Zero knowledge proofs accounting enhances data privacy by allowing verification of financial statements without revealing underlying details, contrasting with cash basis accounting, which records transactions only when cash changes hands. This innovative cryptographic method ensures transaction authenticity while maintaining confidentiality, addressing transparency and security concerns in traditional bookkeeping. Explore how zero knowledge proofs can revolutionize your accounting practices beyond the limitations of cash basis methods.

Why it is important

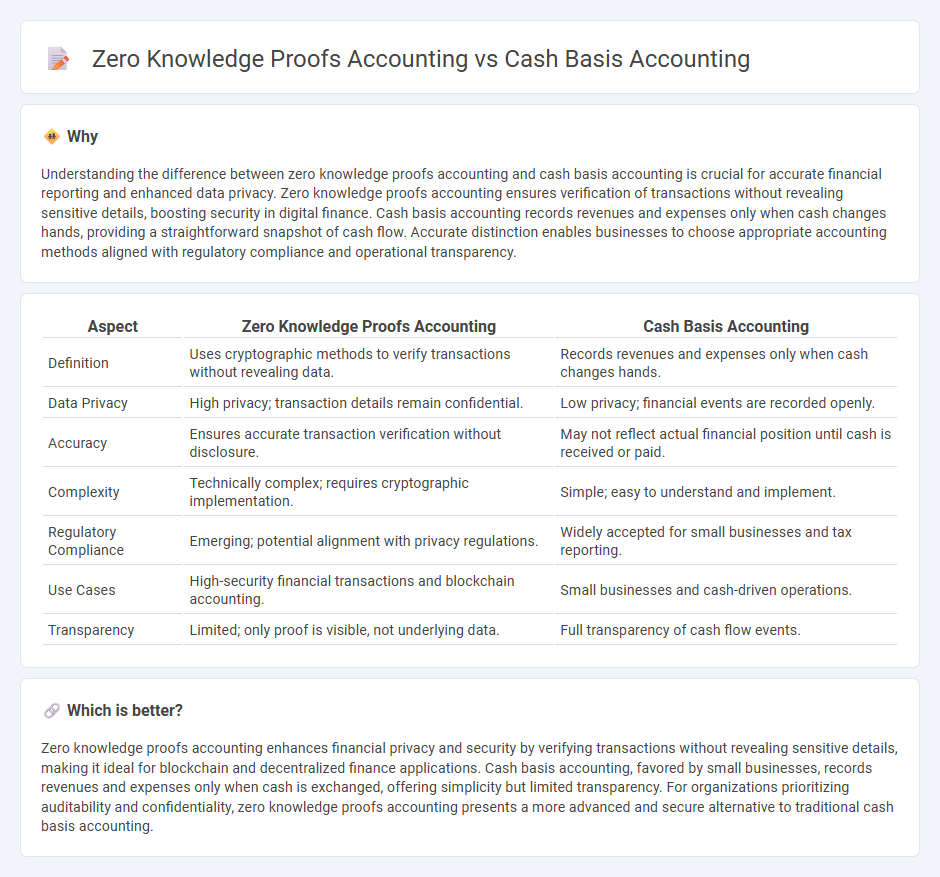

Understanding the difference between zero knowledge proofs accounting and cash basis accounting is crucial for accurate financial reporting and enhanced data privacy. Zero knowledge proofs accounting ensures verification of transactions without revealing sensitive details, boosting security in digital finance. Cash basis accounting records revenues and expenses only when cash changes hands, providing a straightforward snapshot of cash flow. Accurate distinction enables businesses to choose appropriate accounting methods aligned with regulatory compliance and operational transparency.

Comparison Table

| Aspect | Zero Knowledge Proofs Accounting | Cash Basis Accounting |

|---|---|---|

| Definition | Uses cryptographic methods to verify transactions without revealing data. | Records revenues and expenses only when cash changes hands. |

| Data Privacy | High privacy; transaction details remain confidential. | Low privacy; financial events are recorded openly. |

| Accuracy | Ensures accurate transaction verification without disclosure. | May not reflect actual financial position until cash is received or paid. |

| Complexity | Technically complex; requires cryptographic implementation. | Simple; easy to understand and implement. |

| Regulatory Compliance | Emerging; potential alignment with privacy regulations. | Widely accepted for small businesses and tax reporting. |

| Use Cases | High-security financial transactions and blockchain accounting. | Small businesses and cash-driven operations. |

| Transparency | Limited; only proof is visible, not underlying data. | Full transparency of cash flow events. |

Which is better?

Zero knowledge proofs accounting enhances financial privacy and security by verifying transactions without revealing sensitive details, making it ideal for blockchain and decentralized finance applications. Cash basis accounting, favored by small businesses, records revenues and expenses only when cash is exchanged, offering simplicity but limited transparency. For organizations prioritizing auditability and confidentiality, zero knowledge proofs accounting presents a more advanced and secure alternative to traditional cash basis accounting.

Connection

Zero-knowledge proofs enhance cash basis accounting by enabling secure verification of cash transactions without revealing sensitive financial details, promoting data privacy and integrity. This cryptographic method ensures real-time validation of cash inflows and outflows, aligning with the fundamental principles of cash basis accounting focused on actual cash exchanges. Integrating zero-knowledge proofs reduces fraud risks and improves trust in financial statements prepared under the cash basis framework.

Key Terms

Revenue Recognition

Cash basis accounting records revenue only when cash is received, simplifying financial reporting but potentially distorting earnings by ignoring accrued revenues. Zero-knowledge proofs accounting uses cryptographic methods to verify revenue recognition without revealing sensitive transaction details, enhancing privacy and trust in financial data. Discover how these innovative approaches reshape transparency and accuracy in revenue reporting.

Transaction Privacy

Cash basis accounting records transactions only when cash changes hands, making financial statements straightforward but less private. Zero knowledge proofs accounting employs cryptographic methods to verify transactions' validity without revealing sensitive details, significantly enhancing transaction privacy. Explore how zero knowledge proofs revolutionize secure and private financial recording.

Verifiability

Cash basis accounting recognizes revenue and expenses only when cash transactions occur, offering simplicity but limited verifiability since financial events rely on tangible cash flow records. Zero knowledge proofs accounting employs cryptographic techniques to validate transactions without revealing sensitive data, enhancing verifiability through secure, privacy-preserving proofs that confirm accuracy and integrity. Explore the cutting-edge advantages of zero knowledge proofs to understand their transformative impact on accounting transparency.

Source and External Links

Cash Basis Accounting: Definition, Example, Pros and Cons - This webpage provides an in-depth explanation of cash basis accounting, its advantages, disadvantages, and how it differs from accrual accounting.

Cash-based accounting: A guide to the cash basis - This guide covers how cash-based accounting works, its pros and cons, and how it affects tax reporting, as well as tips for transitioning to accrual accounting.

What Is Cash Basis Accounting? Definition and Guide - This article defines cash basis accounting, explains its use by small businesses, and discusses how it focuses solely on cash transactions, making it suitable for businesses with high positive cash flow.

dowidth.com

dowidth.com