Embedded finance reporting integrates real-time financial data within business operations, enabling seamless tracking of transactions and cash flows across platforms. Cost accounting reports focus on analyzing production expenses to determine product profitability and support budgeting decisions. Discover how these reporting methods enhance financial transparency and strategic planning in modern enterprises.

Why it is important

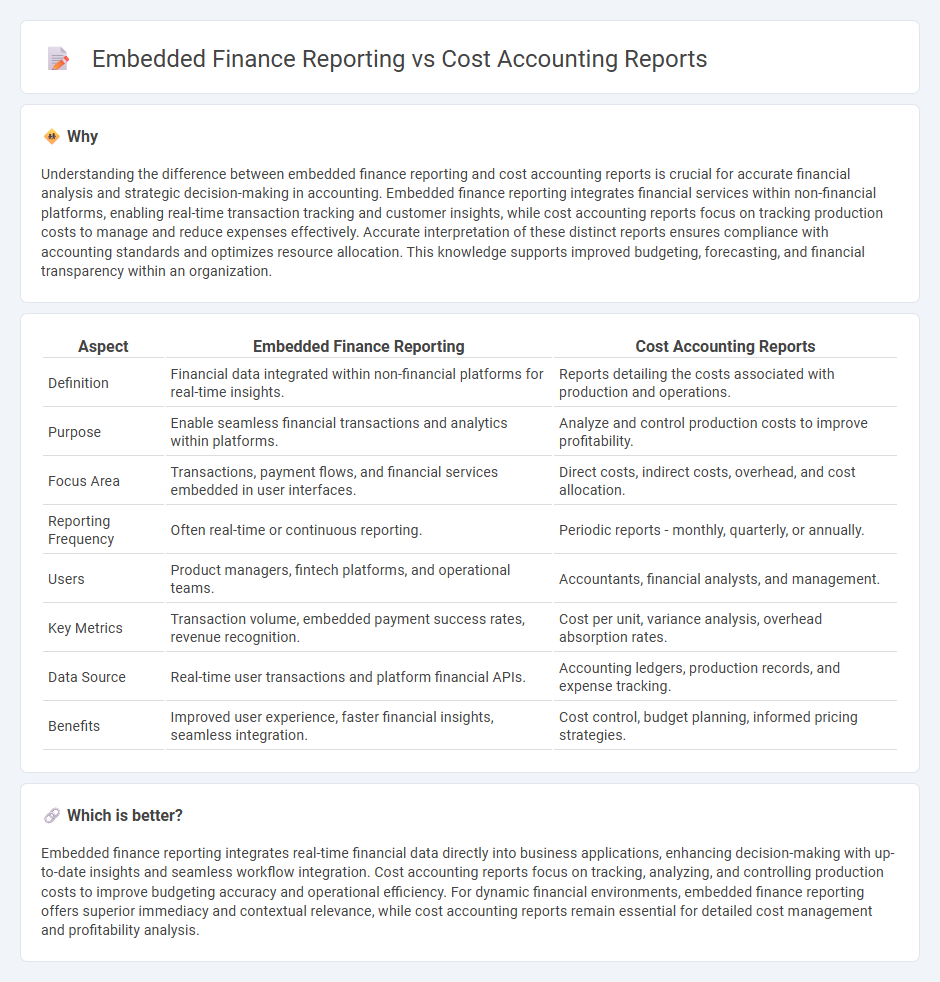

Understanding the difference between embedded finance reporting and cost accounting reports is crucial for accurate financial analysis and strategic decision-making in accounting. Embedded finance reporting integrates financial services within non-financial platforms, enabling real-time transaction tracking and customer insights, while cost accounting reports focus on tracking production costs to manage and reduce expenses effectively. Accurate interpretation of these distinct reports ensures compliance with accounting standards and optimizes resource allocation. This knowledge supports improved budgeting, forecasting, and financial transparency within an organization.

Comparison Table

| Aspect | Embedded Finance Reporting | Cost Accounting Reports |

|---|---|---|

| Definition | Financial data integrated within non-financial platforms for real-time insights. | Reports detailing the costs associated with production and operations. |

| Purpose | Enable seamless financial transactions and analytics within platforms. | Analyze and control production costs to improve profitability. |

| Focus Area | Transactions, payment flows, and financial services embedded in user interfaces. | Direct costs, indirect costs, overhead, and cost allocation. |

| Reporting Frequency | Often real-time or continuous reporting. | Periodic reports - monthly, quarterly, or annually. |

| Users | Product managers, fintech platforms, and operational teams. | Accountants, financial analysts, and management. |

| Key Metrics | Transaction volume, embedded payment success rates, revenue recognition. | Cost per unit, variance analysis, overhead absorption rates. |

| Data Source | Real-time user transactions and platform financial APIs. | Accounting ledgers, production records, and expense tracking. |

| Benefits | Improved user experience, faster financial insights, seamless integration. | Cost control, budget planning, informed pricing strategies. |

Which is better?

Embedded finance reporting integrates real-time financial data directly into business applications, enhancing decision-making with up-to-date insights and seamless workflow integration. Cost accounting reports focus on tracking, analyzing, and controlling production costs to improve budgeting accuracy and operational efficiency. For dynamic financial environments, embedded finance reporting offers superior immediacy and contextual relevance, while cost accounting reports remain essential for detailed cost management and profitability analysis.

Connection

Embedded finance reporting integrates financial services within non-financial platforms, enabling real-time transaction data capture essential for accurate cost accounting reports. Cost accounting reports rely on this precise, timely data to analyze and allocate expenses effectively, improving budgeting and financial decision-making. This connection enhances financial transparency and operational efficiency across business functions.

Key Terms

**Cost accounting reports**

Cost accounting reports provide detailed insights into production costs, helping businesses analyze expenses related to materials, labor, and overhead to optimize profitability. These reports enable managers to make informed decisions by tracking cost variances and evaluating efficiency in various departments. Explore how cost accounting reports can transform your financial strategy for enhanced operational control.

Overhead allocation

Cost accounting reports provide detailed overhead allocation by tracing indirect costs to specific cost centers or activities, enabling precise product costing and profitability analysis. Embedded finance reporting integrates financial services data within operational platforms, offering real-time insights into overhead expenses directly linked to embedded transactions and processes. Explore our in-depth analysis to understand how these reporting methods optimize overhead allocation for better financial management.

Variance analysis

Cost accounting reports provide detailed insights into budgeted versus actual costs, emphasizing variance analysis to identify discrepancies in production expenses, labor, and material usage. Embedded finance reporting integrates financial services directly within business operations, offering real-time variance analysis on transactional data and payment flows to optimize cash management and financial decision-making. Explore how these reporting methods enhance financial accuracy and operational efficiency in your organization.

Source and External Links

Reports and Analytics for Cost Accounting - This webpage provides information on the reports available for Oracle Cost Accounting, including the Costing Account Balances Report and the Period Costing Account Balances by Supporting References Report.

Cost Accounting and Financial Reporting - ERP systems facilitate real-time tracking of costs, enabling businesses to generate various cost-related reports such as cost center reports and product costing reports.

Cost Accounting: Everything You Need to Know - Cost accounting systems help businesses generate reports that track and compare costs, enabling informed decisions about production and profitability.

dowidth.com

dowidth.com