Fractional CFO services provide strategic financial leadership on a part-time basis, helping businesses optimize cash flow, plan growth, and manage risks without the cost of a full-time executive. Outsourced accounting focuses on handling day-to-day bookkeeping, payroll, and financial reporting to maintain accurate records and compliance. Explore the key differences and benefits to decide which solution best fits your company's financial needs.

Why it is important

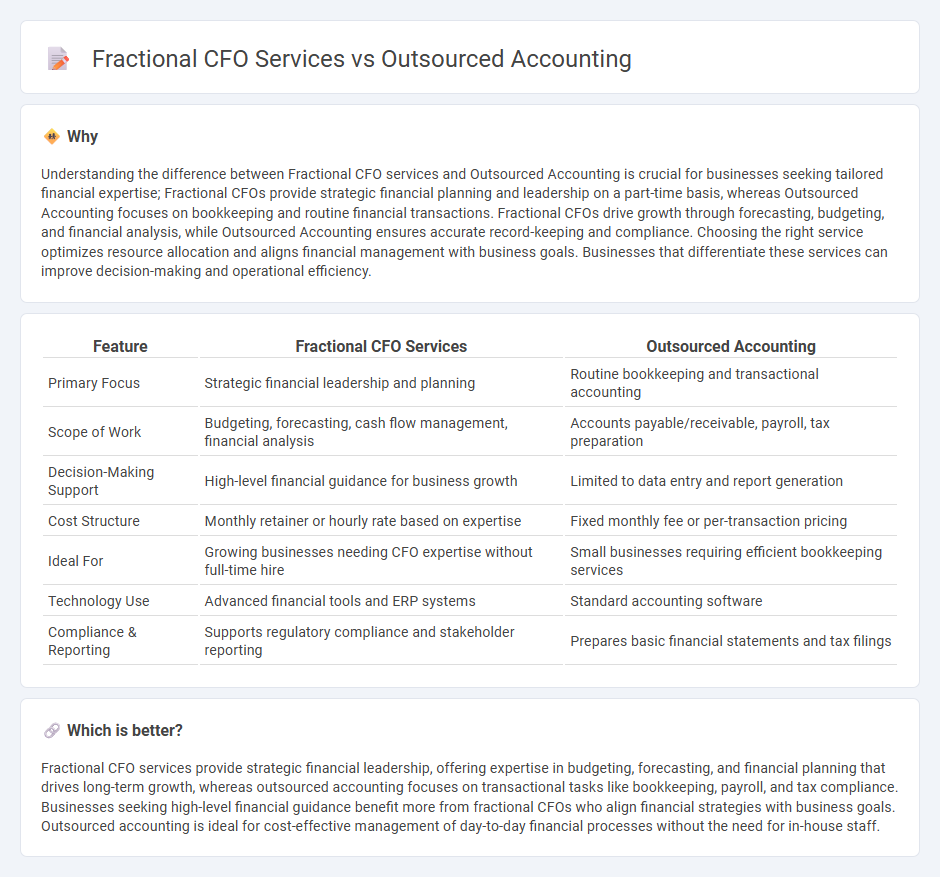

Understanding the difference between Fractional CFO services and Outsourced Accounting is crucial for businesses seeking tailored financial expertise; Fractional CFOs provide strategic financial planning and leadership on a part-time basis, whereas Outsourced Accounting focuses on bookkeeping and routine financial transactions. Fractional CFOs drive growth through forecasting, budgeting, and financial analysis, while Outsourced Accounting ensures accurate record-keeping and compliance. Choosing the right service optimizes resource allocation and aligns financial management with business goals. Businesses that differentiate these services can improve decision-making and operational efficiency.

Comparison Table

| Feature | Fractional CFO Services | Outsourced Accounting |

|---|---|---|

| Primary Focus | Strategic financial leadership and planning | Routine bookkeeping and transactional accounting |

| Scope of Work | Budgeting, forecasting, cash flow management, financial analysis | Accounts payable/receivable, payroll, tax preparation |

| Decision-Making Support | High-level financial guidance for business growth | Limited to data entry and report generation |

| Cost Structure | Monthly retainer or hourly rate based on expertise | Fixed monthly fee or per-transaction pricing |

| Ideal For | Growing businesses needing CFO expertise without full-time hire | Small businesses requiring efficient bookkeeping services |

| Technology Use | Advanced financial tools and ERP systems | Standard accounting software |

| Compliance & Reporting | Supports regulatory compliance and stakeholder reporting | Prepares basic financial statements and tax filings |

Which is better?

Fractional CFO services provide strategic financial leadership, offering expertise in budgeting, forecasting, and financial planning that drives long-term growth, whereas outsourced accounting focuses on transactional tasks like bookkeeping, payroll, and tax compliance. Businesses seeking high-level financial guidance benefit more from fractional CFOs who align financial strategies with business goals. Outsourced accounting is ideal for cost-effective management of day-to-day financial processes without the need for in-house staff.

Connection

Fractional CFO services and outsourced accounting are interconnected through their shared goal of providing businesses with expert financial management without the cost of a full-time executive. Fractional CFOs often rely on outsourced accounting firms to deliver accurate, timely financial reports and bookkeeping, enabling strategic decision-making. This synergy enhances financial insights, optimizes cash flow management, and supports scalable growth for companies.

Key Terms

Cost Efficiency

Outsourced accounting services typically offer lower upfront costs by handling routine bookkeeping and financial reporting tasks remotely, making them ideal for small businesses with limited budgets. Fractional CFO services provide strategic financial leadership and advanced forecasting at a fraction of the cost of a full-time CFO, delivering long-term cost efficiency through improved financial planning and decision-making. Explore how tailored financial solutions can maximize your company's cost efficiency and growth potential.

Financial Strategy

Outsourced accounting primarily handles transactional tasks such as bookkeeping, payroll, and tax preparation, ensuring accurate financial records and regulatory compliance. Fractional CFO services offer strategic financial planning, cash flow management, budgeting, and long-term growth strategies tailored to optimize business performance. Explore how integrating fractional CFO insights can transform your financial strategy and drive sustainable success.

Service Scope

Outsourced accounting primarily handles routine financial tasks such as bookkeeping, payroll, and tax preparation, ensuring compliance and accurate record-keeping for businesses. Fractional CFO services encompass strategic financial management, including budgeting, forecasting, cash flow optimization, and long-term financial planning tailored to organizational growth. Explore the distinct benefits and determine which service aligns best with your financial goals.

Source and External Links

Outsourced Accounting Services - Cherry Bekaert - Offers specialized industry-specific knowledge, advanced technologies, and compliance support for regulatory requirements to optimize business growth.

Outsourced Accounting Services | Fully Accountable - Provides custom solutions for managing business finances and cash flow, specializing in e-commerce, digital marketing agencies, and SaaS companies.

Outsourced Finance and Accounting Services - Offers full- or part-time professionals to support accounting functions, leveraging technology to streamline processes and address compliance issues.

dowidth.com

dowidth.com