Fair value measurement reflects the estimated market price an asset could fetch in an orderly transaction between market participants at the measurement date. Current cost accounting records assets based on the amount required to replace them in the present market, emphasizing current acquisition costs rather than resale value. Explore more to understand how these valuation methods impact financial reporting and decision-making.

Why it is important

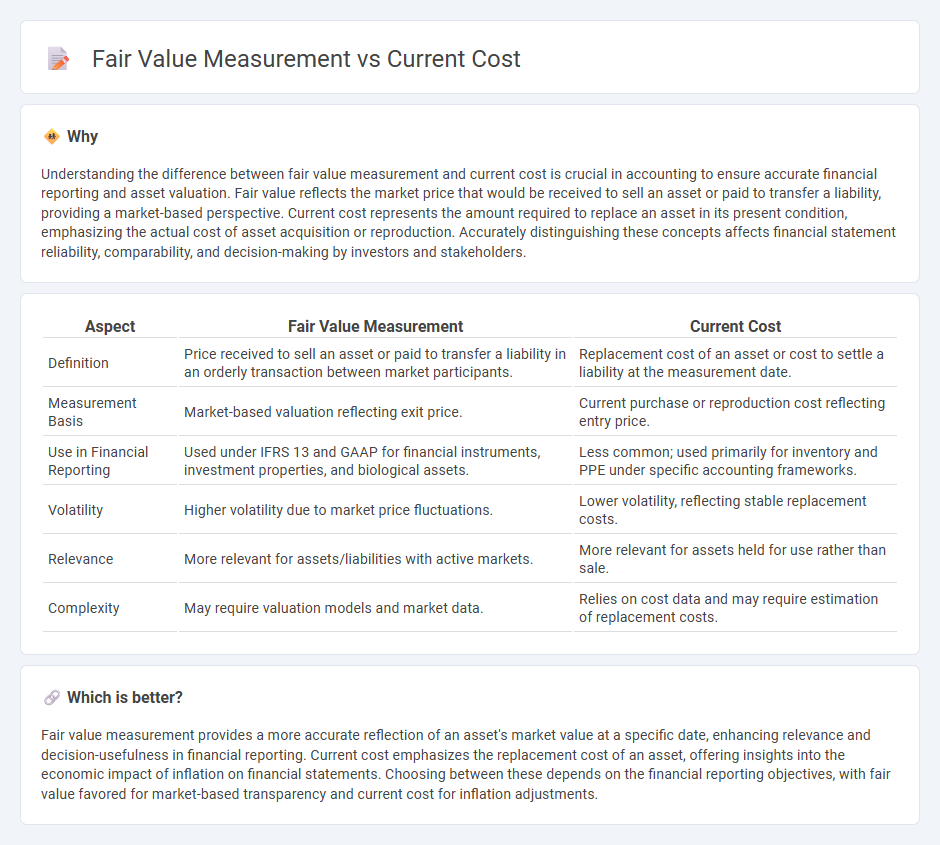

Understanding the difference between fair value measurement and current cost is crucial in accounting to ensure accurate financial reporting and asset valuation. Fair value reflects the market price that would be received to sell an asset or paid to transfer a liability, providing a market-based perspective. Current cost represents the amount required to replace an asset in its present condition, emphasizing the actual cost of asset acquisition or reproduction. Accurately distinguishing these concepts affects financial statement reliability, comparability, and decision-making by investors and stakeholders.

Comparison Table

| Aspect | Fair Value Measurement | Current Cost |

|---|---|---|

| Definition | Price received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. | Replacement cost of an asset or cost to settle a liability at the measurement date. |

| Measurement Basis | Market-based valuation reflecting exit price. | Current purchase or reproduction cost reflecting entry price. |

| Use in Financial Reporting | Used under IFRS 13 and GAAP for financial instruments, investment properties, and biological assets. | Less common; used primarily for inventory and PPE under specific accounting frameworks. |

| Volatility | Higher volatility due to market price fluctuations. | Lower volatility, reflecting stable replacement costs. |

| Relevance | More relevant for assets/liabilities with active markets. | More relevant for assets held for use rather than sale. |

| Complexity | May require valuation models and market data. | Relies on cost data and may require estimation of replacement costs. |

Which is better?

Fair value measurement provides a more accurate reflection of an asset's market value at a specific date, enhancing relevance and decision-usefulness in financial reporting. Current cost emphasizes the replacement cost of an asset, offering insights into the economic impact of inflation on financial statements. Choosing between these depends on the financial reporting objectives, with fair value favored for market-based transparency and current cost for inflation adjustments.

Connection

Fair value measurement and current cost are both valuation techniques used in accounting to assess asset and liability values at specific points in time. Fair value measurement reflects the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Current cost focuses on the amount of cash or cash equivalents that would be required to replace an asset in its present condition, linking directly to fair value by providing a basis for evaluating asset replacement and ensuring up-to-date financial reporting.

Key Terms

Historical Cost

Historical cost measurement records assets and liabilities at their original acquisition price, providing a reliable and objective basis free from market fluctuations. This method contrasts with fair value measurement, which reflects current market conditions but may introduce volatility and subjectivity. Explore more to understand the implications of historical cost on financial reporting and decision-making.

Market Value

Market value, a key component in fair value measurement, reflects the price an asset would fetch in an orderly transaction between market participants at the measurement date. Unlike current cost, which records the price to replace an asset, fair value incorporates market perspectives, providing a more dynamic and market-sensitive valuation. Explore further to understand how market value drives decision-making in financial reporting.

Replacement Cost

Replacement cost measurement reflects the amount required to replace an asset with a similar one at current market prices, offering a dynamic assessment unlike historical cost, which records the original purchase price without reflecting market changes. This method enhances financial reporting accuracy by accounting for inflation and asset obsolescence, providing stakeholders with a realistic value for decision-making. Discover how replacement cost measurement influences asset valuation and financial transparency in modern accounting practices.

Source and External Links

Current cost definition - AccountingTools - Current cost is the amount required to replace an asset in the current period using current methods, materials, and specifications, reflecting up-to-date values for financial reporting and decision-making, unlike historical cost which records the original purchase price.

Current Cost- What Is It, Examples, Vs Historical Cost Method - Current cost represents the amount a company would pay to replace an asset on the market today and is used in accounting for more accurate asset valuation, especially in contexts affected by inflation.

CURRENT COST definition and meaning | Collins English Dictionary - Current cost refers to the prevailing price paid for materials, labor, or assets at present, and is used in accounting to restate asset values based on their current replacement costs rather than original purchase prices.

dowidth.com

dowidth.com