Triple entry accounting enhances transaction transparency by integrating cryptographic verification alongside traditional debit and credit records, revolutionizing financial accountability. Governmental accounting focuses on public sector financial management, emphasizing fund accounting, budget compliance, and reporting to ensure accountability and transparency in using public resources. Explore how these accounting systems uniquely address transparency, control, and accountability in financial management.

Why it is important

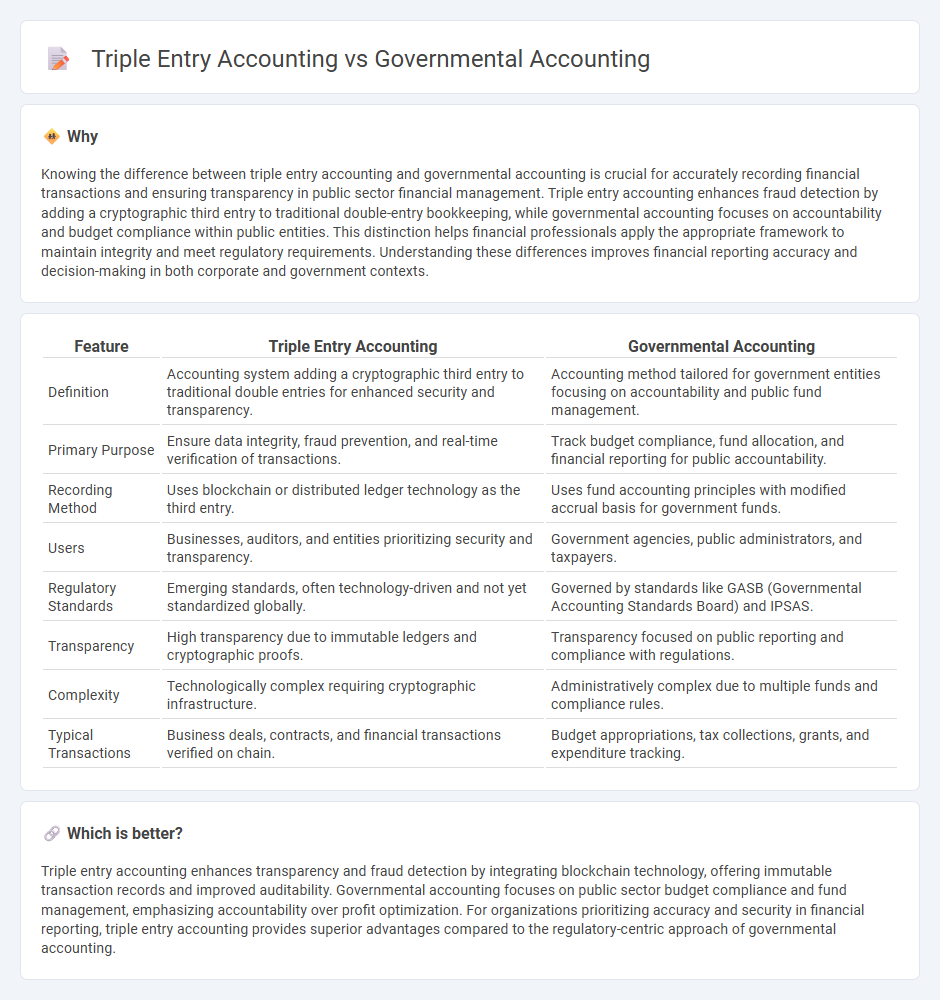

Knowing the difference between triple entry accounting and governmental accounting is crucial for accurately recording financial transactions and ensuring transparency in public sector financial management. Triple entry accounting enhances fraud detection by adding a cryptographic third entry to traditional double-entry bookkeeping, while governmental accounting focuses on accountability and budget compliance within public entities. This distinction helps financial professionals apply the appropriate framework to maintain integrity and meet regulatory requirements. Understanding these differences improves financial reporting accuracy and decision-making in both corporate and government contexts.

