Embedded finance compliance requires adherence to specific financial regulations that govern the integration of financial services within non-financial platforms, ensuring secure and transparent transactions. Data privacy compliance focuses on safeguarding personal and financial information, adhering to laws such as GDPR and CCPA to protect user data from unauthorized access and breaches. Explore how these compliance areas intersect and impact accounting practices in modern financial ecosystems.

Why it is important

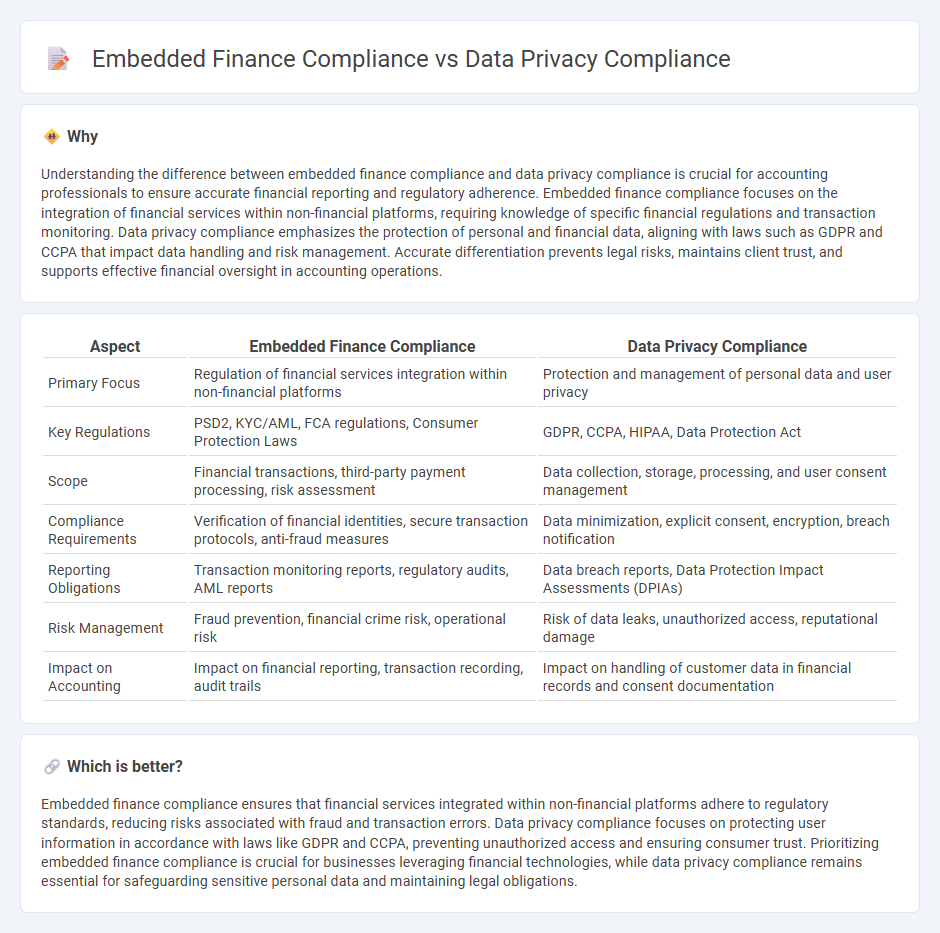

Understanding the difference between embedded finance compliance and data privacy compliance is crucial for accounting professionals to ensure accurate financial reporting and regulatory adherence. Embedded finance compliance focuses on the integration of financial services within non-financial platforms, requiring knowledge of specific financial regulations and transaction monitoring. Data privacy compliance emphasizes the protection of personal and financial data, aligning with laws such as GDPR and CCPA that impact data handling and risk management. Accurate differentiation prevents legal risks, maintains client trust, and supports effective financial oversight in accounting operations.

Comparison Table

| Aspect | Embedded Finance Compliance | Data Privacy Compliance |

|---|---|---|

| Primary Focus | Regulation of financial services integration within non-financial platforms | Protection and management of personal data and user privacy |

| Key Regulations | PSD2, KYC/AML, FCA regulations, Consumer Protection Laws | GDPR, CCPA, HIPAA, Data Protection Act |

| Scope | Financial transactions, third-party payment processing, risk assessment | Data collection, storage, processing, and user consent management |

| Compliance Requirements | Verification of financial identities, secure transaction protocols, anti-fraud measures | Data minimization, explicit consent, encryption, breach notification |

| Reporting Obligations | Transaction monitoring reports, regulatory audits, AML reports | Data breach reports, Data Protection Impact Assessments (DPIAs) |

| Risk Management | Fraud prevention, financial crime risk, operational risk | Risk of data leaks, unauthorized access, reputational damage |

| Impact on Accounting | Impact on financial reporting, transaction recording, audit trails | Impact on handling of customer data in financial records and consent documentation |

Which is better?

Embedded finance compliance ensures that financial services integrated within non-financial platforms adhere to regulatory standards, reducing risks associated with fraud and transaction errors. Data privacy compliance focuses on protecting user information in accordance with laws like GDPR and CCPA, preventing unauthorized access and ensuring consumer trust. Prioritizing embedded finance compliance is crucial for businesses leveraging financial technologies, while data privacy compliance remains essential for safeguarding sensitive personal data and maintaining legal obligations.

Connection

Embedded finance compliance and data privacy compliance intersect through the protection of sensitive financial data within integrated financial services. Regulations such as GDPR and PSD2 mandate strict controls on data handling, ensuring embedded finance platforms securely process customer information. Ensuring alignment between these compliance areas minimizes legal risks and enhances trust in embedded financial ecosystems.

Key Terms

**Data privacy compliance:**

Data privacy compliance involves adhering to regulations like GDPR, CCPA, and HIPAA to protect personal data from unauthorized access and breaches. It requires implementing strong encryption, secure data storage, and regular audits to ensure consumer information remains confidential and secure. Explore how organizations maintain data privacy compliance to build consumer trust and avoid hefty penalties.

GDPR (General Data Protection Regulation)

Data privacy compliance under GDPR mandates strict controls on personal data processing, ensuring transparency, consent, and data subject rights protection. Embedded finance compliance integrates financial services within non-financial platforms, requiring adherence to GDPR alongside financial regulations to safeguard sensitive customer information. Explore how businesses navigate these dual obligations by understanding key GDPR principles in embedded finance contexts.

Data Minimization

Data privacy compliance centers on data minimization by collecting only essential personal information to reduce the risk of breaches and ensure alignment with regulations like GDPR and CCPA. Embedded finance compliance requires stringent data minimization practices to protect sensitive financial data, adhering to standards such as PCI DSS and PSD2 to maintain trust and security. Explore the nuanced differences and best practices in data minimization across these compliance domains to enhance your understanding.

Source and External Links

What Is Data Compliance? - This article discusses how organizations can establish a robust data compliance program to meet regulatory standards and protect sensitive information.

What Is Data Privacy Compliance? - This webpage explains data privacy compliance, highlighting the importance of following regulations like GDPR and CCPA to protect personal information.

Understanding Data Privacy - This article explores how data privacy compliance strategies can help mitigate cyber threats by establishing robust security policies and procedures.

dowidth.com

dowidth.com