Invoice factoring platforms provide businesses with immediate cash flow by selling outstanding invoices to third parties at a discount, improving liquidity and reducing collection risks. Dynamic discounting leverages early payment options between buyers and suppliers, offering discounts in exchange for faster payments to optimize working capital management. Explore the key differences and benefits of these financial solutions to enhance your accounting strategy.

Why it is important

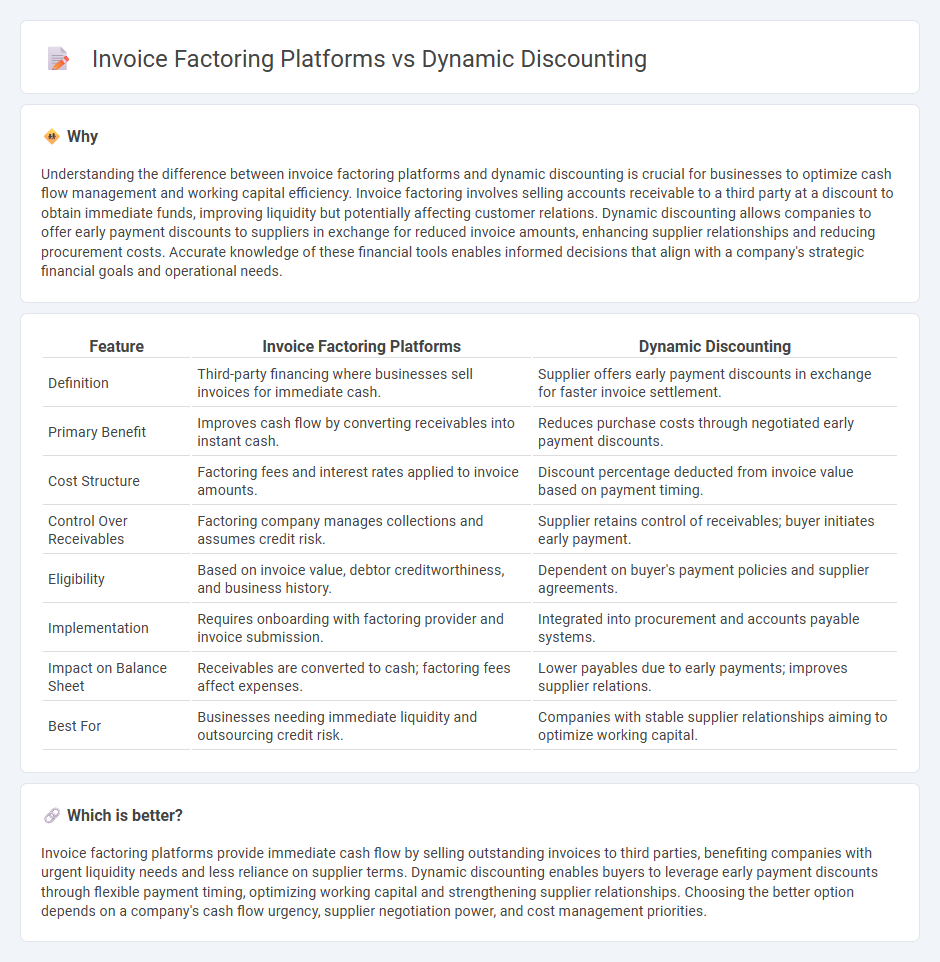

Understanding the difference between invoice factoring platforms and dynamic discounting is crucial for businesses to optimize cash flow management and working capital efficiency. Invoice factoring involves selling accounts receivable to a third party at a discount to obtain immediate funds, improving liquidity but potentially affecting customer relations. Dynamic discounting allows companies to offer early payment discounts to suppliers in exchange for reduced invoice amounts, enhancing supplier relationships and reducing procurement costs. Accurate knowledge of these financial tools enables informed decisions that align with a company's strategic financial goals and operational needs.

