Forensic accounting software specializes in detecting financial fraud, analyzing complex transactions, and supporting legal investigations by providing detailed audit trails and data visualization. Cost accounting software focuses on tracking, analyzing, and controlling business expenses to optimize budgeting, pricing, and profitability using real-time cost allocation and inventory management features. Explore the unique capabilities and benefits of each software to enhance your accounting practice.

Why it is important

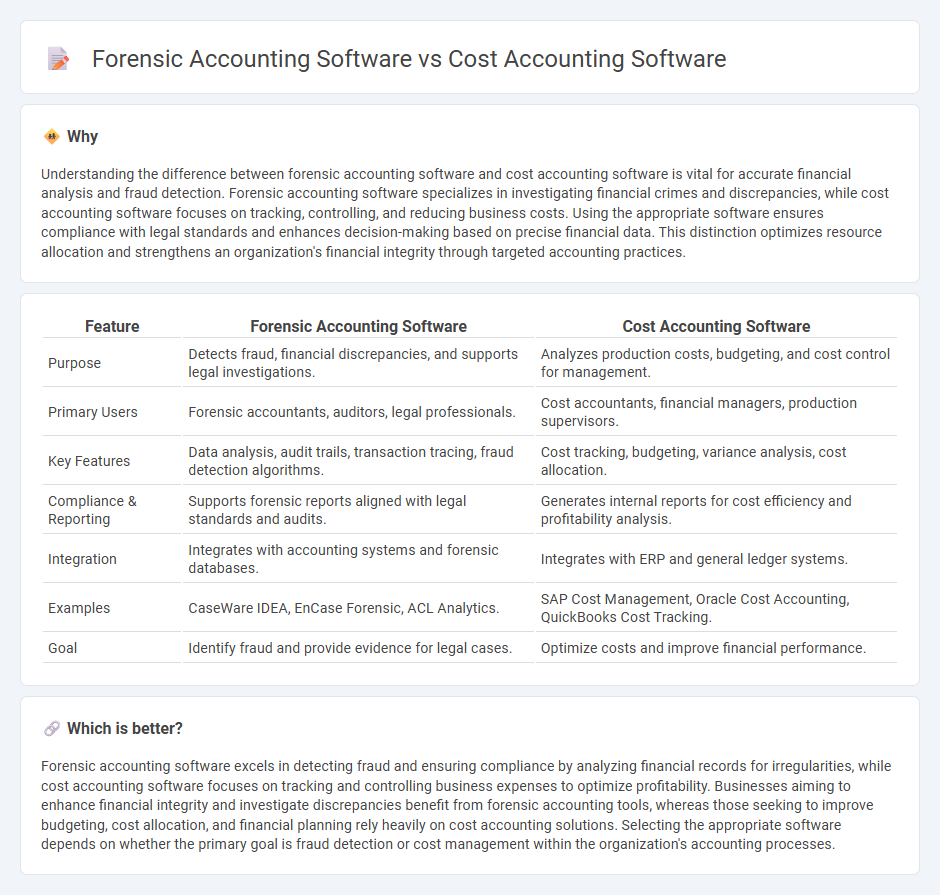

Understanding the difference between forensic accounting software and cost accounting software is vital for accurate financial analysis and fraud detection. Forensic accounting software specializes in investigating financial crimes and discrepancies, while cost accounting software focuses on tracking, controlling, and reducing business costs. Using the appropriate software ensures compliance with legal standards and enhances decision-making based on precise financial data. This distinction optimizes resource allocation and strengthens an organization's financial integrity through targeted accounting practices.

Comparison Table

| Feature | Forensic Accounting Software | Cost Accounting Software |

|---|---|---|

| Purpose | Detects fraud, financial discrepancies, and supports legal investigations. | Analyzes production costs, budgeting, and cost control for management. |

| Primary Users | Forensic accountants, auditors, legal professionals. | Cost accountants, financial managers, production supervisors. |

| Key Features | Data analysis, audit trails, transaction tracing, fraud detection algorithms. | Cost tracking, budgeting, variance analysis, cost allocation. |

| Compliance & Reporting | Supports forensic reports aligned with legal standards and audits. | Generates internal reports for cost efficiency and profitability analysis. |

| Integration | Integrates with accounting systems and forensic databases. | Integrates with ERP and general ledger systems. |

| Examples | CaseWare IDEA, EnCase Forensic, ACL Analytics. | SAP Cost Management, Oracle Cost Accounting, QuickBooks Cost Tracking. |

| Goal | Identify fraud and provide evidence for legal cases. | Optimize costs and improve financial performance. |

Which is better?

Forensic accounting software excels in detecting fraud and ensuring compliance by analyzing financial records for irregularities, while cost accounting software focuses on tracking and controlling business expenses to optimize profitability. Businesses aiming to enhance financial integrity and investigate discrepancies benefit from forensic accounting tools, whereas those seeking to improve budgeting, cost allocation, and financial planning rely heavily on cost accounting solutions. Selecting the appropriate software depends on whether the primary goal is fraud detection or cost management within the organization's accounting processes.

Connection

Forensic accounting software and cost accounting software intersect in their ability to enhance financial accuracy and fraud detection within organizations. Forensic accounting software specializes in analyzing financial records for irregularities, while cost accounting software focuses on tracking and managing production expenses to optimize profitability. Integrating both solutions provides comprehensive insight into financial operations, improving audit efficiency and cost control.

Key Terms

Cost allocation

Cost accounting software specializes in cost allocation by accurately tracking and assigning direct and indirect expenses to products, departments, or projects, enabling precise profitability analysis and budgeting. Forensic accounting software, on the other hand, focuses on detecting cost misallocations and fraudulent activities through detailed transaction analysis and audit trails. Explore the key differences and benefits of each software to optimize your financial management strategies.

Fraud detection

Cost accounting software primarily helps track and manage expenses, budgets, and cost control to improve business profitability, while forensic accounting software is specialized in identifying, analyzing, and preventing fraudulent activities through detailed financial data examination and audit trails. Forensic accounting tools integrate advanced analytics, anomaly detection, and AI-driven pattern recognition specifically designed to uncover fraud, making them essential for fraud detection beyond typical cost management capabilities. Explore in-depth features and best practices of both software types to strengthen your organization's fraud prevention strategy.

Variance analysis

Cost accounting software specializes in tracking production costs and analyzing cost variances to enhance budgeting accuracy and operational efficiency, utilizing tools that compare actual costs against standard costs. Forensic accounting software focuses on identifying and analyzing financial discrepancies, fraud detection, and investigating suspicious transactions, often incorporating detailed variance analysis to uncover anomalies. Explore how integrating both software types can power comprehensive financial insight and control.

Source and External Links

Cost Accounting Software | Financial Management Solutions - TGI - Offers strong cost accounting and financial management capabilities through Enterprise 21 ERP software, supporting multiple costing methods and detailed cost tracking.

Best Accounting Software for Small Business of 2025 - NerdWallet - Reviews and compares various accounting software options for small businesses, including their pricing and features for cost management.

Job Costing Accounting Software for Manufacturing - Global Shop Solutions - Provides job costing software designed to help manufacturing businesses analyze and manage cost components such as material, labor, and overhead.

dowidth.com

dowidth.com