Supply chain finance accounting focuses on the management of financial transactions between buyers and suppliers to optimize cash flow and working capital, whereas hedge accounting aims to reduce the volatility of financial statements by matching gains and losses on hedging instruments with the underlying exposure. Supply chain finance accounting involves tracking payables, receivables, and discounting arrangements, while hedge accounting requires detailed documentation and compliance with accounting standards like IFRS 9 or ASC 815. Explore further to understand the distinct accounting treatments and strategic importance of each in corporate finance management.

Why it is important

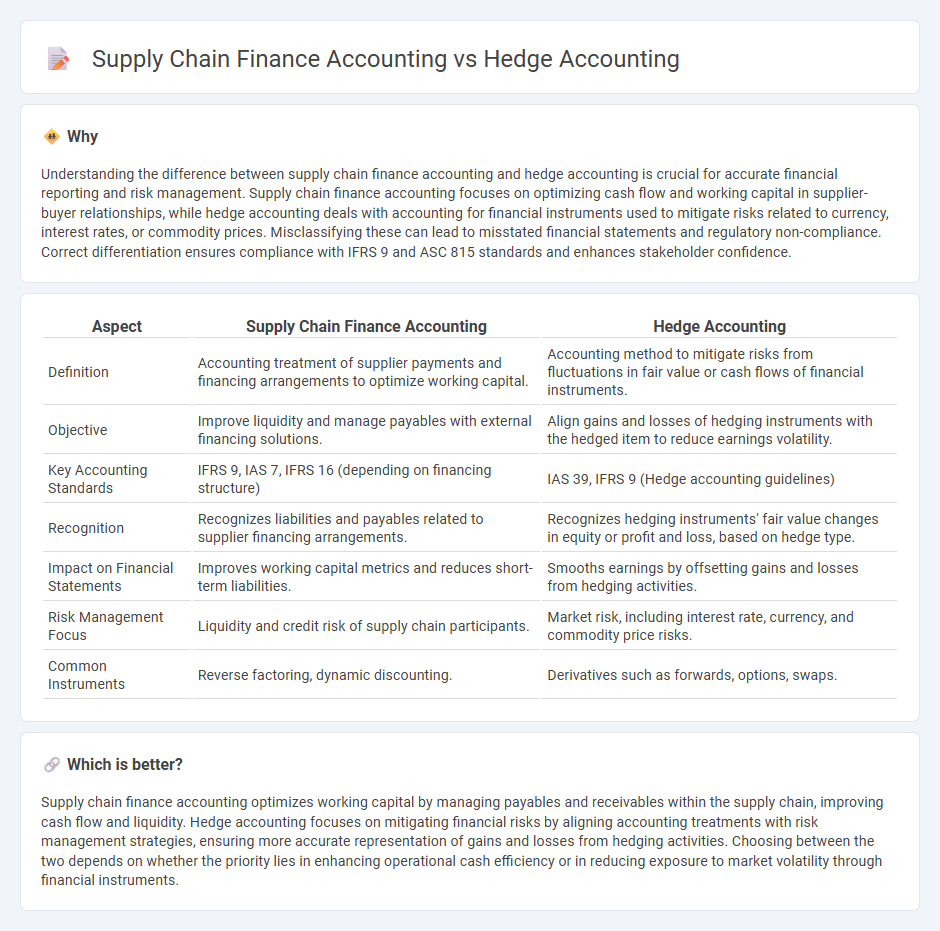

Understanding the difference between supply chain finance accounting and hedge accounting is crucial for accurate financial reporting and risk management. Supply chain finance accounting focuses on optimizing cash flow and working capital in supplier-buyer relationships, while hedge accounting deals with accounting for financial instruments used to mitigate risks related to currency, interest rates, or commodity prices. Misclassifying these can lead to misstated financial statements and regulatory non-compliance. Correct differentiation ensures compliance with IFRS 9 and ASC 815 standards and enhances stakeholder confidence.

