Digital asset valuation involves assessing cryptocurrencies and blockchain-based tokens using specialized models that consider market volatility and liquidity risks. Mark-to-market accounting records assets at their current market price, reflecting real-time financial status but potentially causing profit fluctuation due to market swings. Explore detailed comparisons to understand how each method impacts financial reporting and investment strategies.

Why it is important

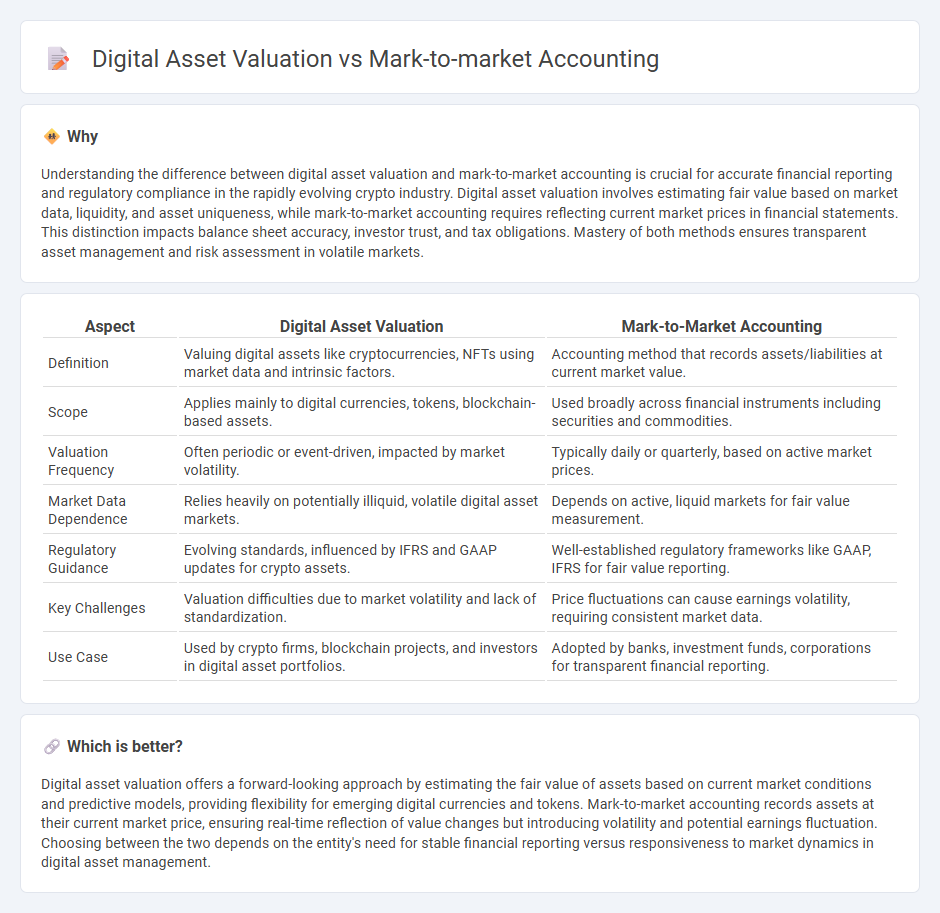

Understanding the difference between digital asset valuation and mark-to-market accounting is crucial for accurate financial reporting and regulatory compliance in the rapidly evolving crypto industry. Digital asset valuation involves estimating fair value based on market data, liquidity, and asset uniqueness, while mark-to-market accounting requires reflecting current market prices in financial statements. This distinction impacts balance sheet accuracy, investor trust, and tax obligations. Mastery of both methods ensures transparent asset management and risk assessment in volatile markets.

Comparison Table

| Aspect | Digital Asset Valuation | Mark-to-Market Accounting |

|---|---|---|

| Definition | Valuing digital assets like cryptocurrencies, NFTs using market data and intrinsic factors. | Accounting method that records assets/liabilities at current market value. |

| Scope | Applies mainly to digital currencies, tokens, blockchain-based assets. | Used broadly across financial instruments including securities and commodities. |

| Valuation Frequency | Often periodic or event-driven, impacted by market volatility. | Typically daily or quarterly, based on active market prices. |

| Market Data Dependence | Relies heavily on potentially illiquid, volatile digital asset markets. | Depends on active, liquid markets for fair value measurement. |

| Regulatory Guidance | Evolving standards, influenced by IFRS and GAAP updates for crypto assets. | Well-established regulatory frameworks like GAAP, IFRS for fair value reporting. |

| Key Challenges | Valuation difficulties due to market volatility and lack of standardization. | Price fluctuations can cause earnings volatility, requiring consistent market data. |

| Use Case | Used by crypto firms, blockchain projects, and investors in digital asset portfolios. | Adopted by banks, investment funds, corporations for transparent financial reporting. |

Which is better?

Digital asset valuation offers a forward-looking approach by estimating the fair value of assets based on current market conditions and predictive models, providing flexibility for emerging digital currencies and tokens. Mark-to-market accounting records assets at their current market price, ensuring real-time reflection of value changes but introducing volatility and potential earnings fluctuation. Choosing between the two depends on the entity's need for stable financial reporting versus responsiveness to market dynamics in digital asset management.

Connection

Digital asset valuation relies heavily on mark-to-market accounting by recording assets at their current market value, ensuring accurate and timely reflection of cryptocurrency prices on financial statements. This method enhances transparency and provides investors with real-time insights into digital asset portfolios, reducing valuation ambiguities in fluctuating markets. Mark-to-market accounting bridges traditional accounting practices with the dynamic nature of digital assets, supporting compliance and risk assessment in blockchain-related finance.

Key Terms

Fair Value

Mark-to-market accounting determines asset values based on current market prices, reflecting real-time fair value that ensures transparency in financial statements. Digital asset valuation leverages fair value principles but faces challenges from market volatility, illiquidity, and lack of standardized valuation models. Explore our comprehensive analysis to understand how fair value impacts financial reporting in digital assets.

Volatility

Mark-to-market accounting records assets at their current market value, reflecting real-time price fluctuations and enhancing financial statement transparency but increasing earnings volatility. Digital asset valuation faces greater challenges due to sparse liquidity and rapidly shifting market dynamics, leading to significant valuation uncertainty and risk assessment complexities. Explore detailed strategies to balance volatility and accuracy in asset valuation for improved financial management.

Liquidity

Mark-to-market accounting relies on current market prices to value assets, offering real-time liquidity insights but often struggling with illiquid or volatile digital assets. Digital asset valuation incorporates broader methodologies including discounted cash flows and network activity metrics to better capture value in markets with limited liquidity. Explore how these approaches impact financial transparency and risk assessment in evolving digital finance ecosystems.

Source and External Links

What is Mark to Market (MTM) & How it Works? - Mark-to-market accounting is a method where assets and liabilities are valued based on their current market price rather than historical cost, allowing financial statements to reflect real-time valuations and showing unrealized gains or losses on balance sheets and income statements.

Mark to Market: Accounting and Finance Definition & Examples - MTM is an accounting method that updates the value of assets or liabilities to reflect their current value, providing a more accurate financial picture compared to historical cost accounting, with practical applications like Berkshire Hathaway's investment reporting.

Mark-to-market accounting - Wikipedia - Mark-to-market, or fair value accounting, records assets and liabilities at current market prices and is part of US GAAP, offering a more accurate but sometimes volatile reflection of financial status compared to stable historical cost accounting.

dowidth.com

dowidth.com