Triple entry accounting enhances traditional double entry by integrating blockchain technology to create an immutable ledger, ensuring transparency and fraud prevention. Forensic accounting involves the investigation and analysis of financial records to detect fraud, embezzlement, and other financial crimes. Explore the differences and applications of these accounting methods to strengthen your financial oversight.

Why it is important

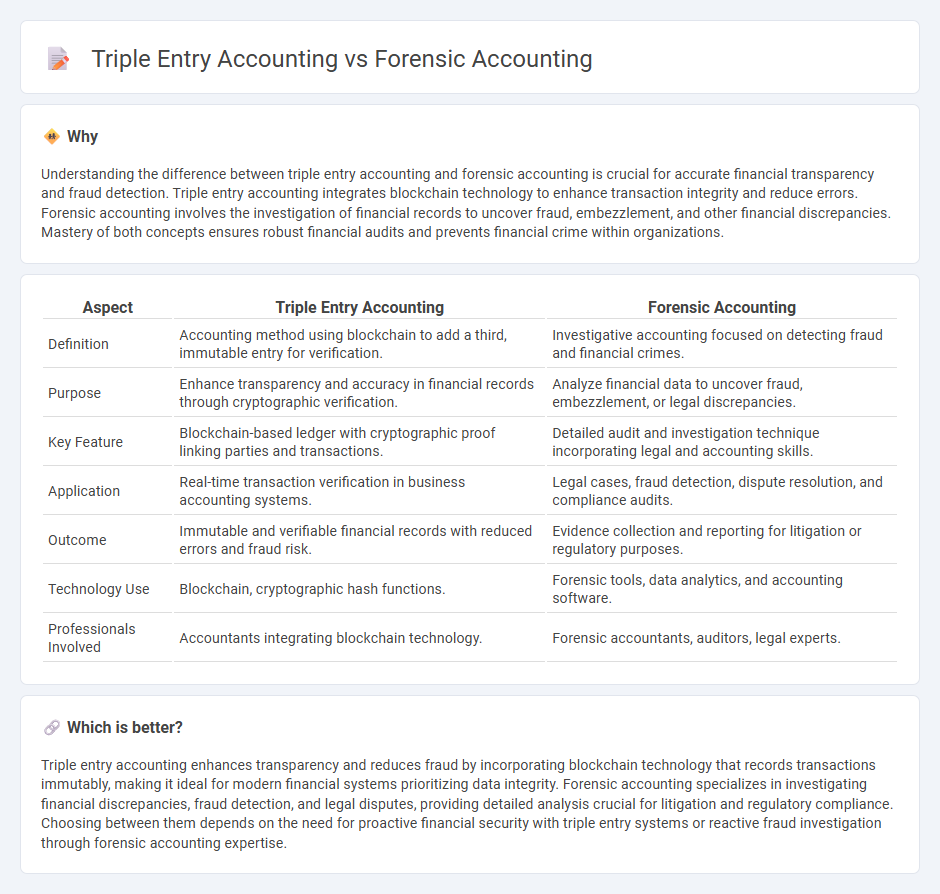

Understanding the difference between triple entry accounting and forensic accounting is crucial for accurate financial transparency and fraud detection. Triple entry accounting integrates blockchain technology to enhance transaction integrity and reduce errors. Forensic accounting involves the investigation of financial records to uncover fraud, embezzlement, and other financial discrepancies. Mastery of both concepts ensures robust financial audits and prevents financial crime within organizations.

Comparison Table

| Aspect | Triple Entry Accounting | Forensic Accounting |

|---|---|---|

| Definition | Accounting method using blockchain to add a third, immutable entry for verification. | Investigative accounting focused on detecting fraud and financial crimes. |

| Purpose | Enhance transparency and accuracy in financial records through cryptographic verification. | Analyze financial data to uncover fraud, embezzlement, or legal discrepancies. |

| Key Feature | Blockchain-based ledger with cryptographic proof linking parties and transactions. | Detailed audit and investigation technique incorporating legal and accounting skills. |

| Application | Real-time transaction verification in business accounting systems. | Legal cases, fraud detection, dispute resolution, and compliance audits. |

| Outcome | Immutable and verifiable financial records with reduced errors and fraud risk. | Evidence collection and reporting for litigation or regulatory purposes. |

| Technology Use | Blockchain, cryptographic hash functions. | Forensic tools, data analytics, and accounting software. |

| Professionals Involved | Accountants integrating blockchain technology. | Forensic accountants, auditors, legal experts. |

Which is better?

Triple entry accounting enhances transparency and reduces fraud by incorporating blockchain technology that records transactions immutably, making it ideal for modern financial systems prioritizing data integrity. Forensic accounting specializes in investigating financial discrepancies, fraud detection, and legal disputes, providing detailed analysis crucial for litigation and regulatory compliance. Choosing between them depends on the need for proactive financial security with triple entry systems or reactive fraud investigation through forensic accounting expertise.

Connection

Triple entry accounting enhances transparency by recording transactions on a shared, immutable ledger, which simplifies the verification process in forensic accounting investigations. Forensic accountants utilize this detailed, tamper-proof data to detect fraud, trace illicit financial activities, and provide evidence in legal disputes. The integration of triple entry accounting methods strengthens the accuracy and reliability of financial audits and fraud examinations.

Key Terms

Forensic accounting:

Forensic accounting involves the application of accounting, auditing, and investigative skills to examine financial records for fraud, embezzlement, or other financial crimes. It aims to provide evidence that can be used in legal proceedings and often involves detailed analysis of complex transactions to uncover discrepancies or illegal activity. Explore the key techniques and tools used in forensic accounting to enhance financial transparency and accountability.

Fraud detection

Forensic accounting employs detailed financial analysis and investigative techniques to identify and prevent fraud, relying heavily on tracing anomalies and inconsistencies in accounting records. Triple entry accounting enhances fraud detection by introducing cryptographic verification and blockchain technology, creating tamper-proof financial ledgers that ensure transparency and accuracy. Explore how integrating both methods can revolutionize fraud prevention strategies in modern finance.

Litigation support

Forensic accounting leverages detailed financial analysis and investigation to uncover fraud, misstatements, or financial discrepancies during litigation support, relying heavily on historical transaction data and audit trails. Triple entry accounting enhances transparency and security by using blockchain technology to create immutable and time-stamped transaction records, facilitating more reliable evidence and stronger verification in legal disputes. Explore the benefits and applications of both methods in litigation support to strengthen financial forensics and legal outcomes.

Source and External Links

Forensic Accounting Career Overview - Forensic accountants use accounting and auditing skills to investigate financial crimes like fraud, embezzlement, and financial disputes by analyzing records, supporting legal matters, and assessing financial risks according to accounting principles and legal standards.

What is Forensic Accounting? - NICE Actimize - Forensic accounting involves investigating financial records to detect, prevent, and resolve fraud or misconduct, using deep analysis to track suspicious transactions, often supporting law enforcement and legal processes.

What Is Forensic Accounting? - MVNU - Forensic accountants apply accounting skills to follow the money trail in cases of fraud or theft, assisting with investigations, preparing expert reports, and providing testimony while understanding the broader legal and business context.

dowidth.com

dowidth.com