Digital twin accounting leverages real-time data replication to create a virtual model of financial processes, enabling proactive analysis and error detection. Continuous auditing employs automated systems to perform ongoing transaction verification, enhancing accuracy and compliance through frequent assessments. Discover how integrating these innovative approaches can transform financial oversight and reporting.

Why it is important

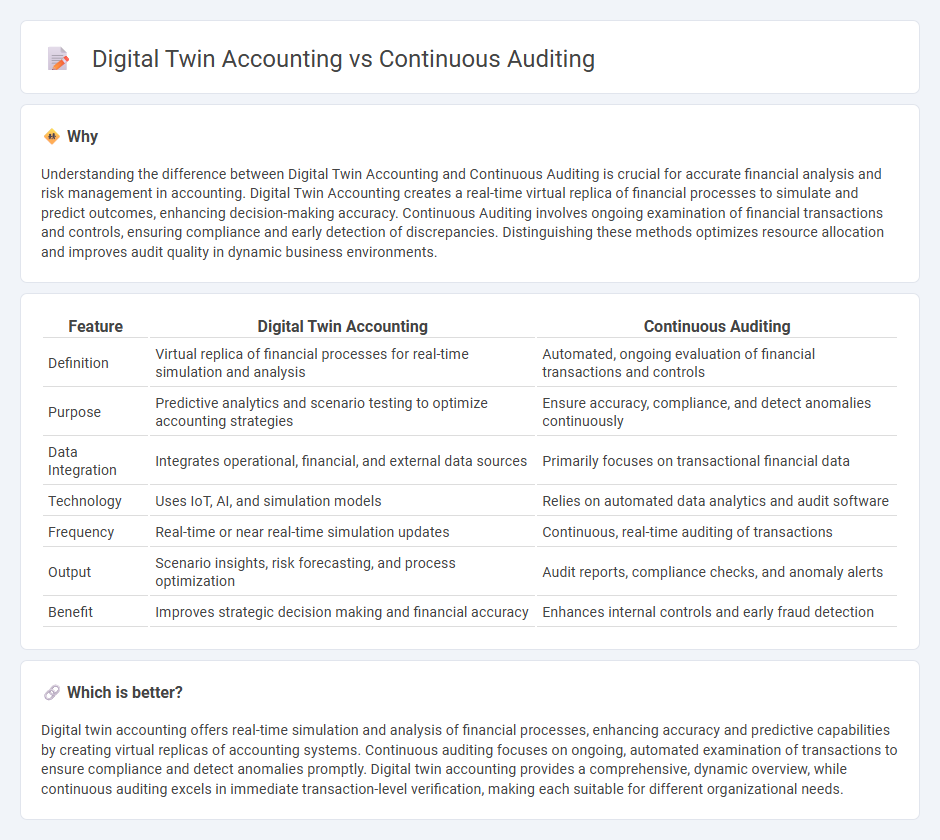

Understanding the difference between Digital Twin Accounting and Continuous Auditing is crucial for accurate financial analysis and risk management in accounting. Digital Twin Accounting creates a real-time virtual replica of financial processes to simulate and predict outcomes, enhancing decision-making accuracy. Continuous Auditing involves ongoing examination of financial transactions and controls, ensuring compliance and early detection of discrepancies. Distinguishing these methods optimizes resource allocation and improves audit quality in dynamic business environments.

Comparison Table

| Feature | Digital Twin Accounting | Continuous Auditing |

|---|---|---|

| Definition | Virtual replica of financial processes for real-time simulation and analysis | Automated, ongoing evaluation of financial transactions and controls |

| Purpose | Predictive analytics and scenario testing to optimize accounting strategies | Ensure accuracy, compliance, and detect anomalies continuously |

| Data Integration | Integrates operational, financial, and external data sources | Primarily focuses on transactional financial data |

| Technology | Uses IoT, AI, and simulation models | Relies on automated data analytics and audit software |

| Frequency | Real-time or near real-time simulation updates | Continuous, real-time auditing of transactions |

| Output | Scenario insights, risk forecasting, and process optimization | Audit reports, compliance checks, and anomaly alerts |

| Benefit | Improves strategic decision making and financial accuracy | Enhances internal controls and early fraud detection |

Which is better?

Digital twin accounting offers real-time simulation and analysis of financial processes, enhancing accuracy and predictive capabilities by creating virtual replicas of accounting systems. Continuous auditing focuses on ongoing, automated examination of transactions to ensure compliance and detect anomalies promptly. Digital twin accounting provides a comprehensive, dynamic overview, while continuous auditing excels in immediate transaction-level verification, making each suitable for different organizational needs.

Connection

Digital twin accounting creates a real-time virtual replica of financial systems that enables continuous auditing by providing ongoing, automated verification of transactions and internal controls. This integration enhances accuracy and transparency in financial reporting through constant data synchronization and anomaly detection. Continuous auditing leverages digital twins to identify risks proactively and ensure compliance, streamlining audit processes and reducing manual errors.

Key Terms

Real-time data

Continuous auditing leverages real-time data streams to provide ongoing assurance and detect anomalies instantly, enhancing financial transparency and compliance. Digital twin accounting creates a virtual replica of financial processes, enabling simulation and predictive analysis based on real-time and historical data inputs. Explore the evolving impact of these technologies on financial accuracy and decision-making to understand their distinct advantages.

Automation

Continuous auditing leverages automated data analysis to provide real-time assurance and fraud detection, enhancing transparency and compliance in financial processes. Digital twin accounting utilizes virtual replicas of accounting systems to simulate, monitor, and optimize financial operations, driving predictive insights and operational efficiency through automation. Explore how these advanced automation technologies revolutionize auditing and accounting practices.

Predictive analytics

Continuous auditing leverages real-time data monitoring to detect anomalies and ensure financial accuracy, enhancing risk management with predictive analytics that forecast potential issues before they arise. Digital twin accounting creates virtual replicas of financial systems, enabling simulations and scenario analyses to predict future financial performance and optimize decision-making processes. Explore how predictive analytics transforms both approaches to drive smarter, data-driven financial strategies.

Source and External Links

Continuous Audit and Monitoring - PwC - This page discusses how continuous auditing helps organizations reduce financial losses by monitoring transactions continuously to detect anomalies and deviations from the norm.

A framework for continuous auditing - This article explains that continuous auditing focuses on testing for risks and control effectiveness on a more frequent basis than traditional auditing methods.

Continuous Auditing: Advantages & Challenges - This resource highlights the advantages of continuous auditing, including sharper accuracy and comprehensive data analysis, allowing for more proactive risk identification.

dowidth.com

dowidth.com