Embedded finance compliance ensures financial services integrated within non-financial platforms adhere to regulatory standards, minimizing risk and protecting consumer data. Revenue recognition in accounting governs how and when income from embedded financial transactions is recorded, aligning with standards like ASC 606 or IFRS 15 to ensure transparency and accuracy. Explore the critical intersections between embedded finance compliance and revenue recognition to optimize accounting practices.

Why it is important

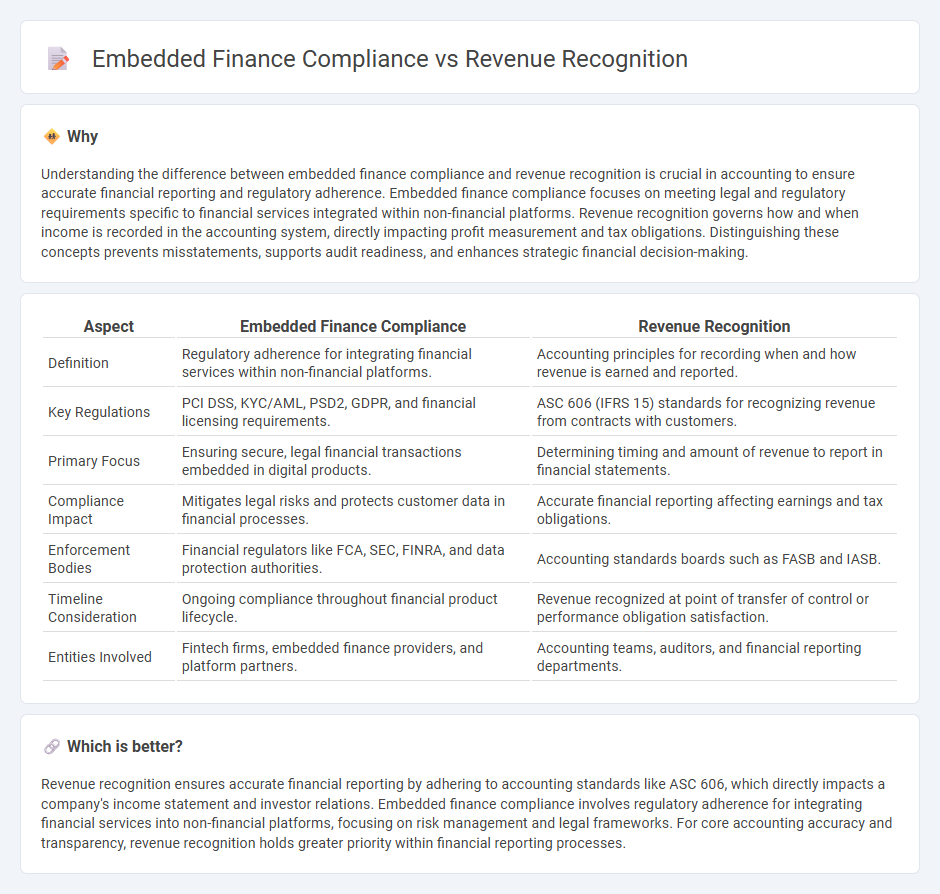

Understanding the difference between embedded finance compliance and revenue recognition is crucial in accounting to ensure accurate financial reporting and regulatory adherence. Embedded finance compliance focuses on meeting legal and regulatory requirements specific to financial services integrated within non-financial platforms. Revenue recognition governs how and when income is recorded in the accounting system, directly impacting profit measurement and tax obligations. Distinguishing these concepts prevents misstatements, supports audit readiness, and enhances strategic financial decision-making.

Comparison Table

| Aspect | Embedded Finance Compliance | Revenue Recognition |

|---|---|---|

| Definition | Regulatory adherence for integrating financial services within non-financial platforms. | Accounting principles for recording when and how revenue is earned and reported. |

| Key Regulations | PCI DSS, KYC/AML, PSD2, GDPR, and financial licensing requirements. | ASC 606 (IFRS 15) standards for recognizing revenue from contracts with customers. |

| Primary Focus | Ensuring secure, legal financial transactions embedded in digital products. | Determining timing and amount of revenue to report in financial statements. |

| Compliance Impact | Mitigates legal risks and protects customer data in financial processes. | Accurate financial reporting affecting earnings and tax obligations. |

| Enforcement Bodies | Financial regulators like FCA, SEC, FINRA, and data protection authorities. | Accounting standards boards such as FASB and IASB. |

| Timeline Consideration | Ongoing compliance throughout financial product lifecycle. | Revenue recognized at point of transfer of control or performance obligation satisfaction. |

| Entities Involved | Fintech firms, embedded finance providers, and platform partners. | Accounting teams, auditors, and financial reporting departments. |

Which is better?

Revenue recognition ensures accurate financial reporting by adhering to accounting standards like ASC 606, which directly impacts a company's income statement and investor relations. Embedded finance compliance involves regulatory adherence for integrating financial services into non-financial platforms, focusing on risk management and legal frameworks. For core accounting accuracy and transparency, revenue recognition holds greater priority within financial reporting processes.

Connection

Embedded finance compliance ensures financial services integrated within non-financial platforms adhere to regulatory standards, directly impacting revenue recognition accuracy by validating transaction legitimacy and timing. Accurate compliance frameworks enable precise application of revenue recognition principles such as ASC 606, ensuring revenues are reported only when performance obligations are fulfilled. This integration reduces financial risks and enhances transparency in accounting processes for embedded finance transactions.

Key Terms

Accrual basis

Revenue recognition under the accrual basis mandates recording revenues when earned, not necessarily when cash is received, ensuring alignment with matching principles and financial reporting standards like IFRS 15 and ASC 606. Embedded finance compliance requires adherence to regulatory frameworks governing financial data integration and transaction processing, emphasizing transparency and risk management in platform-based services. Explore how these frameworks interact to optimize financial accuracy and regulatory adherence in embedded finance ecosystems.

Third-party integration

In revenue recognition, accurate accounting hinges on clear identification of performance obligations and transaction price allocation, particularly when third-party integrations involve multiple parties and variable consideration. Embedded finance compliance demands adherence to regulatory standards, including data protection, anti-money laundering (AML), and Know Your Customer (KYC) protocols, especially when third-party providers are integrated within financial services platforms. Explore best practices for aligning revenue recognition frameworks with embedded finance compliance amid complex third-party integrations to enhance your business's financial integrity.

Regulatory reporting

Revenue recognition standards like ASC 606 and IFRS 15 require detailed disclosure of transaction timing and amounts, ensuring transparent financial reporting. Embedded finance compliance mandates strict adherence to sector-specific regulatory reporting, including anti-money laundering (AML) and Know Your Customer (KYC) protocols to prevent fraud. Explore how aligning revenue recognition with embedded finance regulatory reporting enhances accuracy and trust in financial statements.

Source and External Links

Revenue Recognition: Principles and 5-Step Model - NetSuite - Revenue recognition is an accounting principle that asserts revenue must be recorded as it is earned, following a standardized five-step model for contracts with customers to ensure consistent and accurate reporting.

What is Revenue Recognition? - DealHub - Revenue recognition is the process of accounting for revenue when a business earns it, not when cash is received, and is essential for accurate financial statements and transparent business operations.

Revenue recognition principles & best practices - Stripe - Revenue recognition is a key principle in accrual accounting, requiring businesses to record revenue when it is earned, not when payment is received, and is regulated by standards like ASC 606 (US GAAP) and IFRS 15 (international).

dowidth.com

dowidth.com