Comparison Table

| Feature | Invoice Factoring Platforms | Dynamic Discounting |

|---|---|---|

| Definition | Third-party financing where businesses sell invoices for immediate cash. | Supplier offers early payment discounts in exchange for faster invoice settlement. |

| Primary Benefit | Improves cash flow by converting receivables into instant cash. | Reduces purchase costs through negotiated early payment discounts. |

| Cost Structure | Factoring fees and interest rates applied to invoice amounts. | Discount percentage deducted from invoice value based on payment timing. |

| Control Over Receivables | Factoring company manages collections and assumes credit risk. | Supplier retains control of receivables; buyer initiates early payment. |

| Eligibility | Based on invoice value, debtor creditworthiness, and business history. | Dependent on buyer's payment policies and supplier agreements. |

| Implementation | Requires onboarding with factoring provider and invoice submission. | Integrated into procurement and accounts payable systems. |

| Impact on Balance Sheet | Receivables are converted to cash; factoring fees affect expenses. | Lower payables due to early payments; improves supplier relations. |

| Best For | Businesses needing immediate liquidity and outsourcing credit risk. | Companies with stable supplier relationships aiming to optimize working capital. |

Which is better?

Invoice factoring platforms provide immediate cash flow by selling outstanding invoices to third parties, benefiting companies with urgent liquidity needs and less reliance on supplier terms. Dynamic discounting enables buyers to leverage early payment discounts through flexible payment timing, optimizing working capital and strengthening supplier relationships. Choosing the better option depends on a company's cash flow urgency, supplier negotiation power, and cost management priorities.

Connection

Invoice factoring platforms and dynamic discounting both enhance cash flow management by converting accounts receivable into immediate working capital, improving liquidity for businesses. Invoice factoring involves selling invoices at a discount to third-party financiers, while dynamic discounting allows buyers to pay suppliers earlier in exchange for discounts, optimizing payment terms based on real-time financial data. Integrating these solutions streamlines financial operations, reduces credit risk, and supports efficient supply chain financing.

Key Terms

Cash Flow

Dynamic discounting platforms enhance cash flow by enabling buyers to offer early payments to suppliers in exchange for discounts, improving working capital efficiency. Invoice factoring platforms provide immediate cash by selling outstanding invoices to third-party factors, shifting credit risk away from the business. Explore how these solutions can be tailored to optimize your company's cash flow management.

Early Payment

Dynamic discounting platforms enable buyers to pay suppliers earlier than invoice due dates in exchange for a discount, improving cash flow efficiency without involving third-party financing. Invoice factoring platforms provide immediate cash to suppliers by selling outstanding invoices to a third party at a discount, transferring collection responsibility while accelerating payment. Discover how early payment solutions can optimize working capital by exploring the differences between these platforms.

Receivables Financing

Dynamic discounting platforms enable buyers to pay suppliers earlier than invoice due dates in exchange for discounts, optimizing working capital and reducing days sales outstanding (DSO). Invoice factoring platforms offer immediate cash flow to sellers by selling accounts receivable to third parties at a discount, transferring collection risk off the seller's balance sheet. Explore more to understand which receivables financing solution best suits your business needs.

Source and External Links

What Is Dynamic Discounting? | Definition & Meaning - Taulia - Dynamic discounting is a flexible payment solution allowing suppliers to receive early payment in exchange for a discount on their invoice, with the discount size varying based on how early the payment is made between invoice approval and due date, financed by the buyer rather than third parties.

Dynamic Discounting: A Key Enabler for Supply Chain Finance - Dynamic discounting involves an arrangement where the supplier offers a discount for early payment that can be fixed or varying, enabling buyers to negotiate better credit terms and suppliers to receive payment anytime before the due date with increasing discounts for earlier payments.

Dynamic discounting - Wikipedia - Dynamic discounting features discounts calculated dynamically based on the days remaining until payment due, allowing suppliers to access working capital without high-cost financing and buyers to benefit from risk-free returns on excess cash, with terms set flexibly by the buyer's credit rating.

dowidth.com

dowidth.com