Blockchain audit trails provide immutable, transparent transaction records secured by cryptographic hashing, enhancing data integrity and reducing fraud in accounting systems. Cloud-based accounting logs enable real-time access, scalable storage, and seamless integration with financial software, improving efficiency and collaboration across distributed teams. Explore the advantages and applications of these technologies to optimize your accounting processes.

Why it is important

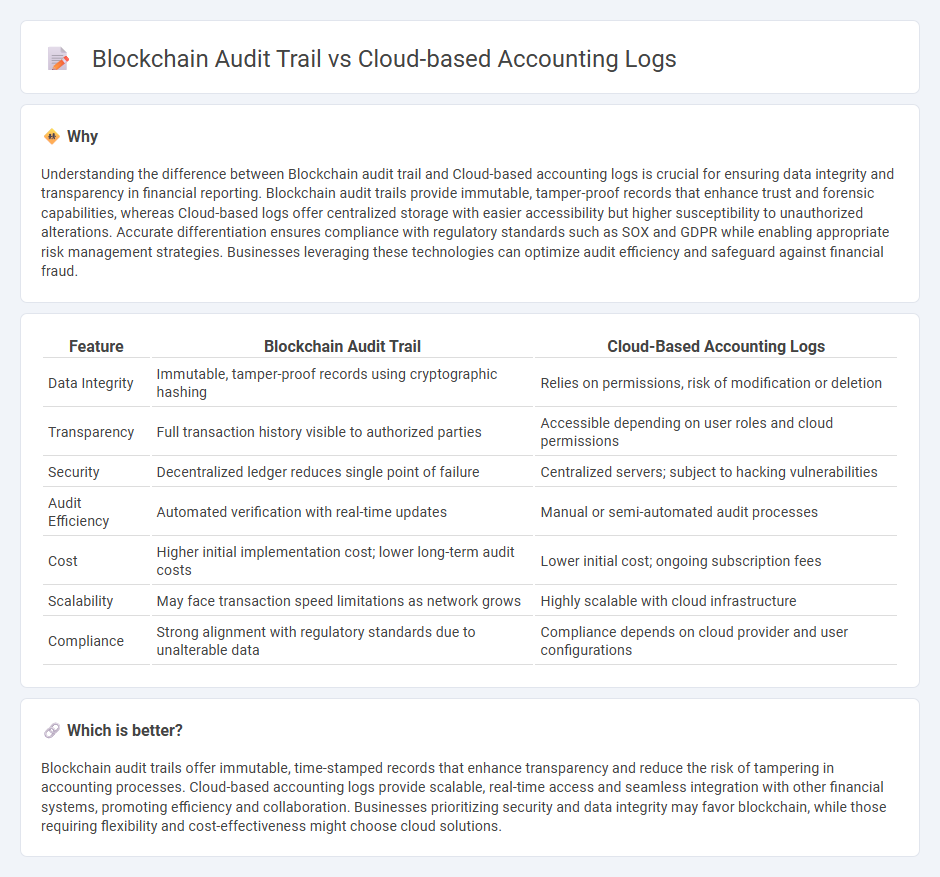

Understanding the difference between Blockchain audit trail and Cloud-based accounting logs is crucial for ensuring data integrity and transparency in financial reporting. Blockchain audit trails provide immutable, tamper-proof records that enhance trust and forensic capabilities, whereas Cloud-based logs offer centralized storage with easier accessibility but higher susceptibility to unauthorized alterations. Accurate differentiation ensures compliance with regulatory standards such as SOX and GDPR while enabling appropriate risk management strategies. Businesses leveraging these technologies can optimize audit efficiency and safeguard against financial fraud.

Comparison Table

| Feature | Blockchain Audit Trail | Cloud-Based Accounting Logs |

|---|---|---|

| Data Integrity | Immutable, tamper-proof records using cryptographic hashing | Relies on permissions, risk of modification or deletion |

| Transparency | Full transaction history visible to authorized parties | Accessible depending on user roles and cloud permissions |

| Security | Decentralized ledger reduces single point of failure | Centralized servers; subject to hacking vulnerabilities |

| Audit Efficiency | Automated verification with real-time updates | Manual or semi-automated audit processes |

| Cost | Higher initial implementation cost; lower long-term audit costs | Lower initial cost; ongoing subscription fees |

| Scalability | May face transaction speed limitations as network grows | Highly scalable with cloud infrastructure |

| Compliance | Strong alignment with regulatory standards due to unalterable data | Compliance depends on cloud provider and user configurations |

Which is better?

Blockchain audit trails offer immutable, time-stamped records that enhance transparency and reduce the risk of tampering in accounting processes. Cloud-based accounting logs provide scalable, real-time access and seamless integration with other financial systems, promoting efficiency and collaboration. Businesses prioritizing security and data integrity may favor blockchain, while those requiring flexibility and cost-effectiveness might choose cloud solutions.

Connection

Blockchain audit trails and cloud-based accounting logs are interconnected through their ability to provide secure, immutable records of financial transactions, enhancing transparency and traceability in accounting practices. Blockchain's decentralized ledger technology ensures tamper-proof data, while cloud-based systems offer scalable, real-time access to accounting logs, facilitating efficient auditing processes. This integration supports compliance, fraud prevention, and accurate financial reporting by combining the strengths of both technologies.

Key Terms

Immutability

Cloud-based accounting logs rely on centralized servers that can be vulnerable to tampering, posing risks to data immutability and audit reliability. Blockchain audit trails utilize decentralized ledgers with cryptographic hashing, ensuring transactions are immutable and verifiable through consensus mechanisms. Explore how these technologies enhance financial transparency and security in modern accounting systems.

Real-time Access

Cloud-based accounting logs provide real-time access by storing transactional data in centralized servers accessible from anywhere with an internet connection, enabling instant updates and quick audit capabilities. Blockchain audit trails offer real-time access through decentralized and immutable ledgers, ensuring data integrity and transparency while recording every transaction across a distributed network. Explore the differences in real-time access features between cloud-based logs and blockchain audit trails to enhance your accounting and auditing processes.

Decentralization

Cloud-based accounting logs centralize data storage on remote servers managed by third-party providers, enabling easier access but increasing vulnerability to data tampering and single points of failure. Blockchain audit trails leverage decentralized ledger technology where transactions are recorded across multiple nodes, ensuring immutability, enhanced transparency, and resistance to unauthorized modifications. Explore the differences in security and trust models between these technologies to understand their impact on modern financial auditing.

Source and External Links

Cloud Logging - Google Cloud Logging enables real-time management, analysis, and monitoring of cloud-based logs with features like Logs Explorer, custom log ingestion APIs, alerting, analytics with BigQuery integration, retention policies, audit logging, and third-party integrations.

Why You Need Cloud Log Management and 3 Critical Best Practices - Cloud-based log management is critical for security monitoring, compliance auditing, and performance monitoring by analyzing logs in real time to detect threats, ensure regulatory compliance, and maintain optimal system performance.

About Accounting Logs - ExtremeCloud IQ User Guide - Accounting logs in cloud environments track detailed user session data including start/stop times, session duration, user names, client device MAC addresses, SSID, data usage, and NAS device information for PPSK and RADIUS sessions.

dowidth.com

dowidth.com