Neobank reconciliation involves verifying transactions within digital banking platforms to ensure accuracy and consistency with customer accounts, whereas general ledger reconciliation focuses on aligning all financial records across an organization's accounting system. Both processes are critical for maintaining financial integrity, detecting discrepancies, and supporting regulatory compliance. Explore deeper insights into the nuances between neobank and general ledger reconciliation techniques.

Why it is important

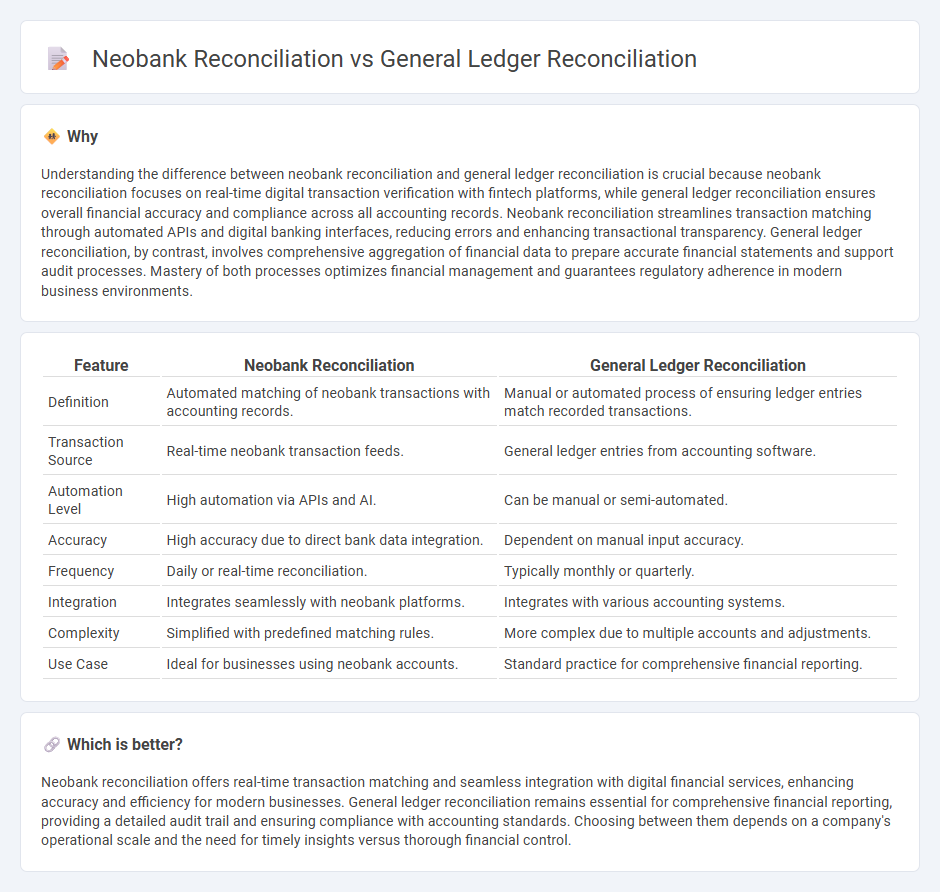

Understanding the difference between neobank reconciliation and general ledger reconciliation is crucial because neobank reconciliation focuses on real-time digital transaction verification with fintech platforms, while general ledger reconciliation ensures overall financial accuracy and compliance across all accounting records. Neobank reconciliation streamlines transaction matching through automated APIs and digital banking interfaces, reducing errors and enhancing transactional transparency. General ledger reconciliation, by contrast, involves comprehensive aggregation of financial data to prepare accurate financial statements and support audit processes. Mastery of both processes optimizes financial management and guarantees regulatory adherence in modern business environments.

Comparison Table

| Feature | Neobank Reconciliation | General Ledger Reconciliation |

|---|---|---|

| Definition | Automated matching of neobank transactions with accounting records. | Manual or automated process of ensuring ledger entries match recorded transactions. |

| Transaction Source | Real-time neobank transaction feeds. | General ledger entries from accounting software. |

| Automation Level | High automation via APIs and AI. | Can be manual or semi-automated. |

| Accuracy | High accuracy due to direct bank data integration. | Dependent on manual input accuracy. |

| Frequency | Daily or real-time reconciliation. | Typically monthly or quarterly. |

| Integration | Integrates seamlessly with neobank platforms. | Integrates with various accounting systems. |

| Complexity | Simplified with predefined matching rules. | More complex due to multiple accounts and adjustments. |

| Use Case | Ideal for businesses using neobank accounts. | Standard practice for comprehensive financial reporting. |

Which is better?

Neobank reconciliation offers real-time transaction matching and seamless integration with digital financial services, enhancing accuracy and efficiency for modern businesses. General ledger reconciliation remains essential for comprehensive financial reporting, providing a detailed audit trail and ensuring compliance with accounting standards. Choosing between them depends on a company's operational scale and the need for timely insights versus thorough financial control.

Connection

Neobank reconciliation and general ledger reconciliation are interconnected through their roles in ensuring financial accuracy and integrity. Neobank reconciliation involves matching transaction records from digital banks with internal accounting data, while general ledger reconciliation confirms that all financial transactions are accurately reflected across various accounts. This connection enhances real-time financial monitoring and reduces discrepancies in overall financial reporting.

Key Terms

**General Ledger Reconciliation:**

General ledger reconciliation ensures accuracy by comparing ledger entries against transaction records to detect discrepancies and maintain financial integrity. It plays a crucial role in identifying errors, fraud, and ensuring compliance with accounting standards. Explore detailed processes and benefits of general ledger reconciliation to optimize your financial management system.

Chart of Accounts

General ledger reconciliation centers on matching transactions against the Chart of Accounts to ensure financial statements' accuracy and compliance with accounting standards. Neobank reconciliation leverages automated tools to align digital banking transactions with the Chart of Accounts, enhancing real-time financial visibility. Explore how these reconciliation methods impact financial management in modern accounting systems.

Trial Balance

General ledger reconciliation involves verifying and matching all account balances within the company's accounting records to ensure accuracy before generating the trial balance, which summarizes financial data for financial statements. Neobank reconciliation specifically addresses the integration and matching of digital banking transactions with the internal ledger, streamlining trial balance accuracy through real-time transaction data and automated processes. Explore deeper to understand how neobank reconciliation transforms trial balance preparation and enhances financial accuracy.

Source and External Links

General ledger reconciliation: A simple guide - This guide provides a step-by-step approach to reconciling general ledgers, ensuring financial statements are accurate before publication.

A complete guide to general ledger reconciliation - This comprehensive guide outlines the process of comparing general ledger balances with independent source documents and resolving discrepancies.

General Ledger Reconciliation Process - An Overview - This overview discusses the importance of reconciling general ledger balances with third-party data to ensure financial reporting accuracy.

dowidth.com

dowidth.com