Outsourced bookkeeping services offer professional accuracy, time efficiency, and compliance with the latest accounting standards, reducing the risk of costly errors. DIY bookkeeping provides full control and direct oversight but requires significant time commitment and expertise to ensure accurate financial records. Explore the advantages and challenges of each approach to determine the best fit for your business needs.

Why it is important

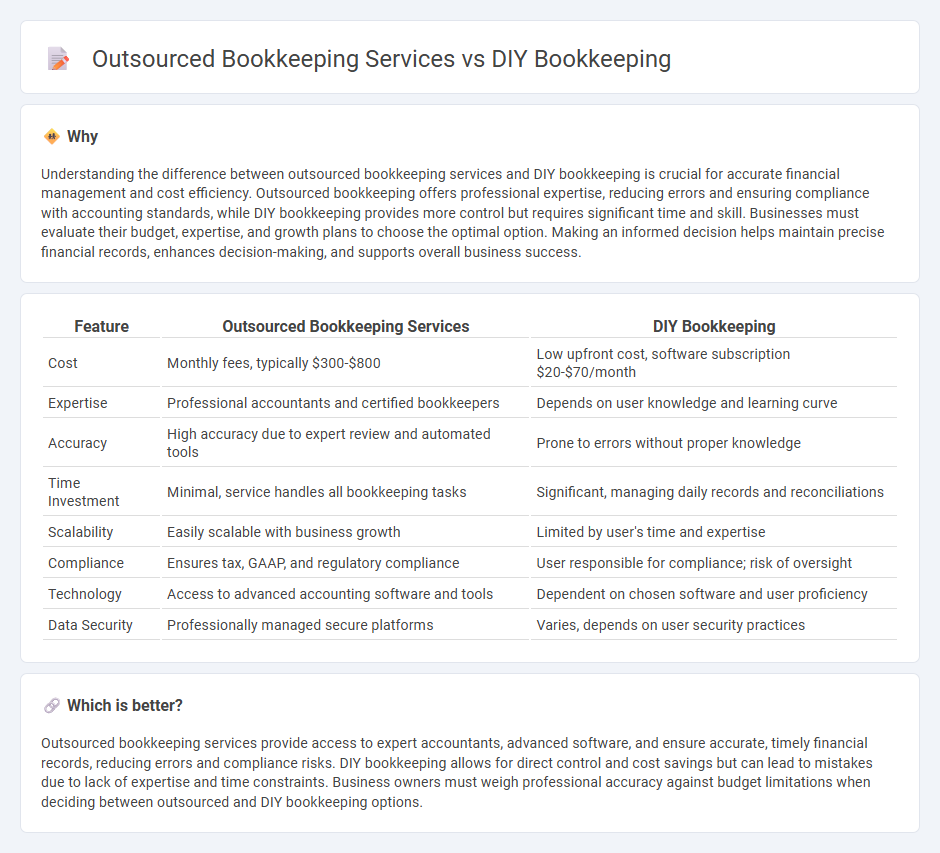

Understanding the difference between outsourced bookkeeping services and DIY bookkeeping is crucial for accurate financial management and cost efficiency. Outsourced bookkeeping offers professional expertise, reducing errors and ensuring compliance with accounting standards, while DIY bookkeeping provides more control but requires significant time and skill. Businesses must evaluate their budget, expertise, and growth plans to choose the optimal option. Making an informed decision helps maintain precise financial records, enhances decision-making, and supports overall business success.

Comparison Table

| Feature | Outsourced Bookkeeping Services | DIY Bookkeeping |

|---|---|---|

| Cost | Monthly fees, typically $300-$800 | Low upfront cost, software subscription $20-$70/month |

| Expertise | Professional accountants and certified bookkeepers | Depends on user knowledge and learning curve |

| Accuracy | High accuracy due to expert review and automated tools | Prone to errors without proper knowledge |

| Time Investment | Minimal, service handles all bookkeeping tasks | Significant, managing daily records and reconciliations |

| Scalability | Easily scalable with business growth | Limited by user's time and expertise |

| Compliance | Ensures tax, GAAP, and regulatory compliance | User responsible for compliance; risk of oversight |

| Technology | Access to advanced accounting software and tools | Dependent on chosen software and user proficiency |

| Data Security | Professionally managed secure platforms | Varies, depends on user security practices |

Which is better?

Outsourced bookkeeping services provide access to expert accountants, advanced software, and ensure accurate, timely financial records, reducing errors and compliance risks. DIY bookkeeping allows for direct control and cost savings but can lead to mistakes due to lack of expertise and time constraints. Business owners must weigh professional accuracy against budget limitations when deciding between outsourced and DIY bookkeeping options.

Connection

Outsourced bookkeeping services and DIY bookkeeping both manage financial records but differ in expertise, cost, and time investment. Small businesses often start with DIY bookkeeping to control expenses but may transition to outsourced services for accuracy and compliance with accounting standards. Integrating cloud-based software allows seamless data sharing, enhancing collaboration between in-house teams and external bookkeeping professionals.

Key Terms

Cost-effectiveness

DIY bookkeeping saves costs by eliminating fees for professional services and software subscriptions, making it ideal for small businesses with simple financial records. Outsourced bookkeeping services provide accurate, time-efficient financial management and reduce risks of errors, often leading to better long-term cost-effectiveness by freeing up resources for core business activities. Explore more to determine which bookkeeping method aligns best with your budget and business needs.

Control & autonomy

DIY bookkeeping provides complete control and direct oversight of financial records, enabling business owners to customize processes according to their unique preferences and needs. Outsourced bookkeeping services offer professional expertise and time-saving benefits, though this often means relinquishing some degree of control and autonomy over daily transactions and data management. Explore in-depth comparisons to determine which option best aligns with your business priorities and operational style.

Expertise & accuracy

DIY bookkeeping often lacks the specialized accounting knowledge necessary to ensure error-free financial records, increasing the risk of compliance issues and inaccurate tax filings. Outsourced bookkeeping services provide access to certified professionals who utilize advanced software and industry best practices to enhance accuracy and maintain regulatory compliance. Discover how expert bookkeeping can improve your financial management and reduce business risks.

Source and External Links

Bookkeeping Basics for Small Business Owners (free template) - This video provides a step-by-step guide for small business owners to manage their bookkeeping using free tools like Google Sheets.

Everything You Need to Start Doing Your Own Bookkeeping - This guide covers the basics of bookkeeping, including both DIY and professional outsourcing options for small businesses.

Small Business Bookkeeping: Step-by-Step Guide to Master Your Finances - This article outlines a five-step process for small businesses to manage their finances effectively through DIY bookkeeping.

dowidth.com

dowidth.com