Revenue recognition automation streamlines the accurate recording of income by integrating real-time data from sales and contracts, ensuring compliance with accounting standards such as ASC 606 and IFRS 15. Tax calculation automation enhances precision in determining liabilities by instantly applying current tax codes and rates, reducing errors and audit risks. Discover how these automation tools transform financial accuracy and efficiency in modern accounting practices.

Why it is important

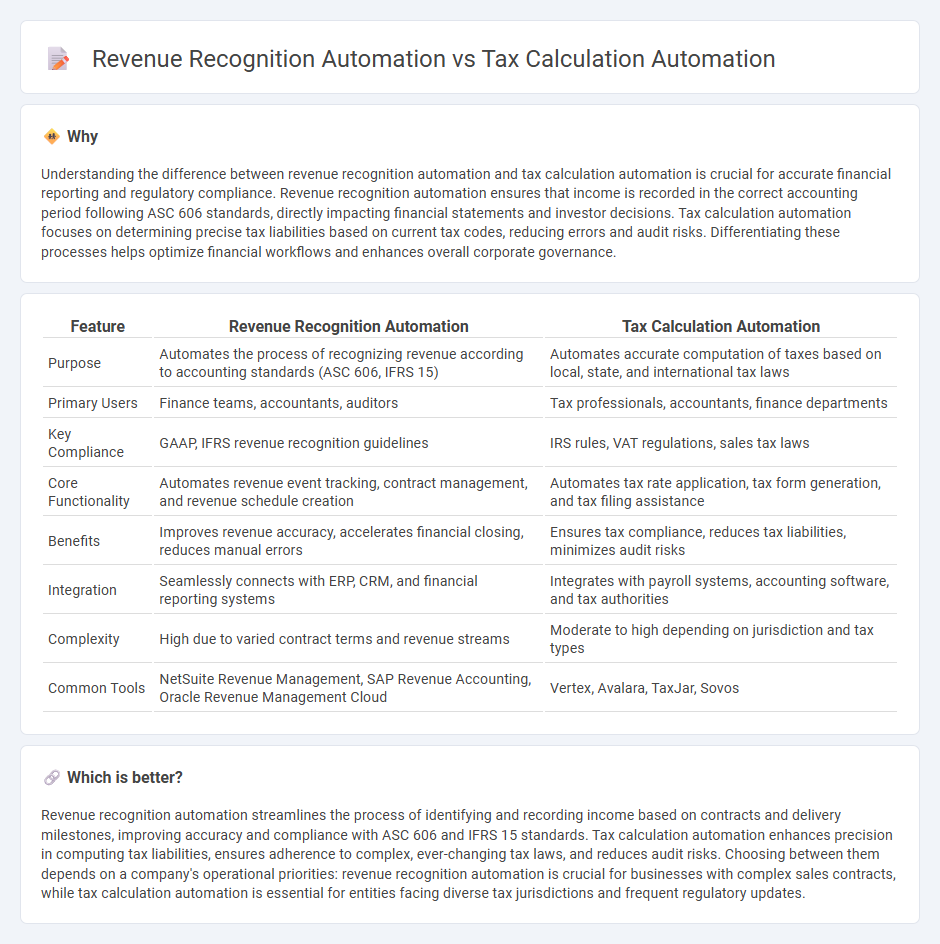

Understanding the difference between revenue recognition automation and tax calculation automation is crucial for accurate financial reporting and regulatory compliance. Revenue recognition automation ensures that income is recorded in the correct accounting period following ASC 606 standards, directly impacting financial statements and investor decisions. Tax calculation automation focuses on determining precise tax liabilities based on current tax codes, reducing errors and audit risks. Differentiating these processes helps optimize financial workflows and enhances overall corporate governance.

