Forensic accounting software specializes in detecting financial fraud and analyzing irregularities through detailed transaction tracking and data analytics. Payroll software focuses on automating employee wage calculations, tax withholdings, and compliance with labor regulations. Explore the key differences and benefits of both software types to optimize your financial management processes.

Why it is important

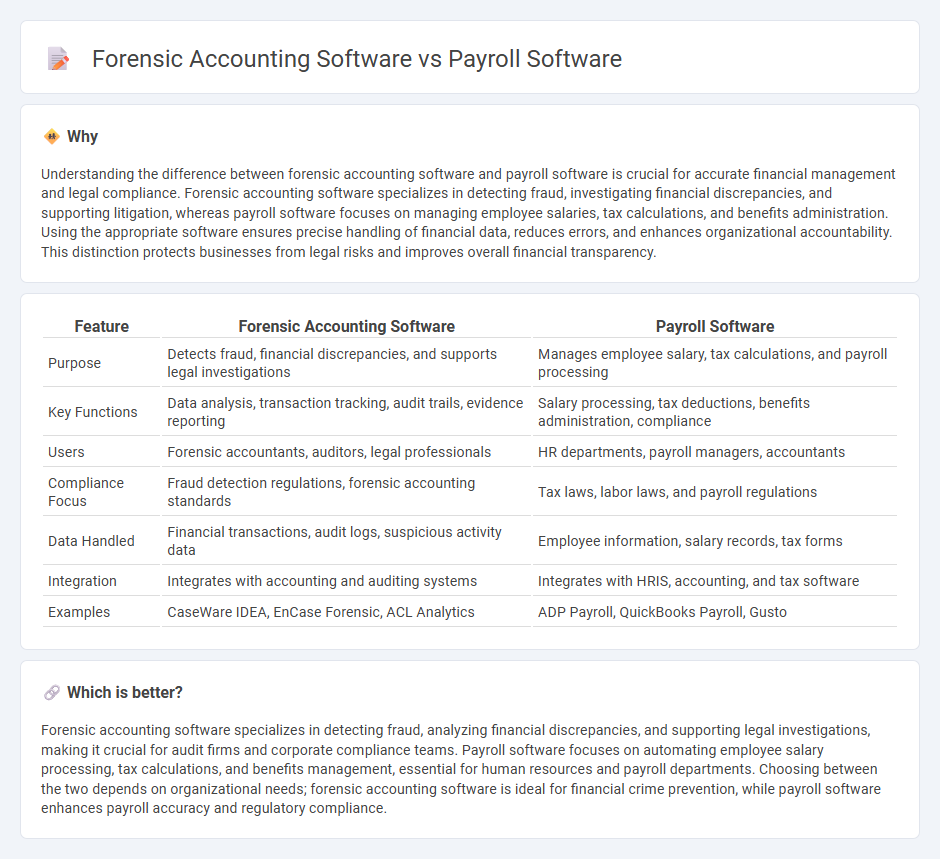

Understanding the difference between forensic accounting software and payroll software is crucial for accurate financial management and legal compliance. Forensic accounting software specializes in detecting fraud, investigating financial discrepancies, and supporting litigation, whereas payroll software focuses on managing employee salaries, tax calculations, and benefits administration. Using the appropriate software ensures precise handling of financial data, reduces errors, and enhances organizational accountability. This distinction protects businesses from legal risks and improves overall financial transparency.

Comparison Table

| Feature | Forensic Accounting Software | Payroll Software |

|---|---|---|

| Purpose | Detects fraud, financial discrepancies, and supports legal investigations | Manages employee salary, tax calculations, and payroll processing |

| Key Functions | Data analysis, transaction tracking, audit trails, evidence reporting | Salary processing, tax deductions, benefits administration, compliance |

| Users | Forensic accountants, auditors, legal professionals | HR departments, payroll managers, accountants |

| Compliance Focus | Fraud detection regulations, forensic accounting standards | Tax laws, labor laws, and payroll regulations |

| Data Handled | Financial transactions, audit logs, suspicious activity data | Employee information, salary records, tax forms |

| Integration | Integrates with accounting and auditing systems | Integrates with HRIS, accounting, and tax software |

| Examples | CaseWare IDEA, EnCase Forensic, ACL Analytics | ADP Payroll, QuickBooks Payroll, Gusto |

Which is better?

Forensic accounting software specializes in detecting fraud, analyzing financial discrepancies, and supporting legal investigations, making it crucial for audit firms and corporate compliance teams. Payroll software focuses on automating employee salary processing, tax calculations, and benefits management, essential for human resources and payroll departments. Choosing between the two depends on organizational needs; forensic accounting software is ideal for financial crime prevention, while payroll software enhances payroll accuracy and regulatory compliance.

Connection

Forensic accounting software and payroll software are connected through their ability to enhance financial accuracy and detect discrepancies in employee compensation data. Forensic accounting tools analyze payroll records to identify fraud, errors, or compliance issues by cross-referencing transactions and audit trails. Integration of these software systems improves organizational transparency and ensures adherence to regulatory payroll standards.

Key Terms

Automation

Payroll software automates salary calculations, tax deductions, and compliance reporting to streamline employee compensation processes, significantly reducing manual errors. Forensic accounting software automates data analysis and fraud detection by identifying irregular financial patterns and generating comprehensive audit trails. Explore how these automation tools enhance financial accuracy and efficiency by learning more about their specialized capabilities.

Fraud Detection

Payroll software primarily manages employee payment processing but often lacks advanced fraud detection capabilities integral to forensic accounting software. Forensic accounting software specializes in identifying irregularities through detailed financial analysis, leveraging algorithms and data analytics to uncover payroll fraud schemes such as ghost employees or falsified hours. Explore how integrating forensic accounting tools can enhance your organization's fraud detection and prevention strategies.

Compliance

Payroll software ensures compliance by automating tax calculations, wage reporting, and adherence to labor laws such as FLSA and IRS regulations, reducing the risk of costly penalties. Forensic accounting software specializes in detecting fraud, tracking financial discrepancies, and supporting legal compliance through detailed audit trails and data analysis. Explore how integrating both technologies enhances organizational compliance and financial integrity.

Source and External Links

ADP Payroll Software - Offers easy and affordable payroll services with automated features for businesses of all sizes.

Xero and Gusto Payroll Software - Simplifies payroll with automated calculations and compliance, offering features like automatic tax filing and employee self-service.

Oracle Payroll Software - Provides comprehensive payroll management solutions that automate employee payments and ensure compliance with financial regulations.

dowidth.com

dowidth.com