ESG reporting focuses on environmental, social, and governance metrics that directly impact a company's long-term financial performance and investor decisions, while Corporate Social Responsibility (CSR) reporting emphasizes broader ethical and philanthropic initiatives often driven by stakeholder interests. ESG uses standardized frameworks such as SASB and GRI, enabling comparability and regulatory compliance, whereas CSR reporting tends to be narrative and voluntary without mandatory guidelines. Explore further to understand how integrating ESG and CSR enhances transparency and stakeholder trust in corporate accounting.

Why it is important

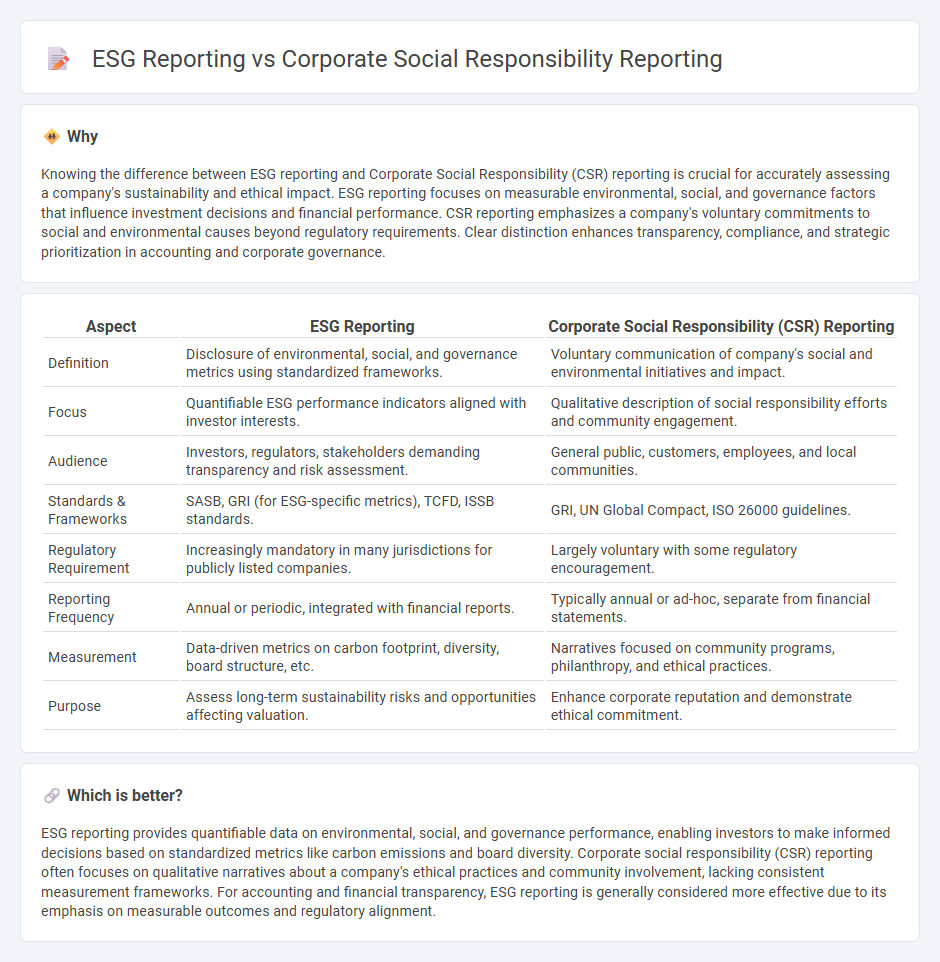

Knowing the difference between ESG reporting and Corporate Social Responsibility (CSR) reporting is crucial for accurately assessing a company's sustainability and ethical impact. ESG reporting focuses on measurable environmental, social, and governance factors that influence investment decisions and financial performance. CSR reporting emphasizes a company's voluntary commitments to social and environmental causes beyond regulatory requirements. Clear distinction enhances transparency, compliance, and strategic prioritization in accounting and corporate governance.

