Predictive close in accounting leverages historical data and advanced algorithms to forecast financial outcomes and expedite the closing process with higher accuracy. Soft close refers to a preliminary financial close allowing for adjustments before finalizing reports, ensuring flexibility and error correction. Explore more to understand the benefits and applications of predictive and soft close techniques in modern finance.

Why it is important

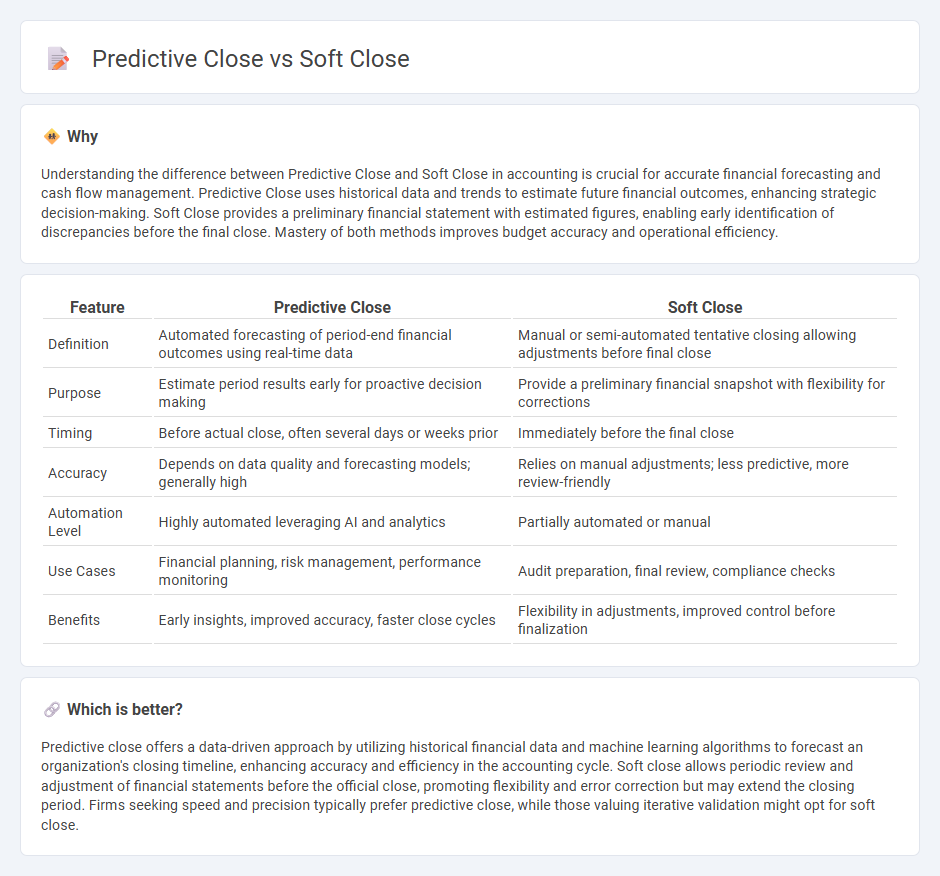

Understanding the difference between Predictive Close and Soft Close in accounting is crucial for accurate financial forecasting and cash flow management. Predictive Close uses historical data and trends to estimate future financial outcomes, enhancing strategic decision-making. Soft Close provides a preliminary financial statement with estimated figures, enabling early identification of discrepancies before the final close. Mastery of both methods improves budget accuracy and operational efficiency.

Comparison Table

| Feature | Predictive Close | Soft Close |

|---|---|---|

| Definition | Automated forecasting of period-end financial outcomes using real-time data | Manual or semi-automated tentative closing allowing adjustments before final close |

| Purpose | Estimate period results early for proactive decision making | Provide a preliminary financial snapshot with flexibility for corrections |

| Timing | Before actual close, often several days or weeks prior | Immediately before the final close |

| Accuracy | Depends on data quality and forecasting models; generally high | Relies on manual adjustments; less predictive, more review-friendly |

| Automation Level | Highly automated leveraging AI and analytics | Partially automated or manual |

| Use Cases | Financial planning, risk management, performance monitoring | Audit preparation, final review, compliance checks |

| Benefits | Early insights, improved accuracy, faster close cycles | Flexibility in adjustments, improved control before finalization |

Which is better?

Predictive close offers a data-driven approach by utilizing historical financial data and machine learning algorithms to forecast an organization's closing timeline, enhancing accuracy and efficiency in the accounting cycle. Soft close allows periodic review and adjustment of financial statements before the official close, promoting flexibility and error correction but may extend the closing period. Firms seeking speed and precision typically prefer predictive close, while those valuing iterative validation might opt for soft close.

Connection

Predictive close and soft close are interconnected accounting practices that enhance financial reporting accuracy and efficiency. Predictive close uses historical data and machine learning algorithms to forecast account balances and potential adjustments before the official close. Soft close serves as an informal interim process allowing preliminary review and reconciliation, which supports the predictive close by identifying discrepancies early in the period.

Key Terms

Period-end Processing

Soft close streamlines period-end processing by gradually finalizing transactions to reduce bottlenecks and improve accuracy in financial reporting. Predictive close uses data analytics to forecast closing activities, enabling proactive adjustments and resource allocation for timely period closure. Explore how combining these approaches can enhance your period-end efficiency and financial accuracy.

Forecasting

Soft close allows businesses to finalize financial data incrementally, improving accuracy in revenue recognition by gradually incorporating estimated figures. Predictive close leverages advanced analytics and machine learning models to forecast period-end financial outcomes with higher precision and speed. Explore how combining soft close methods with predictive close technology can enhance your financial forecasting and decision-making processes.

Real-time Data

Soft close leverages real-time data to subtly gauge customer interest, allowing sales teams to adjust their approach without overt pressure. Predictive close utilizes advanced analytics and machine learning models to forecast the optimal moment for closing based on real-time engagement metrics and historical data trends. Explore more about how integrating real-time data enhances closing strategies for higher conversion rates.

Source and External Links

What Are Soft-Close Hinges and How Do They Work? - Soft-close hinges use a dampening mechanism like a fluid-filled hydraulic cylinder or spring to slow the closing action of doors, preventing slamming and reducing noise and damage.

Soft Close Add-on - Soft-close systems can be easily added to existing cabinet hinges to make doors close softly and silently, effectively stopping cabinet door slamming.

Soft Close Lid Hinges - These hinges use a pneumatic gas mechanism that slowly releases air through springs to gently close lids, serving as a safety and support feature to prevent sudden shutdowns.

dowidth.com

dowidth.com