Forensic analytics involves the examination of financial data to detect fraud, embezzlement, and financial misstatements using advanced data analysis techniques and investigative procedures. Managerial accounting focuses on internal financial reporting to assist management in decision-making, budgeting, and performance evaluation for strategic business planning. Explore the distinct methods and applications of forensic analytics and managerial accounting to understand their crucial roles in financial oversight and corporate governance.

Why it is important

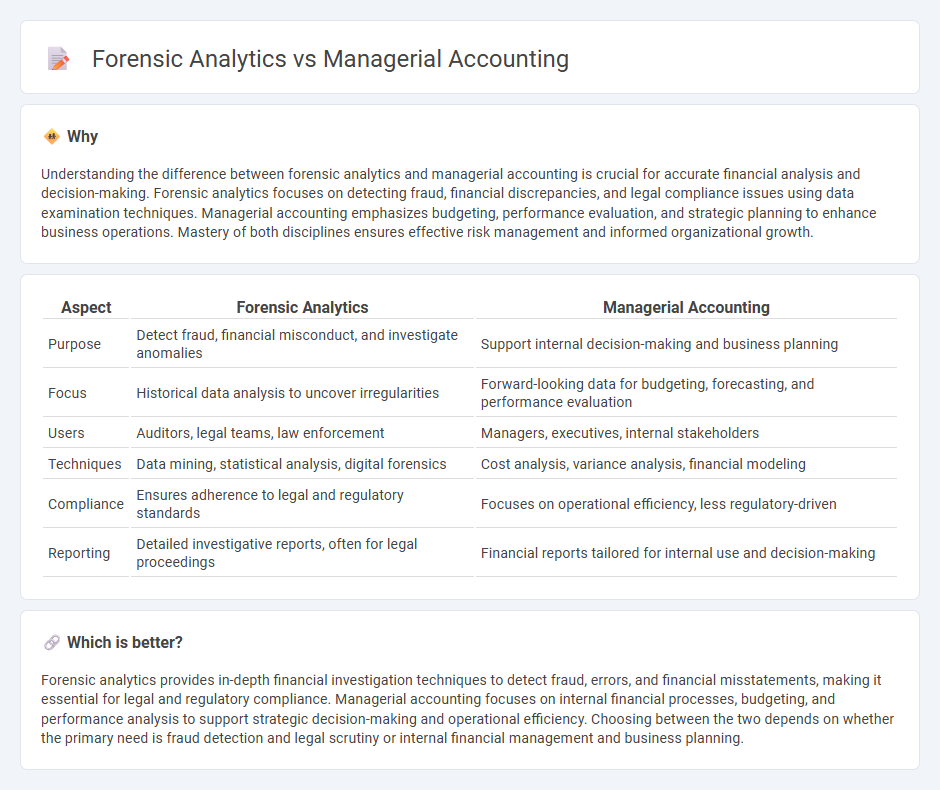

Understanding the difference between forensic analytics and managerial accounting is crucial for accurate financial analysis and decision-making. Forensic analytics focuses on detecting fraud, financial discrepancies, and legal compliance issues using data examination techniques. Managerial accounting emphasizes budgeting, performance evaluation, and strategic planning to enhance business operations. Mastery of both disciplines ensures effective risk management and informed organizational growth.

Comparison Table

| Aspect | Forensic Analytics | Managerial Accounting |

|---|---|---|

| Purpose | Detect fraud, financial misconduct, and investigate anomalies | Support internal decision-making and business planning |

| Focus | Historical data analysis to uncover irregularities | Forward-looking data for budgeting, forecasting, and performance evaluation |

| Users | Auditors, legal teams, law enforcement | Managers, executives, internal stakeholders |

| Techniques | Data mining, statistical analysis, digital forensics | Cost analysis, variance analysis, financial modeling |

| Compliance | Ensures adherence to legal and regulatory standards | Focuses on operational efficiency, less regulatory-driven |

| Reporting | Detailed investigative reports, often for legal proceedings | Financial reports tailored for internal use and decision-making |

Which is better?

Forensic analytics provides in-depth financial investigation techniques to detect fraud, errors, and financial misstatements, making it essential for legal and regulatory compliance. Managerial accounting focuses on internal financial processes, budgeting, and performance analysis to support strategic decision-making and operational efficiency. Choosing between the two depends on whether the primary need is fraud detection and legal scrutiny or internal financial management and business planning.

Connection

Forensic analytics enhances managerial accounting by providing detailed analysis of financial data to detect fraud, errors, and irregularities, ensuring accurate financial reporting and decision-making. Managerial accounting relies on forensic analytics to improve internal controls and strengthen risk management strategies through comprehensive examination of transaction patterns. Combining forensic analytics with managerial accounting supports organizations in maintaining financial integrity and optimizing resource allocation.

Key Terms

**Managerial accounting:**

Managerial accounting emphasizes internal financial analysis, cost management, budgeting, and performance evaluation to support strategic decision-making within organizations. It involves detailed reporting on financial operations, helping managers optimize resource allocation and improve operational efficiency. Explore more to understand how managerial accounting drives business success through data-driven insights.

Budgeting

Managerial accounting emphasizes budgeting as a key tool for planning, controlling, and evaluating financial performance within an organization, often involving variance analysis and forecast adjustments. Forensic analytics, in the context of budgeting, focuses on detecting anomalies, fraud, and financial discrepancies by examining budget data patterns and irregularities. Discover more about how each discipline applies unique techniques to budgeting processes and enhances financial decision-making.

Cost allocation

Managerial accounting emphasizes cost allocation by accurately assigning overhead and direct costs to products or departments to improve budgeting and performance evaluation. Forensic analytics, however, investigates discrepancies and anomalies in cost allocations to detect fraud or financial misstatements. Explore deeper insights into how these approaches enhance financial accuracy and accountability.

Source and External Links

Managerial Accounting: Everything You Need To Know - Managerial accounting involves using financial data and analysis to support internal decision-making, focusing on planning, budgeting, forecasting, performance management, and strategic advice to help a company achieve its financial goals.

Managerial Accounting Made Easy - NetSuite - Managerial accounting combines business information and organizational strategy to deliver internal reports that aid in planning, controlling performance, developing strategies, and evaluating operations, often using principles like causality and analogy to model company activities and support management decisions.

What Is Managerial Accounting | Salesforce ANZ - Managerial accounting provides management with detailed reports, budgets, and cost analyses to understand financial performance, identify improvement areas, manage risks, and facilitate effective planning and budgeting for organizational growth.

dowidth.com

dowidth.com