Comparison Table

| Aspect | ESG Reporting | Corporate Social Responsibility (CSR) Reporting |

|---|---|---|

| Definition | Disclosure of environmental, social, and governance metrics using standardized frameworks. | Voluntary communication of company's social and environmental initiatives and impact. |

| Focus | Quantifiable ESG performance indicators aligned with investor interests. | Qualitative description of social responsibility efforts and community engagement. |

| Audience | Investors, regulators, stakeholders demanding transparency and risk assessment. | General public, customers, employees, and local communities. |

| Standards & Frameworks | SASB, GRI (for ESG-specific metrics), TCFD, ISSB standards. | GRI, UN Global Compact, ISO 26000 guidelines. |

| Regulatory Requirement | Increasingly mandatory in many jurisdictions for publicly listed companies. | Largely voluntary with some regulatory encouragement. |

| Reporting Frequency | Annual or periodic, integrated with financial reports. | Typically annual or ad-hoc, separate from financial statements. |

| Measurement | Data-driven metrics on carbon footprint, diversity, board structure, etc. | Narratives focused on community programs, philanthropy, and ethical practices. |

| Purpose | Assess long-term sustainability risks and opportunities affecting valuation. | Enhance corporate reputation and demonstrate ethical commitment. |

Which is better?

ESG reporting provides quantifiable data on environmental, social, and governance performance, enabling investors to make informed decisions based on standardized metrics like carbon emissions and board diversity. Corporate social responsibility (CSR) reporting often focuses on qualitative narratives about a company's ethical practices and community involvement, lacking consistent measurement frameworks. For accounting and financial transparency, ESG reporting is generally considered more effective due to its emphasis on measurable outcomes and regulatory alignment.

Connection

ESG reporting and Corporate Social Responsibility (CSR) reporting both focus on a company's impact on environmental, social, and governance factors, providing transparent data for stakeholders. ESG reporting emphasizes quantifiable and standardized metrics, aligning with investor expectations and regulatory requirements, while CSR reporting often highlights qualitative narratives about social initiatives and ethical practices. Together, they enhance corporate accountability and inform sustainable business strategies within accounting frameworks.

Key Terms

Stakeholder Engagement

Corporate social responsibility (CSR) reporting emphasizes accountability to a broad range of stakeholders including employees, communities, and suppliers through transparent communication and ethical practices. ESG reporting specifically measures environmental, social, and governance criteria with a stronger focus on investor-driven metrics and long-term sustainability performance. Explore how integrating stakeholder engagement into both reporting frameworks enhances corporate transparency and drives strategic decision-making.

Materiality

Corporate social responsibility (CSR) reporting primarily highlights a company's social and environmental initiatives, often focusing on qualitative narratives rather than quantifiable data, while ESG (Environmental, Social, and Governance) reporting emphasizes measurable performance metrics aligned with investor interests and regulatory standards. Materiality in ESG reporting is defined by its financial impact on enterprise value, guiding companies to disclose information that influences investor decision-making, whereas CSR materiality typically centers on broader stakeholder concerns including community and environmental impacts. Explore the distinctions in materiality frameworks to understand how organizations prioritize sustainability disclosures in CSR versus ESG reporting.

Sustainability Metrics

Corporate social responsibility (CSR) reporting emphasizes a company's ethical impact and community involvement, whereas Environmental, Social, and Governance (ESG) reporting centers on quantifiable sustainability metrics linked to financial performance and risk management. ESG reports utilize standardized frameworks such as GRI, SASB, and TCFD to measure carbon emissions, energy consumption, labor practices, and board diversity, offering investors actionable data for sustainable investment decisions. Explore more to understand how these reporting methods drive corporate transparency and long-term value creation.

Source and External Links

Pursuing Accountability: CSR Reporting Strategies & Examples - CSR reporting is a way for businesses to demonstrate their social and environmental impact, although it is not mandatory in the U.S., with some exceptions for disclosing material ESG risks.

How to report on CSR? - HEC Paris - CSR reporting is a common practice among large corporations to publicize their social and environmental commitments, influencing their CSR ratings and data reliability.

What is CSR reporting? - IBM - CSR reporting provides transparency on a company's social and environmental performance, typically reported annually, and is increasingly aligned with ESG reporting standards.

dowidth.com

dowidth.com