Forensic accounting software specializes in detecting fraud, analyzing financial discrepancies, and supporting legal investigations through detailed audit trails and data tracing. Financial consolidation software focuses on aggregating financial data from multiple subsidiaries, ensuring compliance with accounting standards and generating consolidated financial reports efficiently. Discover how these distinct tools can transform your financial accuracy and compliance strategies.

Why it is important

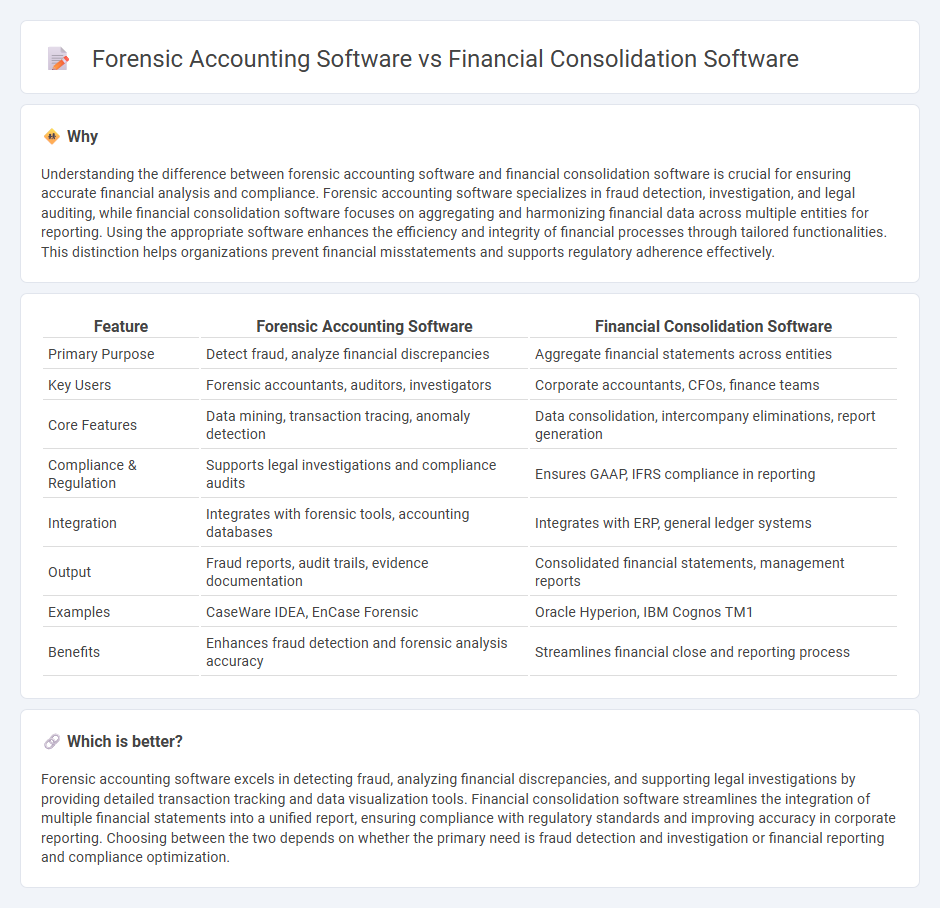

Understanding the difference between forensic accounting software and financial consolidation software is crucial for ensuring accurate financial analysis and compliance. Forensic accounting software specializes in fraud detection, investigation, and legal auditing, while financial consolidation software focuses on aggregating and harmonizing financial data across multiple entities for reporting. Using the appropriate software enhances the efficiency and integrity of financial processes through tailored functionalities. This distinction helps organizations prevent financial misstatements and supports regulatory adherence effectively.

Comparison Table

| Feature | Forensic Accounting Software | Financial Consolidation Software |

|---|---|---|

| Primary Purpose | Detect fraud, analyze financial discrepancies | Aggregate financial statements across entities |

| Key Users | Forensic accountants, auditors, investigators | Corporate accountants, CFOs, finance teams |

| Core Features | Data mining, transaction tracing, anomaly detection | Data consolidation, intercompany eliminations, report generation |

| Compliance & Regulation | Supports legal investigations and compliance audits | Ensures GAAP, IFRS compliance in reporting |

| Integration | Integrates with forensic tools, accounting databases | Integrates with ERP, general ledger systems |

| Output | Fraud reports, audit trails, evidence documentation | Consolidated financial statements, management reports |

| Examples | CaseWare IDEA, EnCase Forensic | Oracle Hyperion, IBM Cognos TM1 |

| Benefits | Enhances fraud detection and forensic analysis accuracy | Streamlines financial close and reporting process |

Which is better?

Forensic accounting software excels in detecting fraud, analyzing financial discrepancies, and supporting legal investigations by providing detailed transaction tracking and data visualization tools. Financial consolidation software streamlines the integration of multiple financial statements into a unified report, ensuring compliance with regulatory standards and improving accuracy in corporate reporting. Choosing between the two depends on whether the primary need is fraud detection and investigation or financial reporting and compliance optimization.

Connection

Forensic accounting software enhances the identification and analysis of financial discrepancies, enabling forensic accountants to detect fraud and ensure compliance. Financial consolidation software aggregates data from multiple subsidiaries, providing a comprehensive financial overview essential for accurate forensic investigations. Together, they streamline financial data integration and anomaly detection, improving the accuracy and efficiency of forensic accounting processes.

Key Terms

Intercompany Eliminations

Financial consolidation software streamlines the process of merging financial data from multiple subsidiaries, ensuring accuracy in Intercompany Eliminations by automatically identifying and removing intercompany transactions to avoid double counting. Forensic accounting software, while primarily aimed at detecting fraud and discrepancies, can also analyze Intercompany Eliminations but with a focus on uncovering irregularities or potential misstatements in intercompany accounts. Explore comprehensive solutions and techniques to optimize Intercompany Eliminations in both software types for enhanced financial integrity.

Audit Trail

Financial consolidation software provides an integrated audit trail that captures all transactional data and adjustments across multiple entities, ensuring compliance with accounting standards like IFRS and GAAP. Forensic accounting software emphasizes detailed audit trails designed to detect fraud, trace irregular transactions, and analyze financial discrepancies with advanced data analytics and forensic tools. Explore the differences in audit trail capabilities to select the right solution for your organization's needs.

Fraud Detection

Financial consolidation software streamlines aggregating financial data across multiple entities to ensure accuracy and consistency in reporting, while forensic accounting software specializes in analyzing financial records to uncover fraud, errors, and discrepancies. Fraud detection capabilities in forensic tools include anomaly detection, transaction tracing, and pattern recognition to identify suspicious activities often overlooked in consolidation processes. Explore how integrating both software types enhances fraud detection efficiency and strengthens financial integrity.

Source and External Links

The 12 Best Financial Consolidation Software Tools for FP&A Teams - This list includes Prophix One, Domo, and Workday Adaptive Planning among others, highlighting their value for financial consolidation and planning.

Financial Consolidation Software - Planful offers a solution that automates data load and validation processes to streamline financial consolidation and close.

Top 7 Financial Consolidation Software Guide - This guide features OneStream as a leading financial consolidation platform, providing a comprehensive solution for handling complex financial reporting requirements.

dowidth.com

dowidth.com