Comparison Table

| Aspect | Supply Chain Finance Accounting | Hedge Accounting |

|---|---|---|

| Definition | Accounting treatment of supplier payments and financing arrangements to optimize working capital. | Accounting method to mitigate risks from fluctuations in fair value or cash flows of financial instruments. |

| Objective | Improve liquidity and manage payables with external financing solutions. | Align gains and losses of hedging instruments with the hedged item to reduce earnings volatility. |

| Key Accounting Standards | IFRS 9, IAS 7, IFRS 16 (depending on financing structure) | IAS 39, IFRS 9 (Hedge accounting guidelines) |

| Recognition | Recognizes liabilities and payables related to supplier financing arrangements. | Recognizes hedging instruments' fair value changes in equity or profit and loss, based on hedge type. |

| Impact on Financial Statements | Improves working capital metrics and reduces short-term liabilities. | Smooths earnings by offsetting gains and losses from hedging activities. |

| Risk Management Focus | Liquidity and credit risk of supply chain participants. | Market risk, including interest rate, currency, and commodity price risks. |

| Common Instruments | Reverse factoring, dynamic discounting. | Derivatives such as forwards, options, swaps. |

Which is better?

Supply chain finance accounting optimizes working capital by managing payables and receivables within the supply chain, improving cash flow and liquidity. Hedge accounting focuses on mitigating financial risks by aligning accounting treatments with risk management strategies, ensuring more accurate representation of gains and losses from hedging activities. Choosing between the two depends on whether the priority lies in enhancing operational cash efficiency or in reducing exposure to market volatility through financial instruments.

Connection

Supply chain finance accounting manages cash flow and working capital optimization within supply chains by recording payables and receivables financing accurately. Hedge accounting involves applying specific accounting treatments to financial instruments that mitigate risks such as interest rate or currency fluctuations affecting supply chain transactions. Both disciplines intersect by ensuring financial reporting reflects the economic impact of risk management strategies on supply chain financing arrangements.

Key Terms

**Fair Value Hedge**

Fair value hedge accounting involves recognizing changes in the fair value of a hedging instrument and the hedged item directly in profit or loss to reduce earnings volatility, primarily used for managing risks related to assets, liabilities, or firm commitments. In contrast, supply chain finance accounting focuses on optimizing working capital and cash flow by extending payment terms or factoring receivables, without directly impacting hedge accounting standards. Explore the nuanced differences and practical applications of fair value hedge accounting within supply chain finance to enhance risk management strategies.

**Reverse Factoring**

Reverse factoring in supply chain finance accounting enhances cash flow by allowing suppliers to receive early payments through a financial intermediary, distinct from hedge accounting that manages risk exposure in financial statements. While hedge accounting involves recognizing and measuring derivatives to offset risks like interest rate fluctuations, reverse factoring centers on optimizing working capital and improving supplier relationships. Explore the detailed comparison between reverse factoring and hedge accounting to understand their unique roles in financial strategy.

**Derivative Instrument**

Hedge accounting involves recognizing derivative instruments used to mitigate risks associated with fluctuations in prices, interest rates, or foreign currencies, aligning gains and losses with the hedged item's accounting period. Supply chain finance accounting typically does not treat financing instruments as derivatives but focuses on trade payables and receivables, emphasizing payment terms and financing costs. Explore the detailed distinctions between hedge accounting and supply chain finance accounting to better understand their impact on financial reporting.

Source and External Links

Hedge accounting - Wikipedia - Hedge accounting is an accounting practice that aims to offset the mark-to-market movements of derivatives in the profit and loss account, involving types such as fair value hedge and cash flow hedge, to reduce profit and loss volatility from derivatives used for risk management.

Beginner's Guide to Hedge Accounting - Chatham Financial - Hedge accounting is a special accounting election aligning gains and losses on derivatives with the underlying hedged items to manage earnings volatility, with qualifying hedge types including fair value, cash flow, and net investment hedges.

Hedge Accounting: Meaning, Types, Benefits & Examples - Hedge accounting reduces effects of financial risks like currency fluctuations by aligning gains and losses of hedging instruments with hedged items, requiring formal documentation, effectiveness demonstration, and ongoing assessment, with three types defined under U.S. GAAP including cash flow hedges as the most common.

dowidth.com

dowidth.com