Payroll crypto taxation involves calculating and reporting taxes on employee compensation paid in cryptocurrency, requiring adherence to specific IRS guidelines for fair market value and taxable income. Payroll deductions encompass mandatory withholdings such as federal income tax, Social Security, Medicare, and employee benefits contributions, which differ significantly from the complexities of crypto taxation. Explore how payroll crypto taxation and payroll deductions impact your business compliance and employee compensation strategies.

Why it is important

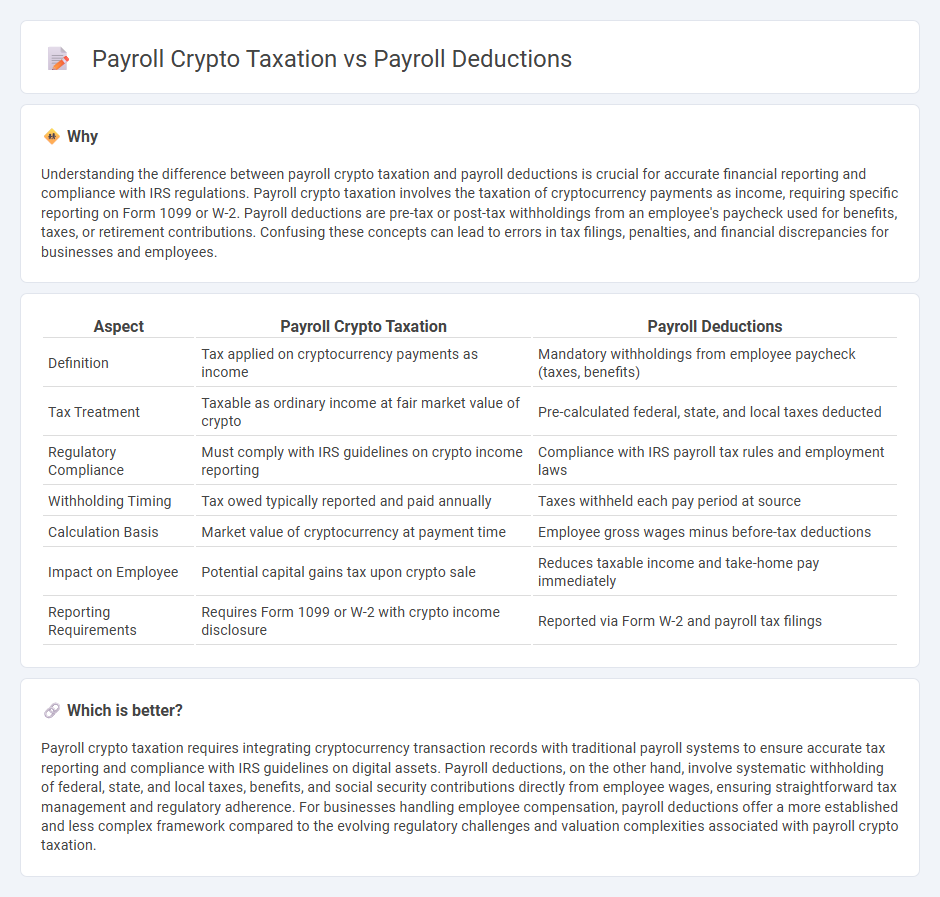

Understanding the difference between payroll crypto taxation and payroll deductions is crucial for accurate financial reporting and compliance with IRS regulations. Payroll crypto taxation involves the taxation of cryptocurrency payments as income, requiring specific reporting on Form 1099 or W-2. Payroll deductions are pre-tax or post-tax withholdings from an employee's paycheck used for benefits, taxes, or retirement contributions. Confusing these concepts can lead to errors in tax filings, penalties, and financial discrepancies for businesses and employees.

Comparison Table

| Aspect | Payroll Crypto Taxation | Payroll Deductions |

|---|---|---|

| Definition | Tax applied on cryptocurrency payments as income | Mandatory withholdings from employee paycheck (taxes, benefits) |

| Tax Treatment | Taxable as ordinary income at fair market value of crypto | Pre-calculated federal, state, and local taxes deducted |

| Regulatory Compliance | Must comply with IRS guidelines on crypto income reporting | Compliance with IRS payroll tax rules and employment laws |

| Withholding Timing | Tax owed typically reported and paid annually | Taxes withheld each pay period at source |

| Calculation Basis | Market value of cryptocurrency at payment time | Employee gross wages minus before-tax deductions |

| Impact on Employee | Potential capital gains tax upon crypto sale | Reduces taxable income and take-home pay immediately |

| Reporting Requirements | Requires Form 1099 or W-2 with crypto income disclosure | Reported via Form W-2 and payroll tax filings |

Which is better?

Payroll crypto taxation requires integrating cryptocurrency transaction records with traditional payroll systems to ensure accurate tax reporting and compliance with IRS guidelines on digital assets. Payroll deductions, on the other hand, involve systematic withholding of federal, state, and local taxes, benefits, and social security contributions directly from employee wages, ensuring straightforward tax management and regulatory adherence. For businesses handling employee compensation, payroll deductions offer a more established and less complex framework compared to the evolving regulatory challenges and valuation complexities associated with payroll crypto taxation.

Connection

Payroll crypto taxation involves calculating taxes on employee payments made in cryptocurrencies, requiring accurate payroll deductions to comply with tax regulations. Employers must integrate payroll systems with crypto tax reporting tools to ensure correct withholding of income, Social Security, and Medicare taxes. Proper synchronization between payroll deductions and crypto taxation safeguards compliance and prevents discrepancies in employee compensation reporting.

Key Terms

Withholding Tax

Payroll deductions typically include withholding tax, Social Security, and Medicare contributions directly subtracted from an employee's paycheck to comply with government regulations. Payroll crypto taxation involves applying withholding tax rules to cryptocurrency payments or income earned, requiring employers to accurately report and withhold taxes on crypto-related earnings. Explore further to understand the complexities of withholding tax in payroll deductions and cryptocurrency income reporting.

Gross-to-Net Calculation

Payroll deductions typically involve mandatory withholdings such as federal and state taxes, Social Security, and Medicare, which are subtracted from the employee's gross pay to calculate net income. Payroll crypto taxation, on the other hand, requires careful tracking of cryptocurrency compensation's fair market value at the time of payment, affecting gross-to-net calculations due to tax obligations on crypto earnings and potential capital gains. Explore the detailed processes and implications of integrating crypto assets into payroll systems to better manage compliance and optimize payroll accuracy.

Cryptocurrency Reporting

Payroll deductions typically involve standard withholdings for taxes, benefits, and retirement contributions, whereas payroll crypto taxation requires specialized reporting of cryptocurrency transactions, including income valuation and capital gains tracking. Employers must accurately report cryptocurrency compensation to comply with IRS guidelines, which mandate detailed documentation of fair market value at the time of payment. Explore comprehensive insights on cryptocurrency reporting to ensure compliance and optimize payroll processes.

Source and External Links

What Are Payroll Deductions & How Do They Work? - Payroll deductions are amounts withheld from employees' paychecks to cover taxes, benefit contributions, union dues, retirement savings, court-ordered payments, and voluntary charitable donations.

What are payroll deductions? Pre-tax & post-tax - Payroll deductions include taxes, garnishments, and benefits, and are calculated by adjusting gross pay for pre-tax contributions, using tax tables, and deducting Medicare, Social Security, and state taxes where applicable.

What are Payroll Deductions? Learn the Basics - Payroll deductions are portions of wages subtracted for mandatory payments like taxes and garnishments, as well as voluntary investments such as health insurance and retirement savings.

dowidth.com

dowidth.com