Digital asset valuation involves assessing the fair market value of cryptocurrencies, tokens, and other blockchain-based assets using methods such as market comparison and discounted cash flow analysis. Goodwill impairment focuses on evaluating the decline in value of intangible assets recorded during acquisitions when their carrying amount exceeds recoverable value. Explore the key differences and implications of these valuation challenges in accounting standards and financial reporting.

Why it is important

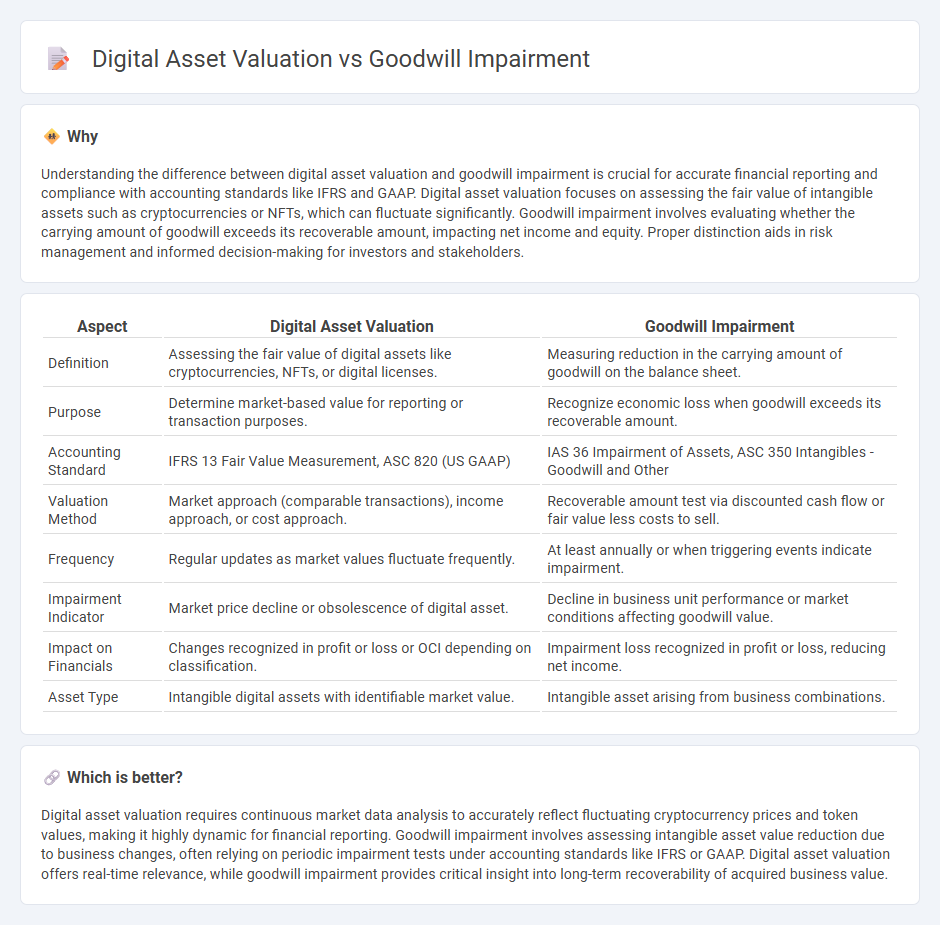

Understanding the difference between digital asset valuation and goodwill impairment is crucial for accurate financial reporting and compliance with accounting standards like IFRS and GAAP. Digital asset valuation focuses on assessing the fair value of intangible assets such as cryptocurrencies or NFTs, which can fluctuate significantly. Goodwill impairment involves evaluating whether the carrying amount of goodwill exceeds its recoverable amount, impacting net income and equity. Proper distinction aids in risk management and informed decision-making for investors and stakeholders.

Comparison Table

| Aspect | Digital Asset Valuation | Goodwill Impairment |

|---|---|---|

| Definition | Assessing the fair value of digital assets like cryptocurrencies, NFTs, or digital licenses. | Measuring reduction in the carrying amount of goodwill on the balance sheet. |

| Purpose | Determine market-based value for reporting or transaction purposes. | Recognize economic loss when goodwill exceeds its recoverable amount. |

| Accounting Standard | IFRS 13 Fair Value Measurement, ASC 820 (US GAAP) | IAS 36 Impairment of Assets, ASC 350 Intangibles - Goodwill and Other |

| Valuation Method | Market approach (comparable transactions), income approach, or cost approach. | Recoverable amount test via discounted cash flow or fair value less costs to sell. |

| Frequency | Regular updates as market values fluctuate frequently. | At least annually or when triggering events indicate impairment. |

| Impairment Indicator | Market price decline or obsolescence of digital asset. | Decline in business unit performance or market conditions affecting goodwill value. |

| Impact on Financials | Changes recognized in profit or loss or OCI depending on classification. | Impairment loss recognized in profit or loss, reducing net income. |

| Asset Type | Intangible digital assets with identifiable market value. | Intangible asset arising from business combinations. |

Which is better?

Digital asset valuation requires continuous market data analysis to accurately reflect fluctuating cryptocurrency prices and token values, making it highly dynamic for financial reporting. Goodwill impairment involves assessing intangible asset value reduction due to business changes, often relying on periodic impairment tests under accounting standards like IFRS or GAAP. Digital asset valuation offers real-time relevance, while goodwill impairment provides critical insight into long-term recoverability of acquired business value.

Connection

Digital asset valuation directly impacts goodwill impairment assessments by influencing the fair value calculations used in impairment testing. When digital assets, such as cryptocurrencies or NFTs, experience volatility or revaluation, the carrying amount of goodwill may need adjustment to reflect decreased recoverable amounts. Accurate digital asset valuation ensures compliance with accounting standards like IFRS 3 and ASC 350, reducing the risk of misstated goodwill impairment charges.

Key Terms

Carrying Value

Goodwill impairment involves assessing whether the carrying value of goodwill exceeds its recoverable amount, leading to a write-down on the balance sheet when the asset is overvalued. Digital asset valuation focuses on determining the fair value of intangible assets such as cryptocurrencies or NFTs, where carrying value represents the purchase price adjusted for any impairment losses or revaluation. Explore more on how these valuation methods impact financial reporting and asset management strategies.

Fair Value

Goodwill impairment and digital asset valuation both rely heavily on fair value measurement under accounting standards such as IFRS and GAAP. Goodwill impairment tests involve estimating the fair value of cash-generating units, adjusting for market conditions, while digital asset valuation focuses on fair value through market data or discounted cash flow models, reflecting liquidity and market volatility. Explore detailed methodologies and accounting implications to better understand the nuances of fair value application in these distinct asset categories.

Intangible Asset

Goodwill impairment involves assessing and recognizing a decline in the value of goodwill on financial statements, typically due to changes in market conditions or company performance. Digital asset valuation for intangible assets requires evaluating unique characteristics such as blockchain technology, ownership rights, and market demand to determine fair value accurately. Explore comprehensive strategies for managing and valuing various intangible assets to enhance financial reporting and investment decisions.

Source and External Links

Goodwill Impairment Accounting - Goodwill impairment involves recognizing a loss when the carrying value of goodwill exceeds its fair market value, affecting financial statements by reducing net income.

8 Real-World Goodwill Impairment Examples - This article provides examples and insights into goodwill impairment, highlighting its impact on financial health and transparency in financial reporting.

Impairment of Goodwill - The article discusses the process of goodwill impairment, including calculating recoverable amounts and recording impairment losses in financial statements.

dowidth.com

dowidth.com