Comparison Table

| Feature | Triple Entry Accounting | Governmental Accounting |

|---|---|---|

| Definition | Accounting system adding a cryptographic third entry to traditional double entries for enhanced security and transparency. | Accounting method tailored for government entities focusing on accountability and public fund management. |

| Primary Purpose | Ensure data integrity, fraud prevention, and real-time verification of transactions. | Track budget compliance, fund allocation, and financial reporting for public accountability. |

| Recording Method | Uses blockchain or distributed ledger technology as the third entry. | Uses fund accounting principles with modified accrual basis for government funds. |

| Users | Businesses, auditors, and entities prioritizing security and transparency. | Government agencies, public administrators, and taxpayers. |

| Regulatory Standards | Emerging standards, often technology-driven and not yet standardized globally. | Governed by standards like GASB (Governmental Accounting Standards Board) and IPSAS. |

| Transparency | High transparency due to immutable ledgers and cryptographic proofs. | Transparency focused on public reporting and compliance with regulations. |

| Complexity | Technologically complex requiring cryptographic infrastructure. | Administratively complex due to multiple funds and compliance rules. |

| Typical Transactions | Business deals, contracts, and financial transactions verified on chain. | Budget appropriations, tax collections, grants, and expenditure tracking. |

Which is better?

Triple entry accounting enhances transparency and fraud detection by integrating blockchain technology, offering immutable transaction records and improved auditability. Governmental accounting focuses on public sector budget compliance and fund management, emphasizing accountability over profit optimization. For organizations prioritizing accuracy and security in financial reporting, triple entry accounting provides superior advantages compared to the regulatory-centric approach of governmental accounting.

Connection

Triple entry accounting enhances transparency and accountability in Governmental accounting by incorporating blockchain technology to create immutable records. This innovation supports accurate tracking of public funds and reduces fraud risks, fostering trust in governmental financial reports. Governmental accounting benefits from triple entry systems through improved auditability and real-time verification of financial transactions.

Key Terms

Fund Accounting

Governmental accounting primarily relies on fund accounting to ensure accountability and compliance by segregating resources into funds based on their intended purposes, enabling transparent tracking of public resources. Triple entry accounting introduces a cryptographic third entry to traditional double-entry bookkeeping, enhancing the accuracy and security of transactions, but it is less common in fund accounting contexts where legal and regulatory frameworks dominate. Explore deeper insights into how fund accounting integrates with emerging accounting technologies and standards.

Blockchain Ledger

Governmental accounting relies on standardized fund accounting to ensure transparency and accountability in public sector financial reporting, while triple entry accounting enhances traditional double-entry bookkeeping with a cryptographically secured third ledger on blockchain technology. Blockchain's immutable ledger in triple entry accounting offers real-time verification, fraud reduction, and improved trust, which are critical for modern governmental financial systems. Explore how integrating blockchain-based triple entry accounting transforms governmental fiscal management and boosts accountability.

Transparency

Governmental accounting prioritizes transparency by systematically recording public funds to ensure accountability and compliance with regulations, enabling stakeholders to track resource allocation and spending clearly. Triple entry accounting enhances transparency through blockchain technology by creating immutable, shared ledgers that allow multiple parties to verify transactions independently and reduce fraud risks. Explore more to understand how these accounting methods revolutionize financial accountability and transparency.

Source and External Links

Governmental accounting - Wikipedia - Governmental accounting records and manages all financial transactions of governments, emphasizing accountability, legal compliance, and the use of fund accounting systems to track resources for specific purposes.

Governmental Accounting Standards Board: What is GASB? - Accruent - The Governmental Accounting Standards Board (GASB) sets U.S. standards for state and local government financial reporting, which includes government-wide statements, fund accounting, and proprietary activities to ensure transparency and fiscal responsibility.

What Is Government Accounting? - Government accountants track public finances to ensure proper use, compliance, fraud detection, and risk assessment, focusing on transparency and accountability to taxpayers.

dowidth.com

dowidth.com