Deep learning forecasting leverages advanced algorithms and large datasets to detect complex patterns and generate highly accurate financial predictions, outperforming traditional methods in scalability and adaptability. Expert judgment relies on human intuition and domain experience, allowing consideration of qualitative factors and context-specific nuances that models may miss. Explore the strengths and limitations of each approach to optimize your accounting forecasting strategies.

Why it is important

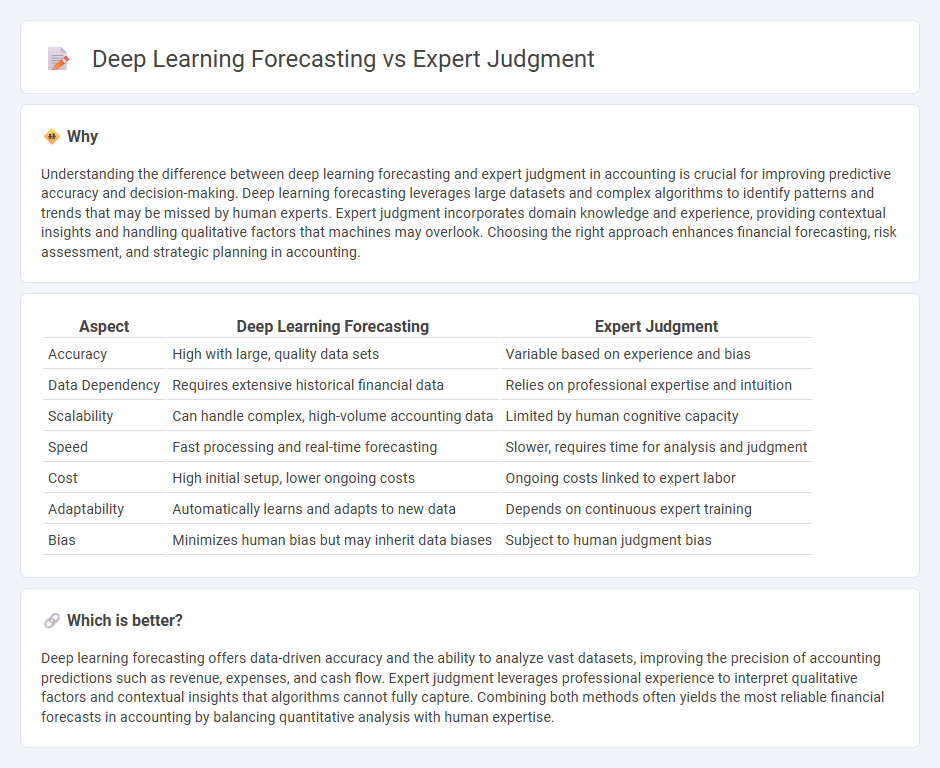

Understanding the difference between deep learning forecasting and expert judgment in accounting is crucial for improving predictive accuracy and decision-making. Deep learning forecasting leverages large datasets and complex algorithms to identify patterns and trends that may be missed by human experts. Expert judgment incorporates domain knowledge and experience, providing contextual insights and handling qualitative factors that machines may overlook. Choosing the right approach enhances financial forecasting, risk assessment, and strategic planning in accounting.

Comparison Table

| Aspect | Deep Learning Forecasting | Expert Judgment |

|---|---|---|

| Accuracy | High with large, quality data sets | Variable based on experience and bias |

| Data Dependency | Requires extensive historical financial data | Relies on professional expertise and intuition |

| Scalability | Can handle complex, high-volume accounting data | Limited by human cognitive capacity |

| Speed | Fast processing and real-time forecasting | Slower, requires time for analysis and judgment |

| Cost | High initial setup, lower ongoing costs | Ongoing costs linked to expert labor |

| Adaptability | Automatically learns and adapts to new data | Depends on continuous expert training |

| Bias | Minimizes human bias but may inherit data biases | Subject to human judgment bias |

Which is better?

Deep learning forecasting offers data-driven accuracy and the ability to analyze vast datasets, improving the precision of accounting predictions such as revenue, expenses, and cash flow. Expert judgment leverages professional experience to interpret qualitative factors and contextual insights that algorithms cannot fully capture. Combining both methods often yields the most reliable financial forecasts in accounting by balancing quantitative analysis with human expertise.

Connection

Deep learning forecasting enhances accounting accuracy by processing vast financial datasets to predict trends and anomalies. Expert judgment complements this by interpreting model outputs and incorporating domain-specific knowledge for nuanced decision-making. Integrating both methods optimizes financial forecasting and risk assessment in accounting practices.

Key Terms

Subjectivity

Expert judgment relies heavily on human intuition and experience, introducing a level of subjectivity that can impact the consistency of forecasting outcomes. Deep learning forecasting uses algorithms trained on large datasets to minimize subjective bias, offering more standardized and scalable predictions. Explore the nuances and comparative advantages of these approaches to enhance your forecasting strategy.

Pattern recognition

Expert judgment leverages human experience and intuition to identify complex patterns that may be too subtle for algorithms to detect, especially in noisy or incomplete data sets. Deep learning forecasting uses neural networks to automatically recognize intricate patterns in large-scale datasets, offering high accuracy but requiring extensive computational resources and training data. Explore the strengths and applications of both approaches to enhance your pattern recognition and forecasting strategies.

Model interpretability

Expert judgment offers clear model interpretability by leveraging human experience to explain forecasting decisions, while deep learning forecasting often functions as a black box with complex, non-transparent algorithms. Deep learning models excel in capturing intricate patterns within large datasets, but their interpretability remains a critical challenge for practical applications requiring trust and accountability. Explore comprehensive comparisons to understand which forecasting approach best suits your needs.

Source and External Links

Glossary: Expert judgment - Statistics Explained - Eurostat - Expert judgment is a method based on consulting one or more experts with experience and knowledge in a topic, used when other methods are not feasible or for additional validation, helping to complete, validate, interpret, and predict data and impacts.

What is Expert Judgment in Project Management? - Wrike - Expert judgment in project management is a technique relying on skill, expertise, or specialized knowledge from individuals such as team members, stakeholders, or consultants to inform decisions, recognize risks, and identify opportunities, despite inherent biases like overconfidence.

Structured expert judgment using the Classical Method - Structured expert judgment aggregates experts' uncertainty quantitatively and applies scientific quality controls like neutrality and empirical validation, with Cooke's Classical Model being a rigorous approach to incorporate expert opinion into decision-making.

dowidth.com

dowidth.com