Neobank reconciliation involves matching internal transaction records with external bank statements to ensure financial accuracy and detect discrepancies unique to digital banking platforms. Customer account reconciliation focuses on verifying individual account balances and transactions to guarantee accurate customer reporting and trust. Explore more to understand the critical differences and best practices in both reconciliation processes.

Why it is important

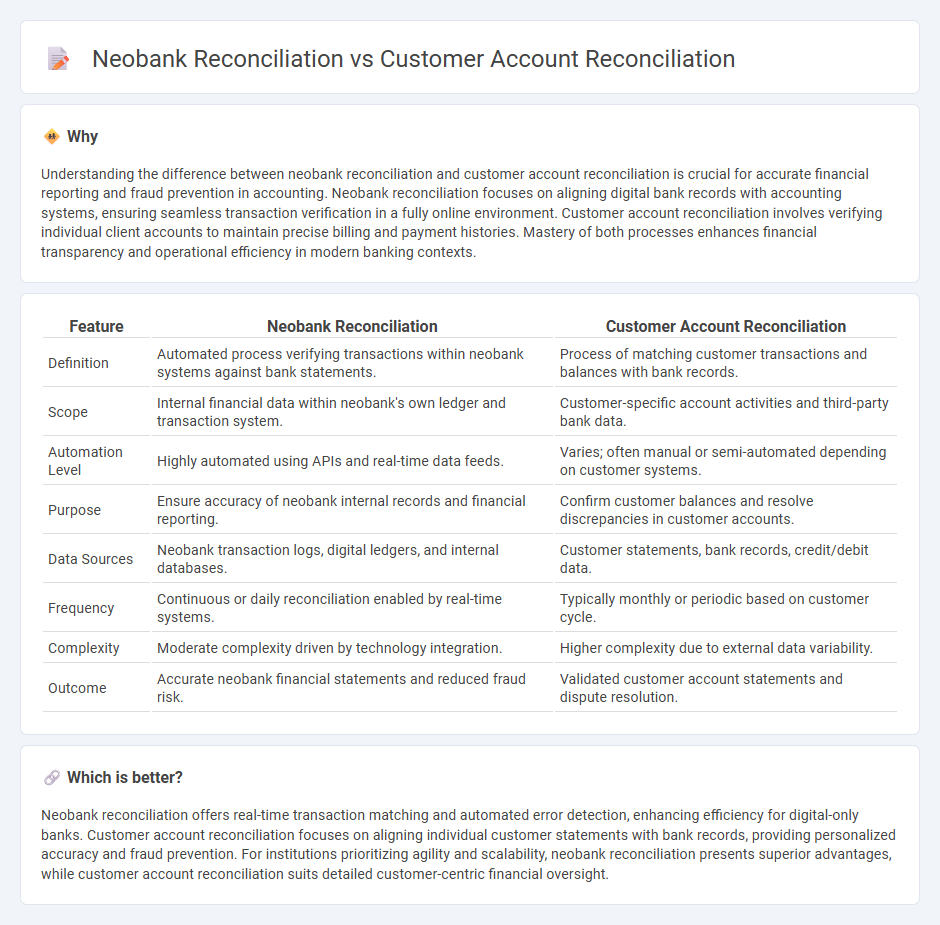

Understanding the difference between neobank reconciliation and customer account reconciliation is crucial for accurate financial reporting and fraud prevention in accounting. Neobank reconciliation focuses on aligning digital bank records with accounting systems, ensuring seamless transaction verification in a fully online environment. Customer account reconciliation involves verifying individual client accounts to maintain precise billing and payment histories. Mastery of both processes enhances financial transparency and operational efficiency in modern banking contexts.

Comparison Table

| Feature | Neobank Reconciliation | Customer Account Reconciliation |

|---|---|---|

| Definition | Automated process verifying transactions within neobank systems against bank statements. | Process of matching customer transactions and balances with bank records. |

| Scope | Internal financial data within neobank's own ledger and transaction system. | Customer-specific account activities and third-party bank data. |

| Automation Level | Highly automated using APIs and real-time data feeds. | Varies; often manual or semi-automated depending on customer systems. |

| Purpose | Ensure accuracy of neobank internal records and financial reporting. | Confirm customer balances and resolve discrepancies in customer accounts. |

| Data Sources | Neobank transaction logs, digital ledgers, and internal databases. | Customer statements, bank records, credit/debit data. |

| Frequency | Continuous or daily reconciliation enabled by real-time systems. | Typically monthly or periodic based on customer cycle. |

| Complexity | Moderate complexity driven by technology integration. | Higher complexity due to external data variability. |

| Outcome | Accurate neobank financial statements and reduced fraud risk. | Validated customer account statements and dispute resolution. |

Which is better?

Neobank reconciliation offers real-time transaction matching and automated error detection, enhancing efficiency for digital-only banks. Customer account reconciliation focuses on aligning individual customer statements with bank records, providing personalized accuracy and fraud prevention. For institutions prioritizing agility and scalability, neobank reconciliation presents superior advantages, while customer account reconciliation suits detailed customer-centric financial oversight.

Connection

Neobank reconciliation automates transaction matching and ledger updates, enhancing the accuracy of customer account reconciliation by ensuring all digital transactions are correctly recorded. Customer account reconciliation relies on this automated data to verify individual balances and identify discrepancies promptly. Efficient integration between neobank reconciliation systems and customer account processes reduces errors, improves financial transparency, and accelerates closing cycles.

Key Terms

**Customer Account Reconciliation:**

Customer account reconciliation ensures the accuracy of transactions by matching customer payments against invoices or statements, minimizing discrepancies and preventing financial errors. It involves detailed verification of account balances, facilitating transparent financial records and enhancing customer trust. Explore more about customer account reconciliation processes and their impact on business financial integrity.

Outstanding Balances

Customer account reconciliation involves verifying outstanding balances by matching transaction records with customer statements to ensure accuracy and prevent discrepancies. Neobank reconciliation focuses on real-time tracking of outstanding balances across digital wallets and linked accounts, leveraging automated processes to minimize errors and enhance transparency. Explore detailed strategies to optimize outstanding balance management in both traditional and neobank systems.

Payment Discrepancies

Customer account reconciliation involves verifying payments and balances between a customer's records and a company's ledger to identify discrepancies such as double payments, missed invoices, or unauthorized transactions. Neobank reconciliation focuses on real-time synchronization of digital transactions, leveraging API integrations and AI-driven analytics to detect payment mismatches, fraud, and settlement errors within decentralized systems. Explore the latest techniques and tools used in both reconciliation processes to enhance payment accuracy and financial transparency.

Source and External Links

What Is Account Reconciliation? The Clear Guide to All You Need - Customer account reconciliation verifies that accounts receivable records match the customer's account statements via a detailed process including gathering documents, comparing records, identifying discrepancies, making adjustments, and reviewing before filing.

What Is Account Reconciliation - Datarails - Customer reconciliation involves comparing invoices sent to accounts receivable ledger records to find discrepancies, often performed at month-end to ensure accuracy before financial statements are released.

Account Reconciliation: Types, Processes, and Common Pitfalls - Customer reconciliation confirms that accounts receivable records correspond to customer account statements by either documentation review or analytics review to detect errors or anomalies.

dowidth.com

dowidth.com