Blockchain-based accounting offers enhanced transparency, immutability, and real-time transaction verification compared to traditional spreadsheet accounting, which often relies on manual data entry and is prone to errors and fraud. While spreadsheets provide flexibility and ease of use for small-scale bookkeeping, blockchain integration ensures stronger security and auditability for complex financial operations. Explore the benefits of blockchain in accounting to understand how it transforms financial data management.

Why it is important

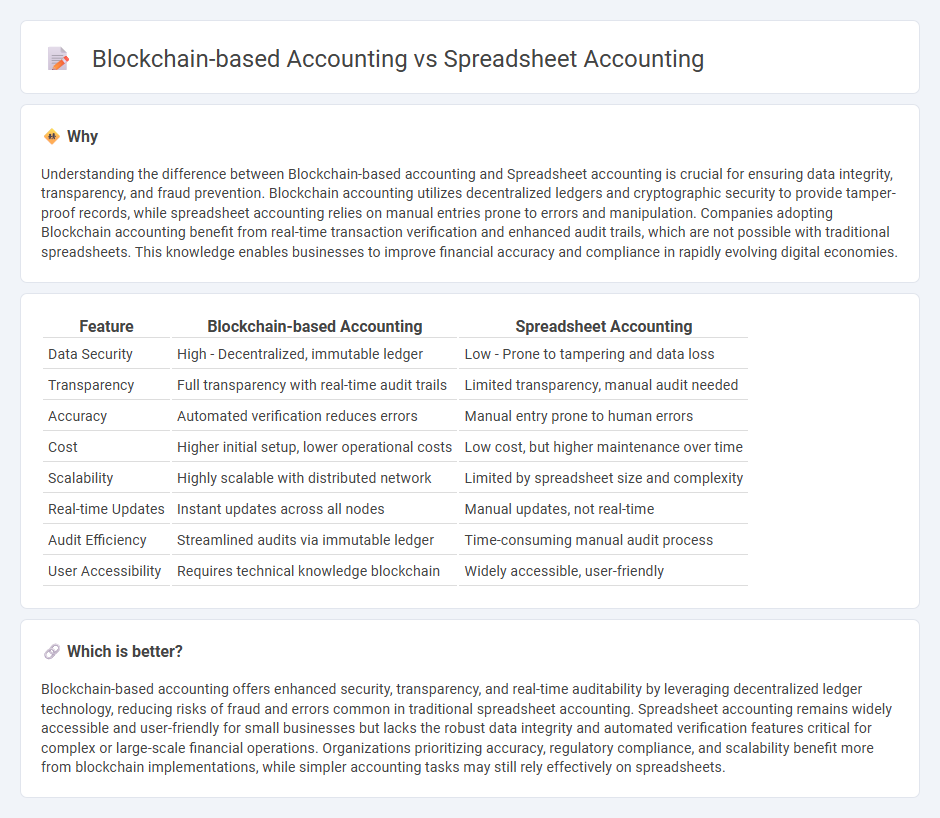

Understanding the difference between Blockchain-based accounting and Spreadsheet accounting is crucial for ensuring data integrity, transparency, and fraud prevention. Blockchain accounting utilizes decentralized ledgers and cryptographic security to provide tamper-proof records, while spreadsheet accounting relies on manual entries prone to errors and manipulation. Companies adopting Blockchain accounting benefit from real-time transaction verification and enhanced audit trails, which are not possible with traditional spreadsheets. This knowledge enables businesses to improve financial accuracy and compliance in rapidly evolving digital economies.

Comparison Table

| Feature | Blockchain-based Accounting | Spreadsheet Accounting |

|---|---|---|

| Data Security | High - Decentralized, immutable ledger | Low - Prone to tampering and data loss |

| Transparency | Full transparency with real-time audit trails | Limited transparency, manual audit needed |

| Accuracy | Automated verification reduces errors | Manual entry prone to human errors |

| Cost | Higher initial setup, lower operational costs | Low cost, but higher maintenance over time |

| Scalability | Highly scalable with distributed network | Limited by spreadsheet size and complexity |

| Real-time Updates | Instant updates across all nodes | Manual updates, not real-time |

| Audit Efficiency | Streamlined audits via immutable ledger | Time-consuming manual audit process |

| User Accessibility | Requires technical knowledge blockchain | Widely accessible, user-friendly |

Which is better?

Blockchain-based accounting offers enhanced security, transparency, and real-time auditability by leveraging decentralized ledger technology, reducing risks of fraud and errors common in traditional spreadsheet accounting. Spreadsheet accounting remains widely accessible and user-friendly for small businesses but lacks the robust data integrity and automated verification features critical for complex or large-scale financial operations. Organizations prioritizing accuracy, regulatory compliance, and scalability benefit more from blockchain implementations, while simpler accounting tasks may still rely effectively on spreadsheets.

Connection

Blockchain-based accounting and spreadsheet accounting both serve as tools for financial data management, with blockchain providing decentralized, immutable ledger verification while spreadsheets offer flexible data organization and analysis. Integration occurs when blockchain transaction data is exported to spreadsheet formats like Excel or Google Sheets for detailed auditing, forecasting, and reporting purposes. This connection enhances data accuracy, transparency, and real-time collaboration across accounting teams.

Key Terms

**Spreadsheet accounting:**

Spreadsheet accounting offers flexibility and ease of use for small to medium-sized businesses, allowing users to customize financial reports and track transactions with familiar tools like Microsoft Excel or Google Sheets. It relies on manual data entry and formulas, which can lead to errors and limited audit trails compared to blockchain's immutable ledger. Discover the advantages and limitations of spreadsheet accounting in managing business finances.

Manual Data Entry

Spreadsheet accounting relies heavily on manual data entry, which increases the risk of human errors and inconsistencies in financial records. Blockchain-based accounting automates data recording through decentralized ledger technology, ensuring real-time accuracy and reducing the need for manual inputs. Explore how blockchain can transform financial data management for improved reliability and efficiency.

Error Prone

Spreadsheet accounting is highly error-prone due to manual data entry, formula mistakes, and lack of real-time validation, leading to significant financial inaccuracies. Blockchain-based accounting reduces errors through decentralized ledger technology, automated transaction recording, and cryptographic validation, ensuring data immutability and enhanced auditability. Discover how blockchain can transform error-prone accounting processes for greater accuracy and trust.

Source and External Links

Small-Business Accounting: 3 Ways to Use Spreadsheets - Spreadsheets can track income and expenses, automate calculations for accounts payable, and link data between sheets for real-time financial updates

Excel Accounting and Bookkeeping (Template Included) - Enter and categorize each business transaction by date and account in a dedicated sheet, enabling organized, manual bookkeeping directly in Excel

11 Comprehensive Accounting Spreadsheet Templates - Pre-designed templates standardize and streamline accounting processes, improving efficiency, reducing errors, and ensuring consistent results across your team

dowidth.com

dowidth.com