Digital ledger technology enhances accounting accuracy by automating transaction records and reducing human error inherent in manual journal entries. It offers real-time data verification and transparency, essential for auditing and compliance in financial management. Discover how integrating digital ledger technology can transform your accounting processes.

Why it is important

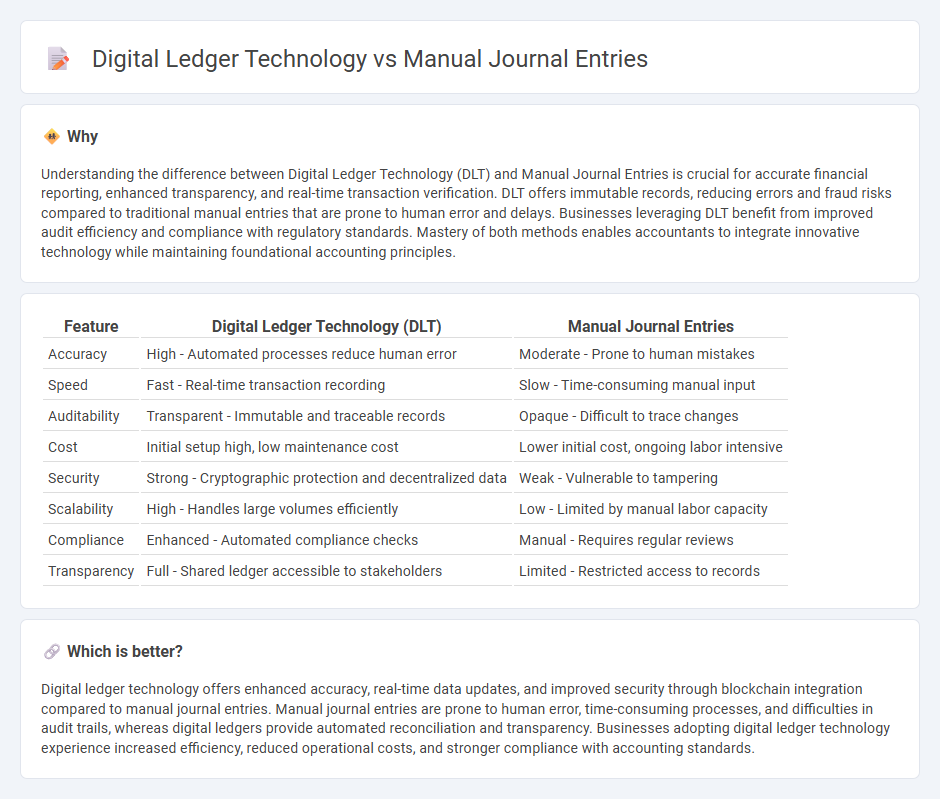

Understanding the difference between Digital Ledger Technology (DLT) and Manual Journal Entries is crucial for accurate financial reporting, enhanced transparency, and real-time transaction verification. DLT offers immutable records, reducing errors and fraud risks compared to traditional manual entries that are prone to human error and delays. Businesses leveraging DLT benefit from improved audit efficiency and compliance with regulatory standards. Mastery of both methods enables accountants to integrate innovative technology while maintaining foundational accounting principles.

Comparison Table

| Feature | Digital Ledger Technology (DLT) | Manual Journal Entries |

|---|---|---|

| Accuracy | High - Automated processes reduce human error | Moderate - Prone to human mistakes |

| Speed | Fast - Real-time transaction recording | Slow - Time-consuming manual input |

| Auditability | Transparent - Immutable and traceable records | Opaque - Difficult to trace changes |

| Cost | Initial setup high, low maintenance cost | Lower initial cost, ongoing labor intensive |

| Security | Strong - Cryptographic protection and decentralized data | Weak - Vulnerable to tampering |

| Scalability | High - Handles large volumes efficiently | Low - Limited by manual labor capacity |

| Compliance | Enhanced - Automated compliance checks | Manual - Requires regular reviews |

| Transparency | Full - Shared ledger accessible to stakeholders | Limited - Restricted access to records |

Which is better?

Digital ledger technology offers enhanced accuracy, real-time data updates, and improved security through blockchain integration compared to manual journal entries. Manual journal entries are prone to human error, time-consuming processes, and difficulties in audit trails, whereas digital ledgers provide automated reconciliation and transparency. Businesses adopting digital ledger technology experience increased efficiency, reduced operational costs, and stronger compliance with accounting standards.

Connection

Digital ledger technology enhances accuracy and transparency in recording manual journal entries by automating data inputs and reducing human errors. Integration of blockchain with traditional accounting systems ensures immutability of journal entries, facilitating real-time reconciliation and audit trails. This connection improves financial reporting efficiency and compliance with regulatory standards.

Key Terms

Data Entry

Manual journal entries involve physically recording transactions in accounting books, which can increase errors and consume significant time. Digital ledger technology automates data entry through blockchain or distributed ledgers, ensuring real-time accuracy, enhanced security, and improved auditability. Explore the benefits and implementation strategies of digital ledger technology to revolutionize your accounting processes.

Audit Trail

Manual journal entries often lack real-time updates and are prone to human errors, making audit trails less reliable and harder to verify. Digital ledger technology, utilizing blockchain and smart contracts, ensures immutable, transparent, and automatically recorded transactions that enhance audit trail accuracy and traceability. Explore how adopting digital ledger systems can transform your audit processes and improve compliance.

Error Reduction

Manual journal entries often lead to higher error rates due to human oversight, inconsistent data input, and delayed reconciliations. Digital ledger technology employs automated data processing, real-time validation, and immutable records to significantly minimize errors and enhance transaction accuracy. Explore how integrating digital ledger solutions can transform error management and improve financial integrity.

Source and External Links

Manual Journals | Help | Zoho Books - Manual journal entries are used to record unique financial transactions that cannot be recorded through normal processes, requiring debit and credit entries to balance before publishing in the system.

Manual Journal Entry Documentation and Approval Policy - Manual journal entries to the General Ledger require proper documentation and approval, typically created by trained individuals through direct upload or via requests processed by finance centers with workflow approval.

Learning Finance: Manual Journal Entry Guide - A manual journal entry records financial transactions entered into financial systems manually, distinguishing them from automated entries, with clear processes for entry details and responsibilities focused on campus usage.

dowidth.com

dowidth.com