Digital asset taxation focuses on the reporting, valuation, and tax implications of cryptocurrencies and other blockchain-based assets, which require specialized knowledge of evolving regulatory frameworks. Estate taxation deals with the assessment of a deceased individual's total assets, including real estate, investments, and personal property, to calculate applicable inheritance taxes. Explore the nuances and key differences between these two complex accounting areas to ensure compliance and optimize financial planning.

Why it is important

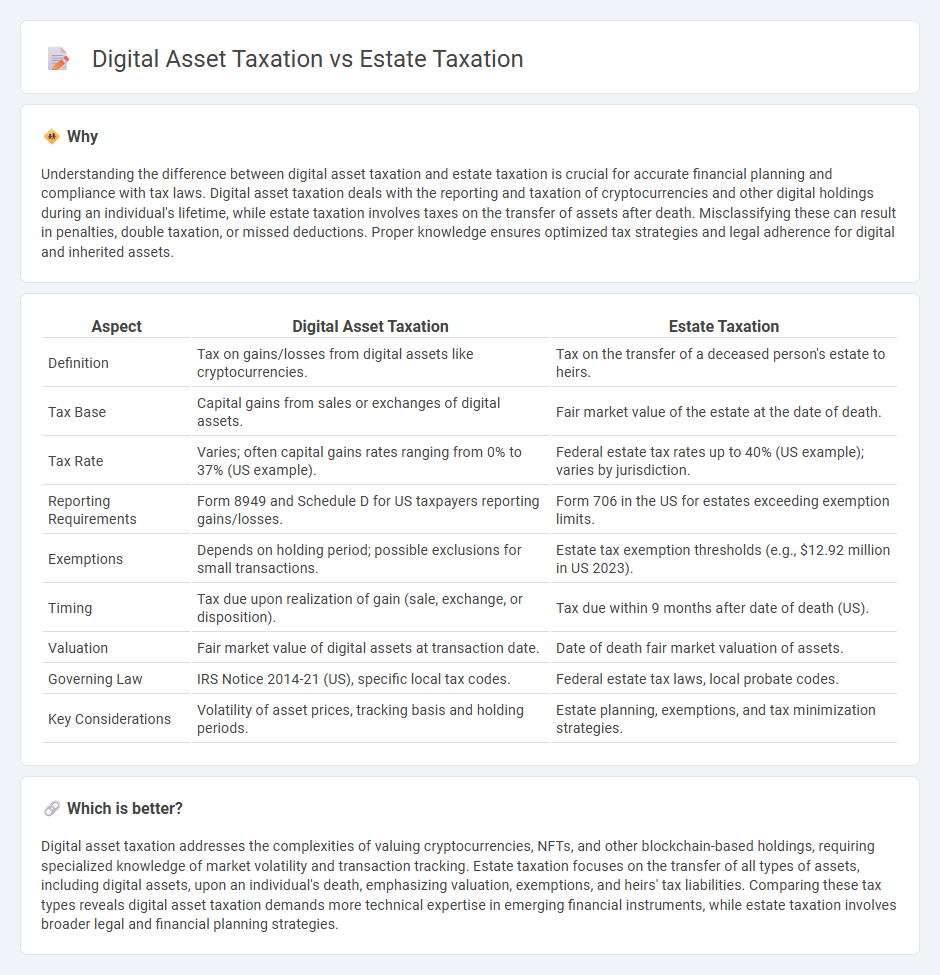

Understanding the difference between digital asset taxation and estate taxation is crucial for accurate financial planning and compliance with tax laws. Digital asset taxation deals with the reporting and taxation of cryptocurrencies and other digital holdings during an individual's lifetime, while estate taxation involves taxes on the transfer of assets after death. Misclassifying these can result in penalties, double taxation, or missed deductions. Proper knowledge ensures optimized tax strategies and legal adherence for digital and inherited assets.

