What is Bank Reconciliation? Step-by-Step Guide + Examples - Bank reconciliation is the process of matching a company's cash records with its bank statements to identify discrepancies and ensure accurate financial reporting.

Definition & Example of Bank Reconciliation - A bank reconciliation statement compares the cash balance on a company's balance sheet to the corresponding amount on its bank statement, helping to detect errors, fraud, or needed accounting adjustments.

Bank Reconciliation: In-Depth Explanation with Examples - The purpose of bank reconciliation is to verify that the company's general ledger Cash account is complete and accurate, with adjustments made until the adjusted bank and book balances match.

dowidth.com

dowidth.com