Embedded finance compliance ensures secure integration of financial services within non-financial platforms by adhering to regulatory standards such as AML and KYC, minimizing legal risks for businesses. Expense management focuses on tracking, controlling, and optimizing organizational spending through automated tools and analytics, enhancing financial transparency and efficiency. Explore the key differences and how each impacts your company's financial strategy.

Why it is important

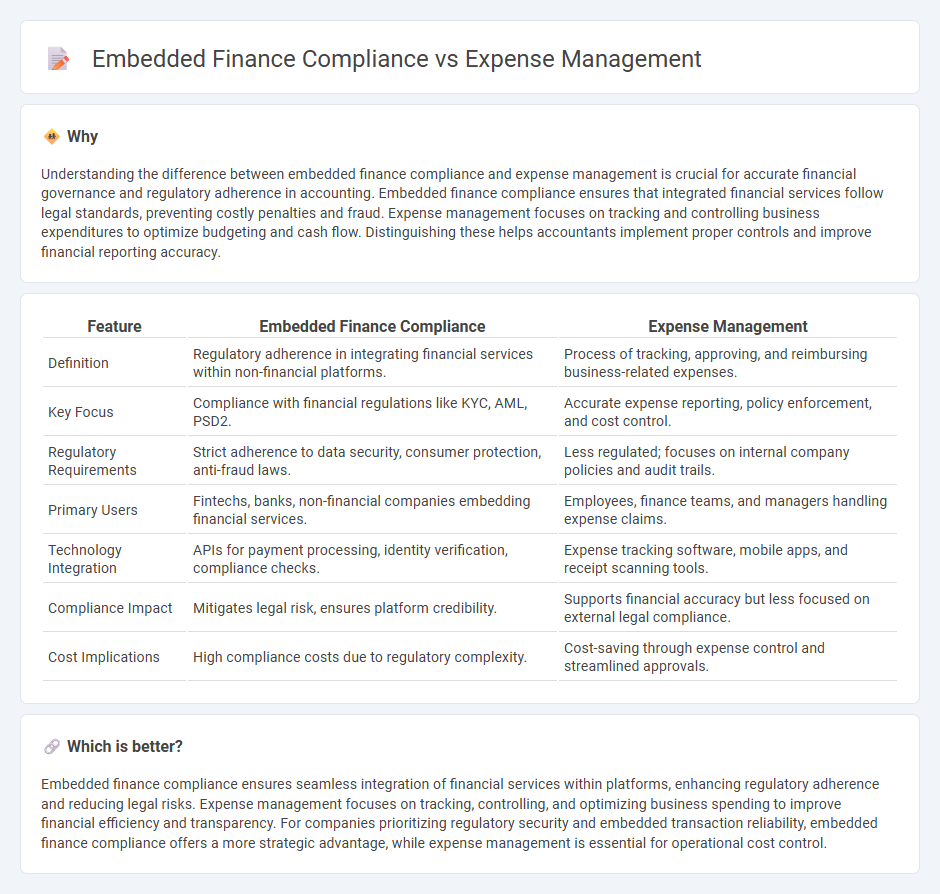

Understanding the difference between embedded finance compliance and expense management is crucial for accurate financial governance and regulatory adherence in accounting. Embedded finance compliance ensures that integrated financial services follow legal standards, preventing costly penalties and fraud. Expense management focuses on tracking and controlling business expenditures to optimize budgeting and cash flow. Distinguishing these helps accountants implement proper controls and improve financial reporting accuracy.

Comparison Table

| Feature | Embedded Finance Compliance | Expense Management |

|---|---|---|

| Definition | Regulatory adherence in integrating financial services within non-financial platforms. | Process of tracking, approving, and reimbursing business-related expenses. |

| Key Focus | Compliance with financial regulations like KYC, AML, PSD2. | Accurate expense reporting, policy enforcement, and cost control. |

| Regulatory Requirements | Strict adherence to data security, consumer protection, anti-fraud laws. | Less regulated; focuses on internal company policies and audit trails. |

| Primary Users | Fintechs, banks, non-financial companies embedding financial services. | Employees, finance teams, and managers handling expense claims. |

| Technology Integration | APIs for payment processing, identity verification, compliance checks. | Expense tracking software, mobile apps, and receipt scanning tools. |

| Compliance Impact | Mitigates legal risk, ensures platform credibility. | Supports financial accuracy but less focused on external legal compliance. |

| Cost Implications | High compliance costs due to regulatory complexity. | Cost-saving through expense control and streamlined approvals. |

Which is better?

Embedded finance compliance ensures seamless integration of financial services within platforms, enhancing regulatory adherence and reducing legal risks. Expense management focuses on tracking, controlling, and optimizing business spending to improve financial efficiency and transparency. For companies prioritizing regulatory security and embedded transaction reliability, embedded finance compliance offers a more strategic advantage, while expense management is essential for operational cost control.

Connection

Embedded finance compliance ensures that financial services integrated within accounting platforms adhere to regulatory standards, reducing risks associated with transactions and data handling. Expense management relies on this compliance framework to securely process corporate spending, maintain accurate records, and enforce policy controls. Together, they optimize financial transparency and accountability in accounting systems.

Key Terms

**Expense Management:**

Expense management solutions streamline the tracking and reporting of business expenditures, ensuring accurate financial data and regulatory compliance with tax laws and corporate policies. Advanced systems integrate real-time expense monitoring, automated receipt capture, and policy enforcement, helping mitigate fraud and reduce processing time. Explore the latest trends and tools in expense management to enhance your organization's financial control and compliance.

Expense Policy

Expense management systems enforce strict adherence to corporate Expense Policies, ensuring all employee expenditures align with predefined financial guidelines and regulatory standards. Embedded finance compliance integrates these policies at a transactional level, streamlining approval workflows and real-time auditing to prevent non-compliant spending. Explore how aligning expense management with embedded finance compliance fortifies your organization's financial controls and reduces risk exposure.

Receipt Reconciliation

Expense management systems streamline receipt reconciliation by automating the verification of transaction data, reducing errors and fraud risk. Embedded finance compliance mandates stringent adherence to regulatory standards, including data privacy and anti-money laundering measures across the reconciliation process. Explore how integrating compliant receipt reconciliation enhances financial accuracy and regulatory adherence.

Source and External Links

The Complete Guide to Expense Management | Brex - Expense management is the process of tracking, analyzing, and controlling business spending by setting clear policies, recording all expenses, and using data insights to optimize financial decisions and compliance.

Expense Management Software & Reporting Solution - Ramp - Ramp automates expense tracking, reimbursement, and reporting, integrates with corporate cards, enforces spending policies, flags non-compliant expenses, and provides real-time insights for smarter financial decisions.

Expense management overview | Microsoft Learn - Microsoft Dynamics 365 Expense Management streamlines the expense lifecycle from submission to reimbursement, automating approvals, enforcing policy compliance, and improving efficiency and regulatory adherence.

dowidth.com

dowidth.com