Fair value measurement reflects the current market value of an asset or liability, providing a dynamic and timely financial perspective, while depreciated cost records the asset at its original cost minus accumulated depreciation, emphasizing historical cost and systematic allocation of expense. Fair value is often used for financial instruments and investment properties, offering transparency and relevance, whereas depreciated cost applies mainly to tangible fixed assets, supporting cost recovery and consistency. Explore these methods further to understand their impact on financial reporting and decision-making.

Why it is important

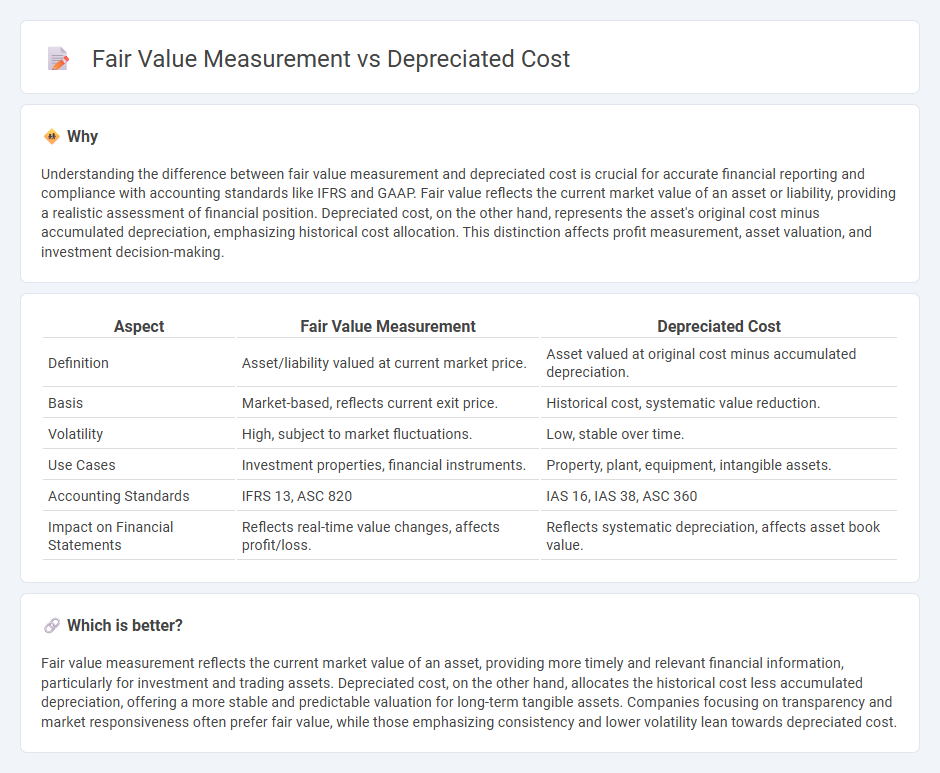

Understanding the difference between fair value measurement and depreciated cost is crucial for accurate financial reporting and compliance with accounting standards like IFRS and GAAP. Fair value reflects the current market value of an asset or liability, providing a realistic assessment of financial position. Depreciated cost, on the other hand, represents the asset's original cost minus accumulated depreciation, emphasizing historical cost allocation. This distinction affects profit measurement, asset valuation, and investment decision-making.

Comparison Table

| Aspect | Fair Value Measurement | Depreciated Cost |

|---|---|---|

| Definition | Asset/liability valued at current market price. | Asset valued at original cost minus accumulated depreciation. |

| Basis | Market-based, reflects current exit price. | Historical cost, systematic value reduction. |

| Volatility | High, subject to market fluctuations. | Low, stable over time. |

| Use Cases | Investment properties, financial instruments. | Property, plant, equipment, intangible assets. |

| Accounting Standards | IFRS 13, ASC 820 | IAS 16, IAS 38, ASC 360 |

| Impact on Financial Statements | Reflects real-time value changes, affects profit/loss. | Reflects systematic depreciation, affects asset book value. |

Which is better?

Fair value measurement reflects the current market value of an asset, providing more timely and relevant financial information, particularly for investment and trading assets. Depreciated cost, on the other hand, allocates the historical cost less accumulated depreciation, offering a more stable and predictable valuation for long-term tangible assets. Companies focusing on transparency and market responsiveness often prefer fair value, while those emphasizing consistency and lower volatility lean towards depreciated cost.

Connection

Fair value measurement and depreciated cost are interconnected accounting methods used to value assets and liabilities. Fair value reflects the current market price at which an asset or liability can be exchanged, while depreciated cost represents the original cost adjusted for accumulated depreciation and impairment losses. The choice between these measurement bases impacts financial statement accuracy and decision-making, particularly for financial instruments and long-term assets.

Key Terms

Historical Cost

Historical cost measures an asset's value based on its original purchase price minus accumulated depreciation, providing a consistent and objective basis for financial reporting. Fair value measurement reflects the current market price, aiming to present a more accurate and timely valuation of assets. Discover more about how historical cost and fair value impact financial statements and investment decisions.

Accumulated Depreciation

Accumulated Depreciation represents the total depreciation expense allocated to an asset since its acquisition, affecting the asset's depreciated cost on the balance sheet by reducing its original cost. Fair Value Measurement, by contrast, reflects the asset's current market value, which may exceed or fall below its depreciated cost due to market conditions. Explore the implications of accumulated depreciation on financial reporting and asset valuation for a deeper understanding.

Market Value

Depreciated cost measurement records asset value based on acquisition cost minus accumulated depreciation, reflecting historical purchase and usage wear, while fair value measurement uses current market value to represent the asset's real-time economic worth. Market value, derived from active market prices or recent transactions, provides a more accurate financial snapshot for assets in liquid markets. Explore further to understand how these measurement methods impact financial reporting and decision-making.

Source and External Links

Depreciated Cost - Definition, Calculation Formula - The depreciated cost is the remaining value of an asset after deducting the accumulated depreciation from its original acquisition cost, used to measure the asset's value at a specific time for accounting and valuation purposes.

Depreciable Cost | Formula + Calculator - Wall Street Prep - Depreciable cost is calculated as the purchase cost of an asset minus its salvage value, representing the portion of the asset's cost that will be depreciated over its useful life.

Depreciated Cost: Definition, Calculation Methods, Example - Indeed - Depreciated cost refers to an asset's current value after subtracting total depreciation from its original cost, showing the asset's worth after accounting for usage and aging over time.

dowidth.com

dowidth.com