Digital asset reporting leverages blockchain technology and automated data analytics to enhance transparency and accuracy in financial disclosures. Conventional auditing relies on manual verification and sampling techniques, often resulting in longer processing times and increased risk of human error. Explore the impact of digital asset reporting on the future of auditing to understand its advantages and implementation strategies.

Why it is important

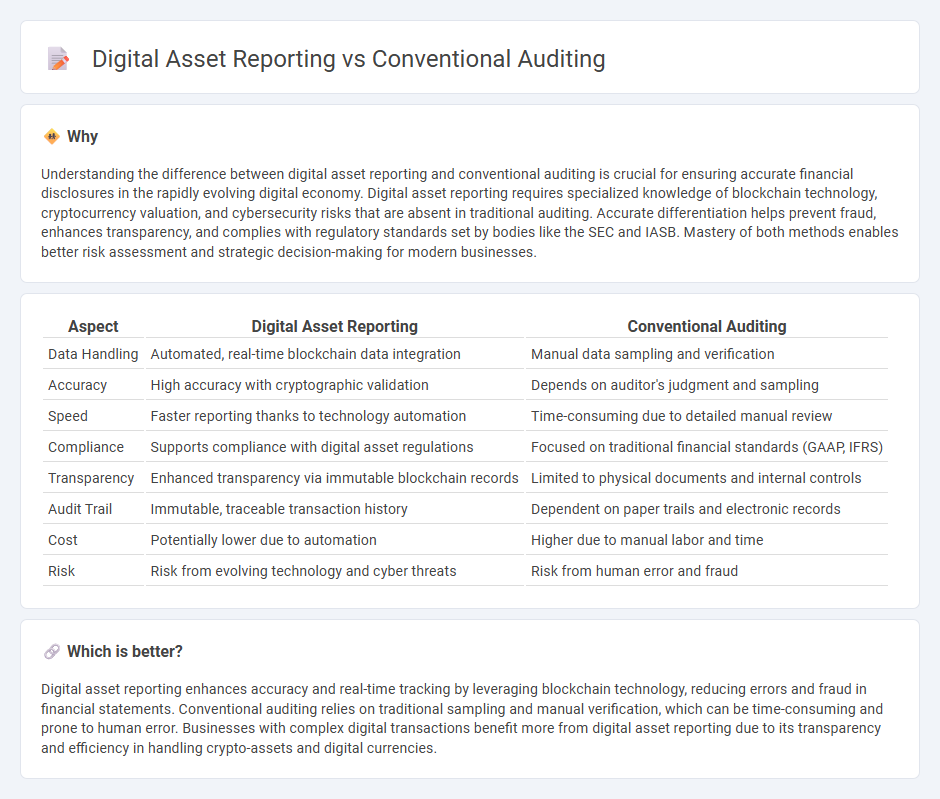

Understanding the difference between digital asset reporting and conventional auditing is crucial for ensuring accurate financial disclosures in the rapidly evolving digital economy. Digital asset reporting requires specialized knowledge of blockchain technology, cryptocurrency valuation, and cybersecurity risks that are absent in traditional auditing. Accurate differentiation helps prevent fraud, enhances transparency, and complies with regulatory standards set by bodies like the SEC and IASB. Mastery of both methods enables better risk assessment and strategic decision-making for modern businesses.

Comparison Table

| Aspect | Digital Asset Reporting | Conventional Auditing |

|---|---|---|

| Data Handling | Automated, real-time blockchain data integration | Manual data sampling and verification |

| Accuracy | High accuracy with cryptographic validation | Depends on auditor's judgment and sampling |

| Speed | Faster reporting thanks to technology automation | Time-consuming due to detailed manual review |

| Compliance | Supports compliance with digital asset regulations | Focused on traditional financial standards (GAAP, IFRS) |

| Transparency | Enhanced transparency via immutable blockchain records | Limited to physical documents and internal controls |

| Audit Trail | Immutable, traceable transaction history | Dependent on paper trails and electronic records |

| Cost | Potentially lower due to automation | Higher due to manual labor and time |

| Risk | Risk from evolving technology and cyber threats | Risk from human error and fraud |

Which is better?

Digital asset reporting enhances accuracy and real-time tracking by leveraging blockchain technology, reducing errors and fraud in financial statements. Conventional auditing relies on traditional sampling and manual verification, which can be time-consuming and prone to human error. Businesses with complex digital transactions benefit more from digital asset reporting due to its transparency and efficiency in handling crypto-assets and digital currencies.

Connection

Digital asset reporting enhances conventional auditing by providing real-time access to blockchain transaction histories and digital wallets, improving accuracy and transparency in financial records. This integration supports auditors in verifying the existence, valuation, and ownership of digital assets, reducing the risk of fraud and misstatements. Implementing automated audit tools and data analytics facilitates efficient compliance with regulatory standards and enhances the overall reliability of financial statements.

Key Terms

Materiality

Conventional auditing assesses materiality through established financial thresholds, relying on historical data and standardized risk models to identify significant misstatements. Digital asset reporting incorporates real-time data analytics and blockchain transparency, offering dynamic materiality evaluation that captures rapid market fluctuations and non-traditional asset valuations. Explore the evolving landscape of materiality assessment by understanding the integration of digital technologies in auditing frameworks.

Blockchain Verification

Conventional auditing relies heavily on manual processes and traditional financial statements, often leading to delays in identifying discrepancies. Digital asset reporting leverages blockchain verification to provide real-time, immutable records that enhance transparency and reduce fraud risk. Explore how blockchain technology revolutionizes audit accuracy and efficiency for deeper insights.

Internal Controls

Conventional auditing primarily relies on manual verification of internal controls through sampling and documentation, which can lead to delays and potential oversights. Digital asset reporting leverages blockchain technology and automated tracking systems to provide real-time transparency, enhancing the accuracy and efficiency of internal control assessments. Explore how integrating digital asset reporting can revolutionize your internal control strategies and auditing processes.

Source and External Links

What Distinguishes Risk-based Auditing from Traditional Auditing - This article contrasts traditional auditing, which relies on checklists and compliance, with risk-based auditing, which focuses on understanding business processes and risk management strategies.

Continuous vs. Traditional Auditing: Which Is Best? - This webpage compares traditional auditing, which is periodic and often manual, with continuous auditing, which uses technology for real-time risk detection and broader scope.

Six Biggest Challenges of Traditional Audit Techniques - This blog highlights the limitations of traditional auditing, including manual processes prone to human error and a limited scope that may miss critical issues.

dowidth.com

dowidth.com