Comparison Table

| Aspect | Digital Asset Taxation | Estate Taxation |

|---|---|---|

| Definition | Tax on gains/losses from digital assets like cryptocurrencies. | Tax on the transfer of a deceased person's estate to heirs. |

| Tax Base | Capital gains from sales or exchanges of digital assets. | Fair market value of the estate at the date of death. |

| Tax Rate | Varies; often capital gains rates ranging from 0% to 37% (US example). | Federal estate tax rates up to 40% (US example); varies by jurisdiction. |

| Reporting Requirements | Form 8949 and Schedule D for US taxpayers reporting gains/losses. | Form 706 in the US for estates exceeding exemption limits. |

| Exemptions | Depends on holding period; possible exclusions for small transactions. | Estate tax exemption thresholds (e.g., $12.92 million in US 2023). |

| Timing | Tax due upon realization of gain (sale, exchange, or disposition). | Tax due within 9 months after date of death (US). |

| Valuation | Fair market value of digital assets at transaction date. | Date of death fair market valuation of assets. |

| Governing Law | IRS Notice 2014-21 (US), specific local tax codes. | Federal estate tax laws, local probate codes. |

| Key Considerations | Volatility of asset prices, tracking basis and holding periods. | Estate planning, exemptions, and tax minimization strategies. |

Which is better?

Digital asset taxation addresses the complexities of valuing cryptocurrencies, NFTs, and other blockchain-based holdings, requiring specialized knowledge of market volatility and transaction tracking. Estate taxation focuses on the transfer of all types of assets, including digital assets, upon an individual's death, emphasizing valuation, exemptions, and heirs' tax liabilities. Comparing these tax types reveals digital asset taxation demands more technical expertise in emerging financial instruments, while estate taxation involves broader legal and financial planning strategies.

Connection

Digital asset taxation intersects with estate taxation through the valuation and transfer of cryptocurrencies and other digital assets during inheritance. Accurate reporting of digital asset values at the time of death is crucial for estate tax calculations, as fluctuations in market prices can significantly impact tax liabilities. Probate processes must integrate blockchain tracking to ensure compliance with tax regulations and to facilitate transparent asset distribution.

Key Terms

Valuation

Estate taxation primarily relies on appraised market values of tangible and intangible assets at the time of an individual's death, often involving real estate, investments, and personal property. Digital asset taxation requires specialized valuation methods due to the volatile nature and decentralized characteristics of cryptocurrencies, NFTs, and other blockchain-based assets. Explore deeper insights into valuation challenges and methodologies for estate and digital asset taxation.

Beneficiary

Estate taxation involves levying taxes on the transfer of a deceased person's assets to beneficiaries, often considering the overall value of the estate and its distribution. Digital asset taxation, by contrast, assesses taxes on cryptocurrencies, NFTs, and other digital holdings that beneficiaries receive, with unique considerations like valuation challenges and regulatory compliance. Explore how estate and digital asset taxation impact beneficiaries differently for a comprehensive understanding.

Fair Market Value

Estate taxation relies heavily on the fair market value (FMV) of assets at the time of an individual's death to determine tax liabilities, ensuring accurate transfer of wealth. Digital asset taxation also depends on FMV, but valuation challenges arise due to market volatility and lack of standardized reporting for cryptocurrencies and NFTs. Explore detailed guidelines and strategies for fair market value assessment in both estate and digital asset taxation.

Source and External Links

Estate tax | Internal Revenue Service - The estate tax is a tax on the right to transfer property at death, based on the fair market value of all assets owned, with deductions allowed, and filing required if the gross estate exceeds the threshold in the year of death.

Guide to Estate Tax: Definition, What to Know - NerdWallet - The federal estate tax ranges from 18% to 40% and applies only to estates over $13.99 million in 2025, with exemptions per individual and unlimited marital deduction for assets inherited by a surviving spouse.

Estate tax in the United States - Wikipedia - The estate tax is a federal tax on the transfer of a deceased person's estate above an exemption amount, with rates and exemptions changing over time, and it applies to property transferred by will.

dowidth.com

dowidth.com