On-demand accrual accounting recognizes revenues and expenses when they are incurred, regardless of cash flow, providing a more accurate financial picture for businesses with complex transactions. Cash basis accounting records revenues and expenses only when cash is received or paid, simplifying bookkeeping but potentially misrepresenting financial health. Explore the differences between these methods to determine which best aligns with your financial goals and reporting needs.

Why it is important

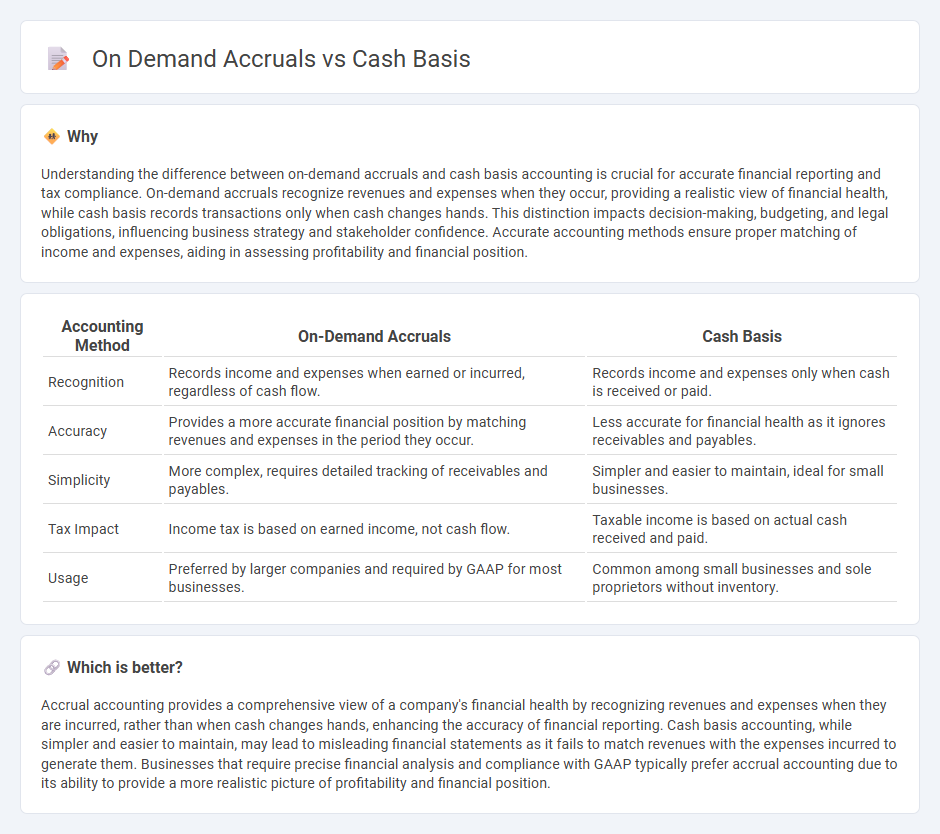

Understanding the difference between on-demand accruals and cash basis accounting is crucial for accurate financial reporting and tax compliance. On-demand accruals recognize revenues and expenses when they occur, providing a realistic view of financial health, while cash basis records transactions only when cash changes hands. This distinction impacts decision-making, budgeting, and legal obligations, influencing business strategy and stakeholder confidence. Accurate accounting methods ensure proper matching of income and expenses, aiding in assessing profitability and financial position.

Comparison Table

| Accounting Method | On-Demand Accruals | Cash Basis |

|---|---|---|

| Recognition | Records income and expenses when earned or incurred, regardless of cash flow. | Records income and expenses only when cash is received or paid. |

| Accuracy | Provides a more accurate financial position by matching revenues and expenses in the period they occur. | Less accurate for financial health as it ignores receivables and payables. |

| Simplicity | More complex, requires detailed tracking of receivables and payables. | Simpler and easier to maintain, ideal for small businesses. |

| Tax Impact | Income tax is based on earned income, not cash flow. | Taxable income is based on actual cash received and paid. |

| Usage | Preferred by larger companies and required by GAAP for most businesses. | Common among small businesses and sole proprietors without inventory. |

Which is better?

Accrual accounting provides a comprehensive view of a company's financial health by recognizing revenues and expenses when they are incurred, rather than when cash changes hands, enhancing the accuracy of financial reporting. Cash basis accounting, while simpler and easier to maintain, may lead to misleading financial statements as it fails to match revenues with the expenses incurred to generate them. Businesses that require precise financial analysis and compliance with GAAP typically prefer accrual accounting due to its ability to provide a more realistic picture of profitability and financial position.

Connection

On-demand accruals and cash basis accounting both track financial transactions but differ in timing recognition; on-demand accruals record revenues and expenses when earned or incurred, irrespective of cash flow, while cash basis recognizes transactions only upon cash receipt or payment. Businesses often reconcile these methods to gain accurate financial insights, especially for cash flow management and reporting purposes. This connection enhances decision-making by aligning accrued liabilities and receivables with actual cash movements.

Key Terms

Revenue recognition

Cash basis accounting recognizes revenue only when cash is received, providing a straightforward snapshot of cash flow but potentially delaying revenue recognition. Accrual accounting, including on-demand accruals, records revenue when it is earned regardless of cash receipt, offering a more accurate depiction of financial performance and matching revenues with related expenses. Explore detailed comparisons to understand which revenue recognition method aligns best with your business needs.

Matching principle

Cash basis accounting records revenues and expenses when cash is actually received or paid, contrasting with on-demand accruals, which recognize financial events when earned or incurred regardless of cash flow. The Matching Principle requires expenses to be recorded in the same period as the revenues they help generate, which is better fulfilled by on-demand accruals than cash basis. Explore our detailed analysis to understand how each method impacts financial statements and compliance.

Timing of transactions

Cash basis accounting records revenues and expenses only when cash is actually received or paid, ensuring real-time transaction timing. On demand accrual accounting recognizes transactions when they occur, regardless of cash flow, providing a more accurate financial position by matching revenues and expenses in the period earned or incurred. Explore detailed comparisons to understand which method best suits your business timing needs.

Source and External Links

Cash-Basis vs. Accrual-Basis Accounting: What's the Difference ... - Cash-basis accounting records revenue when cash is received and expenses when payment is made, focusing simply on actual cash flow without tracking credit transactions.

Cash-based accounting: A guide to the cash basis - Stripe - Cash basis accounting recognizes income and expenses only when cash is actually received or paid, making it easier for managing cash flow but less reflective of obligations on credit.

Cash basis: Overview - GOV.UK - Cash basis accounting is the standard method for sole traders and partnerships to record income and expenses only when money is received or paid, avoiding tax on income not yet received.

dowidth.com

dowidth.com