Comparison Table

| Feature | Revenue Recognition Automation | Tax Calculation Automation |

|---|---|---|

| Purpose | Automates the process of recognizing revenue according to accounting standards (ASC 606, IFRS 15) | Automates accurate computation of taxes based on local, state, and international tax laws |

| Primary Users | Finance teams, accountants, auditors | Tax professionals, accountants, finance departments |

| Key Compliance | GAAP, IFRS revenue recognition guidelines | IRS rules, VAT regulations, sales tax laws |

| Core Functionality | Automates revenue event tracking, contract management, and revenue schedule creation | Automates tax rate application, tax form generation, and tax filing assistance |

| Benefits | Improves revenue accuracy, accelerates financial closing, reduces manual errors | Ensures tax compliance, reduces tax liabilities, minimizes audit risks |

| Integration | Seamlessly connects with ERP, CRM, and financial reporting systems | Integrates with payroll systems, accounting software, and tax authorities |

| Complexity | High due to varied contract terms and revenue streams | Moderate to high depending on jurisdiction and tax types |

| Common Tools | NetSuite Revenue Management, SAP Revenue Accounting, Oracle Revenue Management Cloud | Vertex, Avalara, TaxJar, Sovos |

Which is better?

Revenue recognition automation streamlines the process of identifying and recording income based on contracts and delivery milestones, improving accuracy and compliance with ASC 606 and IFRS 15 standards. Tax calculation automation enhances precision in computing tax liabilities, ensures adherence to complex, ever-changing tax laws, and reduces audit risks. Choosing between them depends on a company's operational priorities: revenue recognition automation is crucial for businesses with complex sales contracts, while tax calculation automation is essential for entities facing diverse tax jurisdictions and frequent regulatory updates.

Connection

Revenue recognition automation streamlines the process of accurately recording income in compliance with accounting standards such as ASC 606 and IFRS 15, reducing manual errors and improving financial reporting efficiency. Tax calculation automation integrates seamlessly with revenue recognition systems by using recognized revenue data to automate precise tax liability computations, ensuring compliance with tax laws and minimizing audit risks. Together, these automated solutions enhance overall accounting accuracy, accelerate financial close processes, and provide real-time insights into both revenue and tax obligations.

Key Terms

**Tax Calculation Automation:**

Tax calculation automation streamlines complex tax computations by utilizing real-time data integration and advanced algorithms to ensure accuracy and compliance with evolving tax regulations. It reduces manual errors, accelerates filing processes, and enhances financial transparency by automatically applying relevant tax codes and rates. Explore how tax calculation automation can transform your financial operations and improve regulatory adherence.

Tax Compliance

Tax calculation automation streamlines the process of determining tax liabilities by leveraging real-time data to ensure accurate and timely tax compliance, reducing human errors and audit risks. Revenue recognition automation focuses on adhering to accounting standards like ASC 606, ensuring that revenue is recorded correctly over time but may not directly address specific tax compliance requirements. Explore how integrating both automations can enhance overall financial accuracy and regulatory adherence.

Nexus Determination

Tax calculation automation streamlines the process of determining tax liabilities by automatically applying jurisdiction-specific rates and regulations, significantly reducing human error and compliance risks. Revenue recognition automation focuses on accurately recording income based on accounting standards, but both systems intersect at Nexus Determination, which identifies where a company has tax obligations due to business presence. Explore further to understand how Nexus Determination impacts automated tax and revenue processes for businesses operating across multiple regions.

Source and External Links

Automate tax computation with machine learning - Infosys - Infosys offers an automation solution using machine learning, OCR, and AI technologies to extract tax data from diverse document formats, standardize inputs, apply tax rates accurately, and ensure traceability and minimal human error in tax computations.

How to Automate Your Income Tax Provision Process - Bloomberg Tax - Bloomberg Tax explains how tax automation software streamlines income tax provision by reducing manual errors, centralizing data for multinational entities, tracking changes at the cell level, and improving compliance and efficiency.

Tax preparation automation: What businesses need to know - Stripe - Tax automation uses software to enhance accuracy, save time, lower costs, and maintain up-to-date compliance by automating data collection, calculations, and filing for businesses and individuals.

dowidth.com

dowidth.com