Continuous close accounting integrates real-time data updates to provide ongoing financial insights, enhancing decision-making accuracy and operational efficiency. Event-driven close, triggered by specific business events, focuses on timely completion of financial statements following key transactions or periods, ensuring compliance and relevance. Explore the differences and advantages of continuous close versus event-driven close accounting to optimize your financial close process.

Why it is important

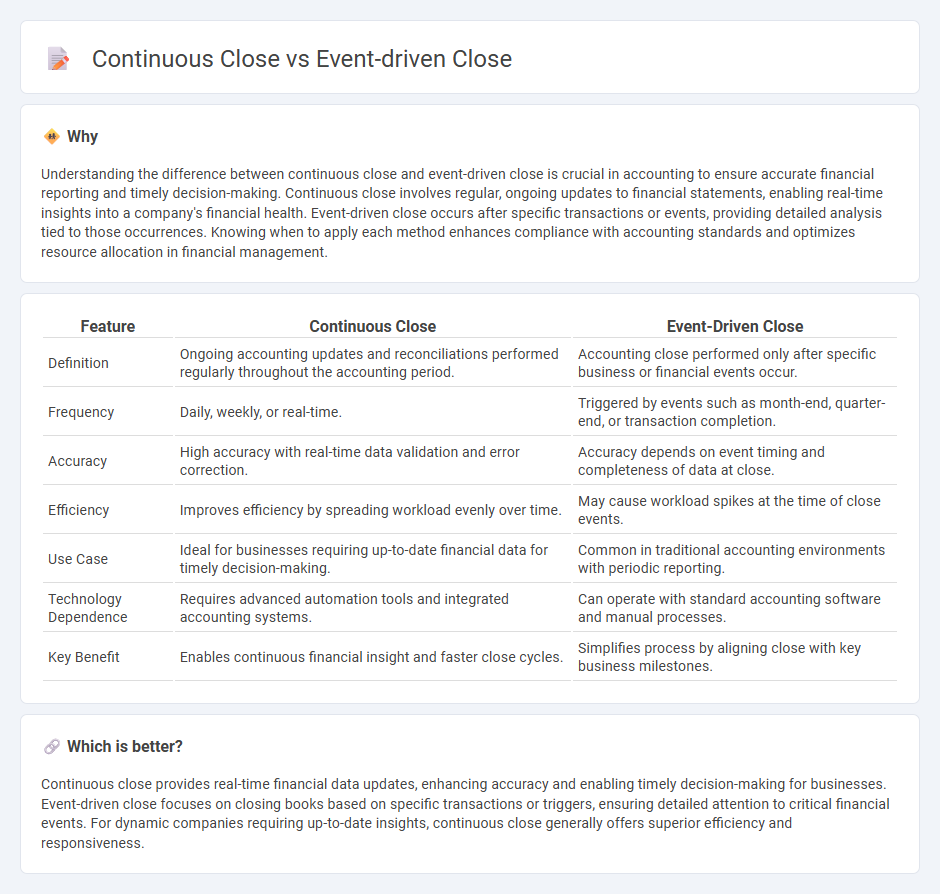

Understanding the difference between continuous close and event-driven close is crucial in accounting to ensure accurate financial reporting and timely decision-making. Continuous close involves regular, ongoing updates to financial statements, enabling real-time insights into a company's financial health. Event-driven close occurs after specific transactions or events, providing detailed analysis tied to those occurrences. Knowing when to apply each method enhances compliance with accounting standards and optimizes resource allocation in financial management.

Comparison Table

| Feature | Continuous Close | Event-Driven Close |

|---|---|---|

| Definition | Ongoing accounting updates and reconciliations performed regularly throughout the accounting period. | Accounting close performed only after specific business or financial events occur. |

| Frequency | Daily, weekly, or real-time. | Triggered by events such as month-end, quarter-end, or transaction completion. |

| Accuracy | High accuracy with real-time data validation and error correction. | Accuracy depends on event timing and completeness of data at close. |

| Efficiency | Improves efficiency by spreading workload evenly over time. | May cause workload spikes at the time of close events. |

| Use Case | Ideal for businesses requiring up-to-date financial data for timely decision-making. | Common in traditional accounting environments with periodic reporting. |

| Technology Dependence | Requires advanced automation tools and integrated accounting systems. | Can operate with standard accounting software and manual processes. |

| Key Benefit | Enables continuous financial insight and faster close cycles. | Simplifies process by aligning close with key business milestones. |

Which is better?

Continuous close provides real-time financial data updates, enhancing accuracy and enabling timely decision-making for businesses. Event-driven close focuses on closing books based on specific transactions or triggers, ensuring detailed attention to critical financial events. For dynamic companies requiring up-to-date insights, continuous close generally offers superior efficiency and responsiveness.

Connection

Continuous close and event-driven close both streamline the accounting process by enabling real-time financial reporting and reducing the end-of-period workload. Continuous close relies on ongoing data validation and transaction processing, while event-driven close triggers financial updates based on specific business activities or events. Integrating these approaches enhances accuracy and accelerates financial close cycles in modern accounting systems.

Key Terms

Real-time Data Processing

Event-driven close systems trigger data processing and updates immediately upon status changes, enabling real-time insights and faster decision-making. Continuous close, on the other hand, involves an ongoing, incremental update process that gradually integrates data throughout a period to maintain up-to-date records. Explore how both approaches enhance accuracy and responsiveness in real-time data processing environments.

Automation

Event-driven close automates financial closing tasks triggered by specific business events, enhancing accuracy and reducing manual intervention. Continuous close streamlines the closing process by integrating real-time data updates and ongoing reconciliations, minimizing close cycle time. Discover how combining these automation strategies can optimize your financial close process.

Transaction Reconciliation

Event-driven close triggers transaction reconciliation immediately upon detecting specific events, ensuring real-time accuracy and faster financial close cycles. Continuous close maintains an ongoing process of transaction reconciliation throughout the accounting period, promoting consistent data integrity and reducing end-period bottlenecks. Explore advanced strategies to optimize your transaction reconciliation process and enhance financial reporting accuracy.

Source and External Links

Event-driven architectures | Eventarc - Google Cloud - Event-driven architectures enable microservices to react to immutable state changes (events), with producers, routers, and consumers operating independently and asynchronously for scalable, decoupled workflows.

Event-driven architecture style - Azure - Learn Microsoft - Event-driven systems rely on producers, channels, and consumers, delivering events in near real time and supporting decoupled, scalable publish-subscribe or event stream models for integration.

Event-Driven Architecture - AWS - AWS event-driven architectures use events to trigger and communicate between independently scalable, resilient services, with an event router mediating between decoupled producers and consumers.

dowidth.com

dowidth.com