Forensic accounting involves the detailed examination of financial records to detect fraud, embezzlement, or legal discrepancies, often supporting litigation or criminal investigations. Compliance reviews focus on evaluating a company's adherence to regulatory standards, internal policies, and financial reporting requirements to mitigate risks and ensure lawful operations. Explore the distinctions and applications of these critical accounting disciplines to enhance your financial oversight strategies.

Why it is important

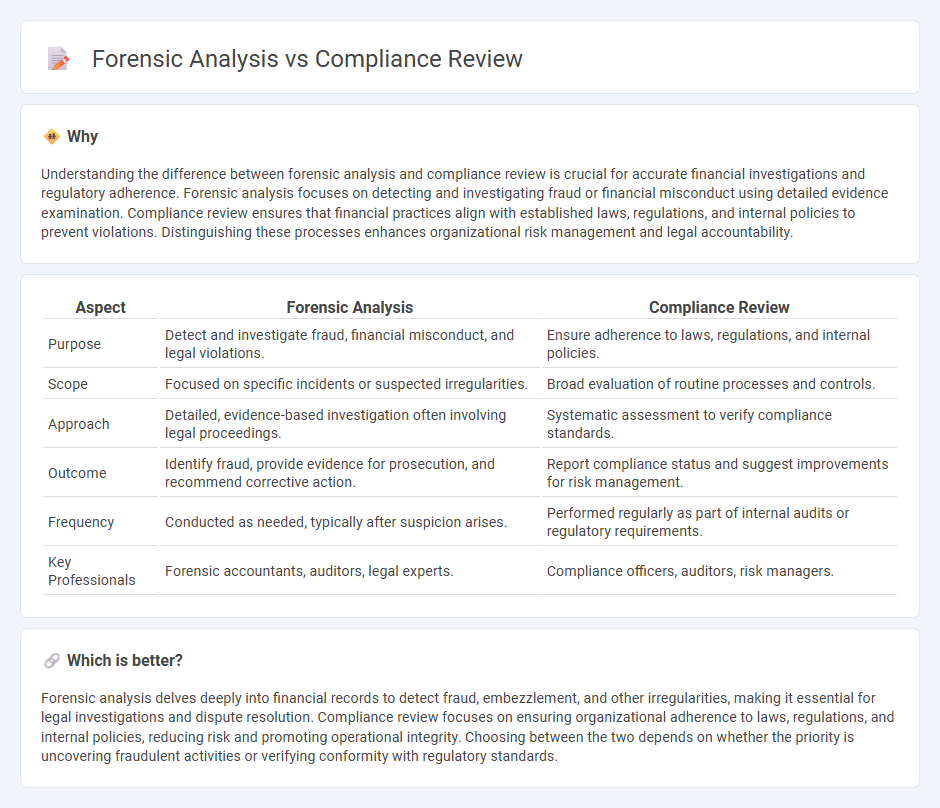

Understanding the difference between forensic analysis and compliance review is crucial for accurate financial investigations and regulatory adherence. Forensic analysis focuses on detecting and investigating fraud or financial misconduct using detailed evidence examination. Compliance review ensures that financial practices align with established laws, regulations, and internal policies to prevent violations. Distinguishing these processes enhances organizational risk management and legal accountability.

Comparison Table

| Aspect | Forensic Analysis | Compliance Review |

|---|---|---|

| Purpose | Detect and investigate fraud, financial misconduct, and legal violations. | Ensure adherence to laws, regulations, and internal policies. |

| Scope | Focused on specific incidents or suspected irregularities. | Broad evaluation of routine processes and controls. |

| Approach | Detailed, evidence-based investigation often involving legal proceedings. | Systematic assessment to verify compliance standards. |

| Outcome | Identify fraud, provide evidence for prosecution, and recommend corrective action. | Report compliance status and suggest improvements for risk management. |

| Frequency | Conducted as needed, typically after suspicion arises. | Performed regularly as part of internal audits or regulatory requirements. |

| Key Professionals | Forensic accountants, auditors, legal experts. | Compliance officers, auditors, risk managers. |

Which is better?

Forensic analysis delves deeply into financial records to detect fraud, embezzlement, and other irregularities, making it essential for legal investigations and dispute resolution. Compliance review focuses on ensuring organizational adherence to laws, regulations, and internal policies, reducing risk and promoting operational integrity. Choosing between the two depends on whether the priority is uncovering fraudulent activities or verifying conformity with regulatory standards.

Connection

Forensic analysis and compliance review are interconnected through their focus on detecting financial irregularities and ensuring adherence to regulatory standards. Forensic accounting involves examining financial records to identify fraud or misconduct, while compliance reviews assess organizational practices against legal and regulatory requirements. Together, they strengthen internal controls and enhance the accuracy and integrity of financial reporting.

Key Terms

**Compliance Review:**

Compliance review involves evaluating organizational processes and controls to ensure adherence to regulatory standards such as GDPR, HIPAA, or SOX, minimizing legal and financial risks. It emphasizes preventive measures, regular audits, and documentation to maintain consistent compliance and avoid penalties. Explore more about how compliance reviews safeguard your business from regulatory breaches and operational inefficiencies.

Regulations

Compliance review ensures adherence to regulatory frameworks such as GDPR, HIPAA, or SOX by systematically evaluating organizational policies and procedures. Forensic analysis investigates potential violations or breaches through detailed examination of digital evidence, often supporting legal proceedings. Explore further to understand the distinct roles and methodologies each approach uses to uphold regulatory standards.

Internal Controls

Compliance review primarily assesses adherence to internal controls and regulatory requirements to ensure organizational policies are effectively implemented. Forensic analysis investigates breaches or failures in internal controls, aiming to detect fraud, financial misconduct, or anomalies. Explore the detailed differences and applications of both methodologies to strengthen your internal control systems.

dowidth.com

dowidth.com